Re: Docket NOS. EO19020209 AND GO19020210 – I/M/O Implementation of an Act Permitting Credits Against The Societal Benefits Charge (P.L. 2011, C.216) and Investigation of an Additional Program for Credits Against the Societal Benefits Charge

Dear Ms. Camacho:

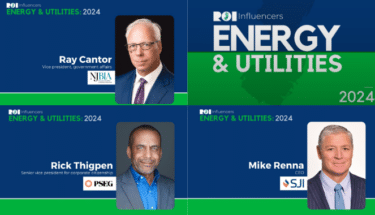

The New Jersey Business and Industry Association is the largest statewide business advocacy organization representing over one million jobs. Our members include the State’s largest energy users, as well as small businesses struggling to pay their energy bills, which are some of the highest in the nation. These high energy costs have contributed to New Jersey’s last-place ranking in the region for overall business climate competitiveness.

The NJBIA has been a longtime supporter of affordable energy costs, especially for the business sectors in the State. We have strongly advocated against the continual increases in the Societal Benefit Charges (SBC). But once those charges were in place, we advocated for their use as statutorily intended.

We were strong proponents of the underlying legislation establishing the credit program that is the subject to the Board’s current inquiry. Energy efficiency programs implemented by businesses are a highly effective means to conserve energy, help meet the State’s greenhouse gas reduction goals, and help make New Jersey a more affordable place to operate a business. It is against this backdrop that we submit the following responses to the questions posed by the Board:

- In implementing the Credit Law, should the Board establish a tiered credit program? If so, please comment on the use of factors such as a customer’s contribution to the SBC, the customer’s total electric and/or natural gas usage, and the nature of the customer’s business and facilities. Should additional factors be considered? If the Board were to establish a tiered credit program, how should it be structured?

NJBIA Response: The goal of this program should be to incentivize energy efficiency projects and to spur economic development. To that end, credits should be maximized to the greatest extent possible and tied to the level of expenditures on approved projects. The Board should establish the maximum credit it will allow and pay that amount based on the level of approved expenditures on approved projects that has occurred in one or more prior years.

We do not believe a tiered program is needed to achieve the goals of the credit program. While it would be preferable that all business spend the maximum amount to achieve the maximum credit under a tiered program, the reality is that not all business have the resources of other large users to benefit from a tiered program. All businesses should benefit from the credit program and the State, as a whole, will benefit from an enhanced participation of commercial and industrial users. A tiered program is counterproductive toward those goals and is not needed.

The Board should also consider rewarding early adopters of energy efficiency through implementation of a credit that takes into account a company’s historic expenditures on approved energy efficiency programs, e.g. expenditures that occurred prior to the immediately preceding year that the credit law uses for benchmarking purchases and for which no credit or other Clean Energy Program-related benefits were received. For years many companies pursued significant energy efficiency projects without compensation from the Board. It would be appropriate for these contributions to be recognized through an SBC credit. Businesses should be rewarded for their energy efficiency purchases, not be put at a competitive disadvantage.

- In what form and how often should credits be issued? Should a credit be provided via the

issuance of a check, a credit to the utility account, or in some other way?

NJBIA Response: We believe that it is most appropriate and productive to receive the credit in the form of a check. If payment is made by check, particularly one directly traceable to an SBC credit application, it increases the likelihood that the company will be able to direct the money for investment in future energy projects, as opposed to merely reducing one of the company’s many accounts payable as would be the case if a utility bill credit were to be issued instead. The issuance of a check would enable energy personnel within a company to maintain better control of the refund and to direct how it will be spent.

The checks should be issued upon approval of the credit or, if a multi-year project is involved with a credit carry forward, either annually on the anniversary date of the approval or when needed for the purchase of approved energy efficiency products and services.

- Should a minimum SBC contribution or maximum credit amount be implemented as part of this program?

NJBIA Response: If the Board elects to impose a minimum contribution for eligibility for this credit, an appropriate requirement for businesses should be as low as possible to encourage maximum participation – but high enough to be implementable from a Board perspective. We believe a contribution in the range of $10,000 is workable feasible and justified to assure that the program is accessible to smaller businesses. No maximum credit should be established, particularly if the Board’s goal is to incentivize larger businesses to participate in the program.

- Should a program annual credit maximum be established which could reduce individual credit

amounts if a threshold dollar amount of SBC credits is reached for a program year? Should a

mechanism to reduce or freeze the impact of the SBC Credit Program be included?

NJBIA Response: Our answer to both questions is no. The goal of the program is to achieve maximum penetration in the business community. To achieve this goal, it is essential to maximize the credit and to provide certainty of its availability.

If the available annual credit amount were to change each year, it would introduce uncertainty into the program and impede the planning and budgeting efforts of the businesses participating in the program. This will reduce participation rates as businesses will lack the needed certainty to establish viable budgets required by their managements for approvals to initiate significant capital projects. There is no benefit to the State to cap or freeze the available credits. No business can receive more than they pay in so the credit program cannot be oversubscribed in a factual sense. Additionally, to the extent the credit program is maximized, the State is achieving its intended purposes of energy efficiency, less energy usage, and less pollutants – as well as economic growth and competitiveness. There is nothing to be gained from a cap or freeze in the credit program.

