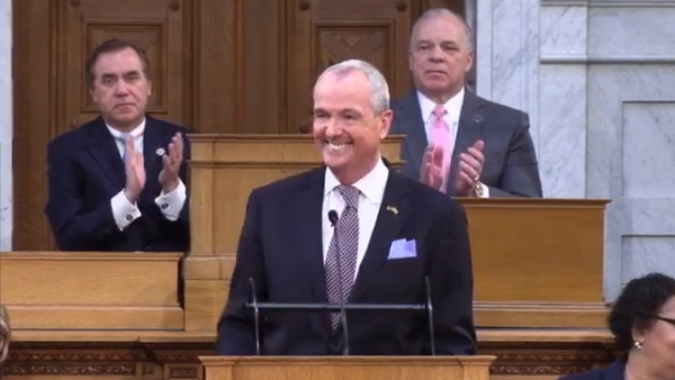

Gov. Phil Murphy delivers his FY 2021 budget address. Behind him are Assembly Speaker Craig Coughlin (left) and Senate President Steve Sweeney.

Despite a booming economy and tax revenues already exceeding estimates, Gov. Phil Murphy again proposed a broad-based tax increase to fund the $40.9 billion proposed budget he unveiled today. The spending plan would increase spending by $2.1 billion over the budget Murphy signed into law last year, a 5.7% increase.

Murphy presented his budget as being pro-growth and progressive, saying it would continue to invest in New Jersey and make the economy stronger and fairer.

“Our administration took office with a clear and unshakable goal – to grow and strengthen New Jersey’s middle class,” Murphy said. “That means creating opportunity, shrinking inequalities, restoring fiscal responsibility, delivering property tax relief, growing our economy, and investing in our future.

“We were told that all of this couldn’t be done. We were told we were dreaming. We were told the math couldn’t possibly work,” he said. “They said we couldn’t be pro-growth and progressive, that we couldn’t make New Jersey stronger and fairer. But we have stayed true to our beliefs. We are who we said we’d be. And, today, we are proving the naysayers wrong.”

Murphy again proposed expanding the millionaires tax by applying the top tax rate, 10.75%, to all income over $1 million. Currently, it applies only to those making $5 million or more annually.

While saying more work needs to be done, Murphy highlighted several economic accomplishments, including the creation of 72,000 private-sector jobs, rising wages, 8,500 residents in 988 recognized apprenticeship programs, and new businesses opening at a rate “far outpacing our peers.”

NJBIA President and CEO Michele N. Siekerka focused on the fact that the governor is again asking for a tax increase even though there is not an obvious need for additional funds and tax revenue collections are exceeding previous projections.

“The question we need to ask ourselves today is: How can tax increases be justified at a time of a budget surplus, built largely on the backs of business, and when spending on discretionary items is going up by hundreds of millions of dollars?” she said in a statement released just after the address.

Siekerka noted that New Jersey has experienced a net loss of $30.1 billion in adjusted gross income over the last 14 years of available data, and that Murphy’s proposal to broaden the base for the top gross income tax rate will do nothing to reverse the trend.

“True relief for the middle class will only be found when our policymakers stop their tax-first approach and embark on a reform agenda that comprehensively addresses underfunded pensions,” she said.

As for the details of the spending plan, the highlights include:

- $50 million for Garden State Guarantee, a new higher education grant program for colleges creating free college programs for families with income under $60,000;

- $20 million for a Jobs NJ apprenticeship program called the NJ Talent Solution;

- small investment in digitizing and modernizing government services like permitting;

- tripling funding for the Commission on Science and Technology to $3 million;

- a record subsidy for NJ TRANSIT of $590 million

- $80 million for a drinking water program

Additionally, the governor pointed to a number of ways the budget embraces fiscal responsibility, beginning with doubling the budget surplus to 4%. It has been well-documented that New Jersey’s budget surplus is still well below where it should be. He also said “one-shot” funding gimmicks (those that do not provide a predictable funding source for the future) represent only 0.8% of the proposed budget.