Moody's Investors Service has affirmed the A3 rating on New Jersey's outstanding general obligation debt and revised the outlook from stable to positive, citing the state's influx of new revenue and recent budget moves that addressed long-term debt and public employee pension system liabilities.

"The revision to the positive outlook reflects the state's better-than-expected financial position and improved governance profile that will enhance budget flexibility during the coronavirus recovery," Moody's said in a statement released Tuesday.

The credit rating agency's praise for New Jersey's recent actions, particularly the acceleration of payments to the state's historically underfunded public pension system, was tempered with caution about the amount of total spending in the $46.4 billion FY22 state budget that took effect July 1.

"Increased spending on recurring programs in fiscal 2022, including education, creates structural budget gaps that make the state vulnerable to budget risks in a period of continued uncertainty and may challenge the state's ability to sustain its improving trajectory," Moody's said.

"Over the next one to two fiscal years, a key rating consideration will be continuation of governance and financial improvements that restore structural budget balance," Moody's said.

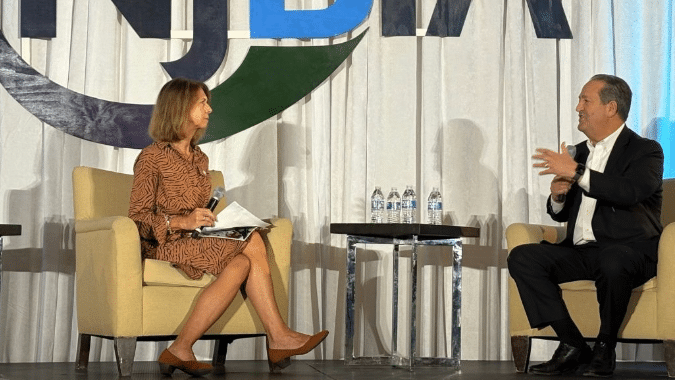

NJBIA Vice President of Government Affairs Christopher Emigholz said he pleased that Moody's shared NJBIA's perspective on the FY22 state budget.

"We strongly supported the full pension payment, and we called for money to be put aside for debt defeasance and prevention as this budget did," Emigholz said. "Like Moody’s we worry about the structural balance, but this budget with no new taxes and some areas of responsible spending on pensions and debt relief is better than recent budgets.”

Moody's announcement affects $40 billion in outstanding rated state debt. In addition to general obligation bonds, Moody's affirmed the rating and upgraded the outlook to positive for bonds issued by the Garden State Preservation Trust; appropriation backed debt; moral obligation debt issued by the South Jersey Port Corporation; the New Jersey County College Enhancement Bond Program Chapter 12; the New Jersey Municipal Qualified Bond Program and New Jersey Qualified School Bond Program intercept programs, and the New Jersey Transportation Trust Fund Authority's (NJ TTFA) Federal Highway Reimbursement Revenue Notes (GARVEEs).

Gov. Phil Murphy on Wednesday welcomed the credit rating agency's decision.

"For the past four years we have approached the fiscal challenges we inherited, not as obstacles, but as opportunities to right our fiscal ship," Murphy said in a press statement. "On the heels of a record 11 credit downgrades under the prior administration and in the midst of an unprecedented global pandemic, we've delivered historic levels of pension funding – including the first full contribution in a quarter of a century – set aside money to pay off a sizable portion of state debt and avoid future issuances, secured long-term savings for the State and its taxpayers, bolstered our surplus, and positioned ourselves well to tackle the remaining challenges that lie ahead."