- What process should be used to review applications?

NJBIA Response: The simpler the process, the better. The Board should want to encourage high participation, from both large and small businesses. Application complexity is a barrier to entry from a cost and operational perspective. The Board should strive to require the minimal amount of information possible in order to ensure its standards are met and the energy efficiency goals are achieved.

The Board may also want to consider offering application outreach and assistance to smaller businesses who may not be able to afford to hire consultants for complex analysis and application details. Providing a list of acceptable products and services would serve to simplify the application and review process. To the extent the Board needs to assure compliance, audits can be performed. We are not aware, and we do not believe the Board is aware, of any significant efforts in the business community to not fully comply with program requirements. The Board should be wary not to create an application process that attempts to attain every bit of information in a completely verifiable manner. Complexity is the enemy of program effectiveness.

- What minimum filing requirements should a commercial or industrial customer be required to

include in any petition filed before the Board under the SBC Credit Program? Should a

customer receiving an SBC credit be prohibited from participating in other NJCEP or utility

programs for the duration of the credit?

NJBIA Response: A simplified process should be adopted. To the extent possible, it is important that the process be streamlined and cumbersome procedures and requirements be avoided. To encourage greater participation levels, the process should not be perceived as a difficult one that involves too much time and effort.

If the Board provides businesses with an approved listing of products and services, applicants should only be required to substantiate that the products and services have been purchased and implemented. This can be done by the provision of receipts and a certification.

If a customer fully participates in the SBC Credit Program, and the customer receives the full benefit to which it is entitled under program rules, the customer should not be permitted to participate in another NJCEP program in each year in which the customer is receiving the full benefit. Customers should not be permitted to receive credits or grants that exceed the customer’s total SBC contribution in a given year.

If only a partial credit is obtained from the SBC Credit Program, the Board should consider allowing the customer to participate in other NJCEP programs on a pro rata basis, so long as the combined benefit would not enable a customer to exceed its annual SBC contribution in a given year.

- How should the SBC contributions per customer, as currently tracked by New Jersey investor-

owned utilities, factor into determinations on granting an SBC credit, if at all?

NJBIA Response: This should only apply if tiered SBC credits are adopted, which we do not recommend, and then only to track year over year contributions. The metric should only apply to program eligibility requirements and should not be applicable to decisions regarding the granting of SBC credits.

- Should the Board implement a SBC credit program beyond the required implementation of

J.S.A. 48:3-60.3 (SBC Discount Program)? If so, what should the eligibility requirements be?

What eligibility limits or criteria should the Board implement in an SBC Discount Program?

NJBIA Response: The Board should consider any mechanism that would enhance program penetration and encourage energy efficiency programs for businesses. The NJBIA is aware that the New Jersey Large Energy Users Coalition has recommended investment credit programs, performance grant programs, and loan opportunities. We believe these are all recommendations that should be seriously considered. The NJBIA would welcome the opportunity to work with the Board to design additional credit programs.

- Should there be limits on the term of any potential discount under an SBC Discount Program?

NJBIA Response: In order to expand the participation rate of businesses participating in the SBC Discount Program, the Board should permit eligible companies to “bank” credits that are earned, but unused during any year of eligibility. Credits should be recognized and deemed “earned” in each year of eligibility and be permitted to accumulate in an account created for the benefit of an eligible company. The credits should be maintained in the account for a period of up to 10 years after the company’s initial year of eligibility or first credit deposit into the account. The Board or a designee would be responsible for tracking and reporting the amounts credited in each such account as well as withdrawals for approved expenditures.

For the Board’s budgeting purposes, the amounts credited should be in the form of actual deposits of funds that are made for the benefit of eligible companies. If a credit remains unused by an eligible company for 11 years after its year of issuance, the credit would be forfeited. The remaining credits earned in each subsequent year would continue to be banked until it is used for a purchase of approved products and services or forfeited in year 11, whichever first occurs.

This approach would provide an eligible company an option to accumulate credits over several years, enabling the company to pursue more significant energy projects than would be possible if only a single year’s credit is available for this purpose. This option could be particularly important to companies that have already addressed “low-hanging fruit” projects and must now develop more comprehensive energy efficiency projects.

- Should a minimum SBC contribution or maximum discount amount be implemented as part of

an SBC Discount Program?

NJBIA Response: A $10,000 minimum contribution appears reasonable under the circumstances, particularly taking into account the demands and costs associated with administering the program. However, no maximum should be imposed, other than capping a credit at 10 years, subject to forfeiture if not used for approved purposes. Again, it is critically important to provide certainty to the marketplace, including the certainty that businesses that satisfy clear program guidelines will qualify for a certain level of credits and that the credits can be used to purchase clearly defined products and services. This will encourage businesses to engage in the long-term planning of projects and enable larger, holistic projects to be developed that require significant credits that have accumulated over multiple years.

- What minimum filing requirements should a commercial or industrial customer be required to

include in any petition filed before the Board under an SBC Discount Program?

NJBIA Response: See response to question number 6.