NJBIA released its 66th annual Business Outlook Survey on Dec. 2. While much of the attention of the 2025 outlook survey focused on New Jersey’s next governor, there were many other facets of the survey.

Today, we look at deeper at New Jersey’s economic climate data found in the 2025 Business Outlook Survey.

New Jersey’s Economic Climate

When respondents were asked about the current business conditions in their industry, 34% said they were experiencing a slowdown (5 percentage points more than last year), while 15% said they were experiencing an expansion.

Eight percent said their industry was moving from a slowdown to a recovery, while 5% said they were moving from an expansion to a slowdown. A majority (38%) said business conditions in their industry were staying the same.

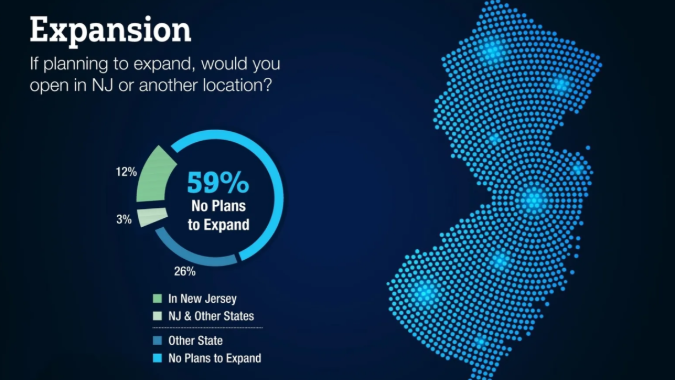

As a location for new or expanded facilities, 28% listed New Jersey as very good or good. Another 32% described the Garden State as fair, and 39% ranked it as poor.

Only 14% said they believe New Jersey has made progress over the last year in easing regulatory obstacles. That number has declined steadily from 24% in 2017.

When asked if their business had postponed installation of equipment or any expansion due to delays in permitting or a regulatory process, 12% said yes.

Sixty-two percent said they made investments to improve productivity in 2024.

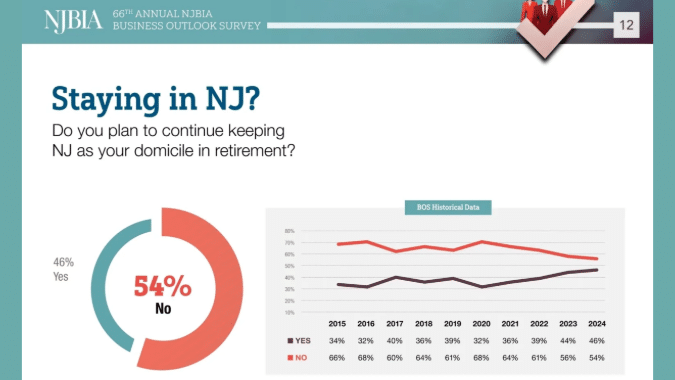

The needle is moving in the right direction on New Jersey’s appeal for people in their golden years, with 46% saying they are planning to keep New Jersey as their domicile in retirement. That number is up 14 percentage points from four years ago and is the highest it has been in a decade.