NJBIA’s 2022 Business Outlook Survey was released this week, with two major storylines taking centerstage among multiple media outlets:

- Nearly three in four business owners said they were challenged to find appropriate staffing in 2021, and nearly the same amount raised wages – some considerably – to help offset their workforce shortage,

- While 37% said there is no change in their future plans due to the continued pandemic challenges of the past 20 months, 28% said they will look to sell or cease their business sooner than previously anticipated due to continued obstacles, while 31% said they are still determining if their plans will change.

NJBIA Chief Government Affairs Officers Chrissy Buteas told NJ101.5’s Michael Symons that the challenge in filling jobs goes beyond the hospitality industry.

“It’s so much more than that,” Buteas said. “Our manufacturers are out looking for employees, our engineers So, we hear it across the board. This workforce challenge is not going away.”

“What our businesses are telling us is because of the struggles, they’re uncertain about their futures moving forward,” Buteas said in another report with NJ Spotlight News’ Rhonda Schaffler. “So will they consider selling, merging or just shutting down shop? And that’s really disappointing.”

Other responses in NJBIA’s 63rd annual Business Outlook Survey include:

- 73% said they were challenged to find appropriate staffing in 2021 (48% said they were considerably challenged, while 25% described the challenges as manageable)

- Those who were challenged to find staff reported the following impacts on their bottom line:

- 57% reported available staff was more stressed or burnt out

- 51% lost revenue

- 50% increased wages higher than they wanted or could afford

- 45% reported service to their customers suffered

- 32% hired staff with lower qualifications

- 24% reduced hours/days open

- Those impacted businesses reported the following hiring experiences in 2021:

- 57% had scheduled interviewees who didn’t show up; 46% had interviewees who canceled their interviews

- 49% had candidates who said they wanted to remain unemployed to collect unemployment benefits

- 27% had candidates who asked to be paid off the books so they could continue to collect unemployment

- 26% had candidates who said childcare challenges impacted their ability to return to work

- 79% said they were impacted by supply chain issues and delays more in 2021 than in previous years

- 52% said they believed businesses that offered remote work flexibility put in-person only employers at a competitive disadvantage

- While wages were up in 2021, respondents were mixed the notion of resolving hiring challenges by having to pay more:

- 39% said they believe staff pay should only be commensurate with the economic value of the position and what they could afford as an employer

- 33% said they now believe they’ll have to pay beyond the economic value and what they can afford in order for their business to be competitive

- 16% said they always believed they should pay beyond the value of the job to be competitive

Employment

Only 13% of businesses increased hiring this year, while 34% said their hiring decreased.

That net negative of -21% was similar to the -23% net negative in hiring in 2020 – although 2020’s low hiring numbers likely had more to do with pandemic-related closures and restrictions than the lack of available workforce that was well-documented this year.

Prior to 2020, there hadn’t been a negative net in hiring activity in this survey since 2012.

Looking to 2022, 33% predicted they will hire more, compared to 9% which predicted less hiring – a +24% net positive hiring outlook and 9% higher than the outlook for 2021.

Wages

Some 33% of employers increased pay for employees by 5% or more in 2021 – compared to 12% who increased pay 5% or more in 2020. All totaled, 72% increased wages this year – compared to 54% who raised pay in 2020.

Businesses expect that upward trend to continue in 2022 with 22% saying they’ll increase wages more than 5%. A year ago, only 9% said they would increase pay more than 5%.

Another 29% said they’ll raise wages between 3%-4.9% in 2022. All totaled, 73% said they’ll increase wages in 2022 – compared to 56% who said they’d raise pay in 2021.

Sales

Actual sales rebounded for New Jersey businesses in 2021, with 43% claiming an increase in sales this year – compared to the meager 19% that saw more sales in 2020 due to the pandemic.

Remarkably, the exact percentage of businesses projected the same sales next year as they forecasted in 2020. A total of 46% anticipate increased sales in 2022, compared to 23% who foresee less sales. Prior to last year, the +23% net positive outlook was the lowest since 2015.

Profits

In the throes of a pandemic, only 20% reported net profits a year ago, compared to 62% who recorded a loss. It marked the first net negative of earnings (-42%) in this survey since the outlook for 2012.

In 2021, however, businesses rebounded at least somewhat – with 37% reporting profits and 42% taking a loss.

What hasn’t improved is businesses’ outlook for profits. Last year, there was a net positive of only 14% believing they would report a profit in 2021. In 2022, however, 38% believe they will make a profit, compared to 26% who think they will lose money. That net positive of 12% is the lowest outlook for profits in this survey since 2012.

Of that 38% hoping to be on the plus-side for 2022, 15% are forecasting profits of 1%-3% next year.

Purchases and Prices

With the increased costs of doing business and historic losses of revenue in 2020 due to the pandemic, 55% of respondents said the prices for their products and/or services increased in 2021 (17% increased substantially, 38% increased modestly).

