The limit on contributions by employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan remains unchanged at $19,500 for 2021, the IRS announced this week.

The catch-up contribution limit for employees aged 50 and over who participate in these plans remains unchanged at $6,500, the IRS said.

The limitation regarding SIMPLE retirement accounts remains unchanged at $13,500.

Details on these and other retirement-related cost-of-living adjustments for 2021 are in Notice 2020-79 PDF, available on IRS.gov.

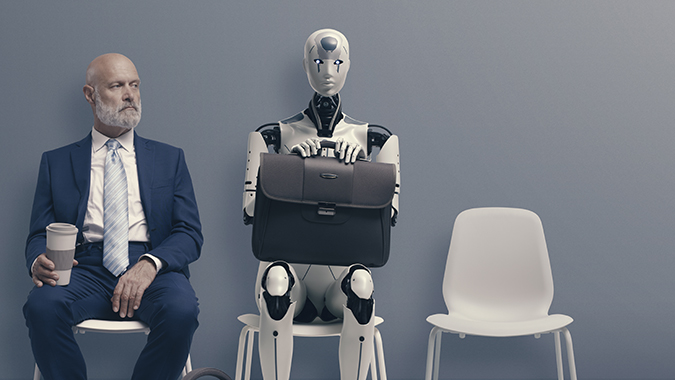

Employers have long struggled to encourage employee participation in retirement accounts — and many feel an increasing responsibility to do so, according to an article in HR Dive. Seventy-eight percent of employer respondents to an early 2020 Bank of America survey reported feeling "very or extremely responsible" for helping employees sustain assets through retirement, up from 33% in 2012.

Employers may have their work cut out for them, HR Dive said. In early March, before widespread layoffs, a Betterment for Business survey results revealed that a third of millennials and Gen Zers had dipped into retirement accounts early. The situation may be even more dire now thanks to pandemic-driven job losses. Half of unemployed older workers are at risk of involuntary retirement according to August research from the Schwartz Center for Economic Policy Analysis at The New School.