NJBIA’s 2025 Regional Business Climate Analysis, released today, shows New Jersey ranks last in the region in cost competitiveness and business taxes for a seventh consecutive year.

The analysis, found here, continues to show New Jersey as an extreme regional outlier with the top corporate tax rate and maximum unemployment insurance tax contribution per employee.

New Jersey also lists the highest property tax paid as a percentage of personal income in the region.

Additionally, New Jersey finished with the second highest top income tax rate and combined state sales tax rate.

“The longer New Jersey continues to have the highest tax burdens and costs in the region, the more our state enhances our unfortunate reputation of not being business friendly,” said NJBIA President and CEO Michele Siekerka.

“These results are perhaps more disappointing as New Jersey abandoned its decision to improve upon its highest-in-the-nation corporate business tax rate in 2024. Other states are well ahead of us with their corporate tax rates, while others continue to lower them, understanding that corporate tax rates affect regional competitiveness.”

New Jersey’s top corporate rate is measured at 11.5%, following Gov. Phil Murphy’s about-face on a prior to commitment to sunset a temporary 2.5% surtax on the state’s largest employers.

Delaware’s 8.70% top corporate rate is a distant second-highest rate in the region, but the First State also has a 0% combined sales tax rate. Meanwhile, neighboring Pennsylvania’s 7.99% CBT rate will continue a downward trajectory to 4.99%.

“These results are another unfortunate reminder of the very serious affordability and regional competitiveness challenges our job creators face in New Jersey, year in and year out,” said NJBIA Vice President of Government Affairs Elissa Frank.

“Until we at least try to either individually or comprehensively reduce our high business cost-drivers, New Jersey will struggle to compete nationally and regionally with other states.”

DATA BREAKDOWN

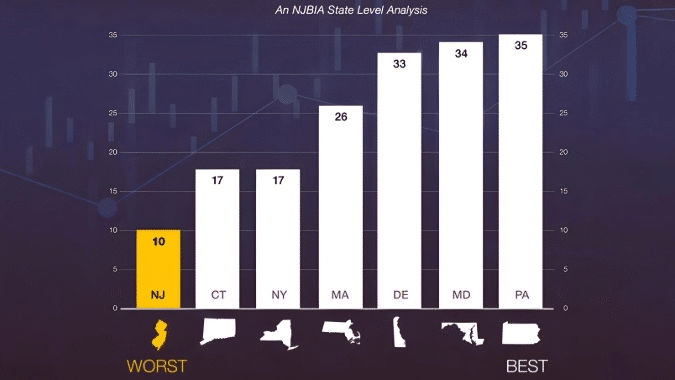

Each year, NJBIA’s annual Regional Business Climate Analysis, prepared by Elissa Frank, scores six individual business cost drivers that measure business competitiveness in seven states.

State rates in each category are scored from 1 (least competitive) to 7 (most competitive).

New Jersey’s overall business climate score was 10 points, making it the least competitive state for the second consecutive year.

Pennsylvania, which was third overall last year, moved up to the top spot with a score of 35 points, making it the most competitive.

Maryland (34) and Delaware (33) finished second and third, respectively, followed by Massachusetts (26), Connecticut (17) and New York (17).

Compared to the six other states, New Jersey has the top property taxes paid as a percentage of income at 4.81%.

In the study, unemployment insurance taxes are represented by the maximum UI contribution per employee, which is calculated by multiplying each state’s taxable wage base and maximum tax rate.

With this metric, New Jersey is now, by far, highest in this category with a $2,771.20 maximum UI contribution per employee.

Because of recent increases in both New Jersey’s taxable wage base and maximum rate, that figure is a whopping $648.40 more than two years ago.

For the fourth straight year, New Jersey’s top income tax rate of 10.75% has been surpassed only by New York’s top rate of 10.9%.

Connecticut currently has the top minimum wage rate of $16.45 per hour, followed by New York ($15.50) and New Jersey ($15.49).

To account for both state and local sales taxes, NJBIA’s sales tax metric combines each state’s statewide sales tax rate with the average of any local sales taxes collected by local governments.

As a result, New Jersey finished with the second-highest combined sales tax rate at 6.6% – a good distance behind New York’s 8.53%.