That 55% is compared to 31% who said they raised prices in 2020. Another 40% said their prices were kept the same this year, while only 5% said they decreased prices.

Regarding future purchasing plans, 44% are expecting to increase the dollar value of their purchases in 2022 and 18% anticipating a decline. That’s a net positive of +26%, nine percentage points higher than the outlook for 2021.

In 2021, 54% of businesses said they made investments to productivity. That’s a slight increase from 50% in 2020, but still off the mark from the pre-pandemic years of 2019 (62%), 2018 (61%) and 2017 (60%).

New Jersey’s Challenges

The overall cost of doing business was listed by 28% as the most troublesome for businesses in New Jersey, breaking a four-year streak where property taxes held the unenviable top spot.

Availability of skilled labor (16%) rocketed to the No. 2 spot, while property taxes (14%) and health insurance costs (14%) rounded out the top four.

Seventy-seven percent expect their health benefits costs to go up in 2022 – an increase of 6% from last year. Twenty percent anticipated those health benefit costs to rise 11% or more in 2022.

As for local property taxes, 69% expected an increase, 28% expected them to remain the same and only 2% expected a decrease.

New Jersey’s Economic Climate

A continued reluctance for businesses to expand in New Jersey remains. Fifty-nine percent of respondents said they had no plans to expand, while 25% said they would expand in another state, compared to 10% that would expand in New Jersey.

As a location for new or expanded facilities, only 22% listed New Jersey as very good or good, while 30% described it as fair and 48% ranked it as poor.

Only 11% said they believe New Jersey has made progress over the last year in easing regulatory obstacles. That number has declined steadily from 24% in 2017.

Only 13%, however, said they needed to postpone installation of equipment or expansion of their business due to permitting delays or the state’s regulatory process.

Only 36% said they are planning to keep New Jersey as their domicile in retirement – a 4% bump from last year, but still a consistent indication of the state’s low appeal for people in their golden years.

New Jersey’s Competitive Levels

New Jersey’s performance compared to other states was fairly similar to past years. However, New Jersey’s workforce issues in 2021 changed one key metric.

Specifically, only 21% of respondents said that the quality of New Jersey’s workforce was better than other states – an 8% drop from last year and the year before. That decline could be indicative of employers forced to take less qualified workers to fill positions, or perhaps a commentary on those who chose to receive unemployment benefits rather than re-entering the workforce.

The leading competitive positive: For the second straight year, 43% rate the quality of New Jersey public schools better than other states. At protecting the environment, 21% said New Jersey does better than other states – a 2% bump from last year’s survey.

But New Jersey continues to struggle in many areas more tied directly to business. It was listed as worse that other states in taxes and fees (88%), controlling government spending (76%), controlling health care costs (72%), controlling labor costs (67%) and the costs of regulatory compliance (63%).

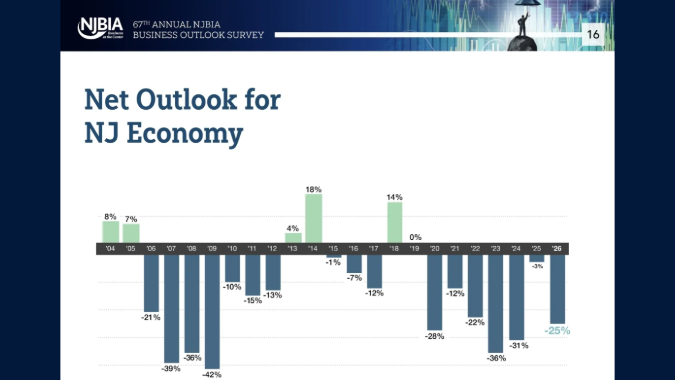

NJ and US Economic Outlooks

In 2021, most (42%) rated New Jersey’s economy as fair, while 29% described it as poor, 25% listed it as good and only 3% called it excellent. These numbers are somewhat improved from the pandemic-laden year of 2020.

But when asked how New Jersey’s economy will fare in the first six months of 2022, only 22% reported it would be better, while 44% said it would be worse.

That -22% net outlook is 10 percentage points lower than the outlook for 2021.

There were bigger changes, however, in the outlook for the U.S. economy. Only 26% said the first six months of 2022 would be better, compared to 41% who said it will be worse. That’s a -15% net outlook for the national economy, likely impacted by inflation, supply chain issues and concern of increased taxes.

That’s also the lowest net outlook for the U.S. economy in this survey since 2012 (-29%).

Cannabis

The New Jersey Cannabis Regulatory Commission has delayed issuing standards to ensure an employer’s right to maintain a drug-free workplace, and consequently, a safe workplace.

Respondents were asked for their level of confidence that they could enforce a drug-free workplace, given the legalization of recreational cannabis in New Jersey. Twenty-nine percent said they were very confident, 26% said they were somewhat confident, while 37% said they were not confident at all.

When it came to workplace safety, however, 29% said they were greatly concerned about maintaining it, while 32% said they were moderately concerned. Thirty-four percent said they were not concerned at all.