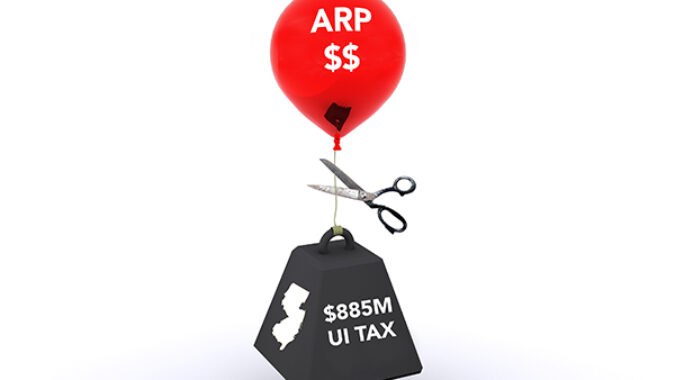

Lawmakers on both sides of the aisle this week publicly sided with NJBIA’s leading advocacy of using federal recovery dollars to lessen or eliminate a massive unemployment payroll tax on employers.

But will it happen?

“Will is actually the operative word,” said NJBIA Vice President,Christopher Emigholz. “We appreciate that some members of the Legislature understand that it’s unfair to sock employers with what could be a near $1 billion tax increase over three years, to replenish an Unemployment Insurance Trust Fund that was depleted through no fault of their own.

“They understand that there is federal recovery money available for that purpose, and a majority of states have taken that path. But ultimately, it’s going to be up to our legislative leadership and Governor Murphy to jointly make that determination.”

News broke late last week after NJBIA had been requesting transparency that the New Jersey Department of Labor posted its employer contribution rates for FY21-22, changing it from Tax Table B to Tax Table C – meaning a $252 million increase for employers in the state this year.

On Monday, multiple media outlets reported the tax increase – which could ultimately amount to a UI tax increase of almost a billion dollars over three years from what employers paid before COVID-19 if no federal funds are used to offset it.

In response to the reports, two state Senate Democrats urged Gov. Phil Murphy to use some of New Jersey’s $6.2 billion in federal COVID-19 aid to reduce the unemployment payroll tax on employers.

Senator Troy Singleton (D-7) noted in a letter to the governor that the American Rescue Plan was created to assist state and local governments with their economic recovery from the coronavirus pandemic and that a steep increase in the unemployment insurance tax would hurt businesses trying to recover.

Senator Dawn Addiego (D-8) issued a statement saying: “We have plenty of federal dollars to go around, and there is no reason businesses should be burdened with an unemployment tax hike when laying off employees was the only way they could stay afloat through last year’s shutdown.”

Assemblyman Roy Freiman (D-16) also voiced support yesterday in the New Jersey Globe.

These asks were in addition to the more predictable public requests from Republican lawmakers such as Sens. Steven Oroho, Anthony Bucco, Mike Testa, Jim Holzapfel and Assemblymen Greg McGuckin, John Catalano, Hal Wirths and Parker Space.

Senator Declan O’Scanlon went a step further urging the Legislature, currently in summer recess, to reconvene to pass legislation to “force the Governor to do the right thing and stop this tax from going into effect.”

Emigholz acknowledged it’s probably unlikely that the $252 million increase beginning with payroll taxes due by Oct. 30 will change between now and then – although the delay in NJDOL informing employers about the rate change was once seen as a possible sign of hope.

“We now hear from NJDOL that the increase was a matter of statute,” Emigholz said. “But if it was in statute, why did the department wait until midway through this quarter to update the tax rate for what is due at the end of this quarter and employers should have been holding already?”

Emigholz says the conversation should turn to using federal recovery dollars to offset the $297 million in projected unemployment taxes in FY23 and $336 million in FY24.

In an NJ Spotlight News story on Tuesday, spokespeople for Senate President Steve Sweeney and Assembly Leader Craig Coughlin were both non-committal about using federal dollars to offset the tax, pointing to aid that has already been provided to New Jersey’s business community during the pandemic.

Thus far, the New Jersey Economic Development Authority has disbursed more than $400 million in grants and loans to help New Jersey businesses.

Emigholz, however, said if the three-year phase-in of an $885 million unemployment tax is not lessened, New Jersey’s business community will be looking at a net loss in comparison to that NJEDA aid.

“We are not in any way diminishing the assistance that has already been provided to our businesses,” Emigholz said. “But let’s not forget much of that aid was provided to keep businesses alive after significant revenue loss when New Jersey had the longest shutdowns and continued restrictions of any state in the nation.

“In three years, if we’re looking at a tax increase that is hundreds of millions more than the aid provided, that’s an overall net loss for businesses in New Jersey. The federal American Rescue Plan money should be used to help those most impacted by the pandemic, and that definitely includes businesses that were forced to close and limit their operations.

“We strongly maintain that the state should not be needlessly hitting our business community with this level of tax increase and we will work with our policymakers to rally further support on this matter,” he said.