Tax increases being considered by state policymakers this budget season would hit areas of New Jersey’s economy that are already challenged, an analysis by the New Jersey Business & Industry Association finds.

New research shows that New Jersey now has a net loss of nearly $25 billion in Adjusted Gross Income over the past 12 years, is poised to become the worst state in the nation for Corporate Business Tax (CBT), and is lagging in the rate of millionaire growth in the region.

“This concerning data should serve as fair warning to our policymakers that higher CBT, millionaires or sales taxes, on top of the cumulative costs from our recent and increasing business mandates, are only giving our business owners and residents more reason to leave our great state,” said NJBIA President and CEO Michele Siekerka. “And if they aren’t leaving, they’re certainly not planning to grow here.

“This analysis speaks to our declining competitiveness in the region and the nation. We need to improve our state’s economy through comprehensive planning, rather than excessive taxation. This is the only way to reclaim our regional competitiveness and to reverse the disturbing trend of outmigration from New Jersey.”

ADJUSTED GROSS INCOME

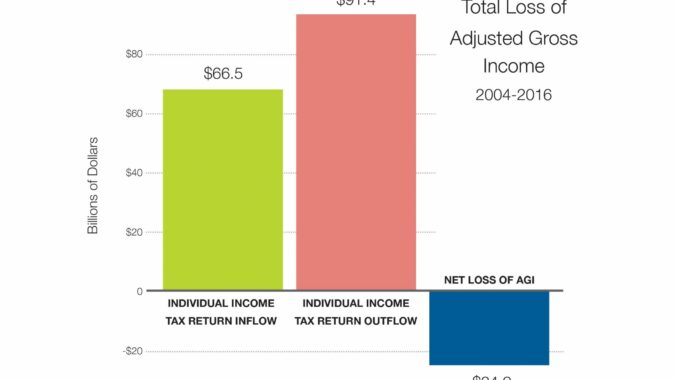

According to the most up-to-date Internal Revenue Service (IRS) data for tax year 2015-2016, New Jersey experienced a net loss in potential Adjusted Gross Income (AGI) of $3.5 billion. This exceeds the average annual rate loss of approximately $2.1 billion over the past 12 years. The change is driven by taxpayers moving out of state and taking their incomes with them.

An NJBIA analysis of the IRS’s Statistics of Income Inflow and Outflow data, finds that from tax year 2004-2005 to 2015-2016, New Jersey experienced a total loss of $24.9 billion in potential AGI.

Since tax year 2004-2005, New Jersey has now gained $66.5 billion in AGI, but lost $91.4 billion.

CORPORATE BUSINESS TAX

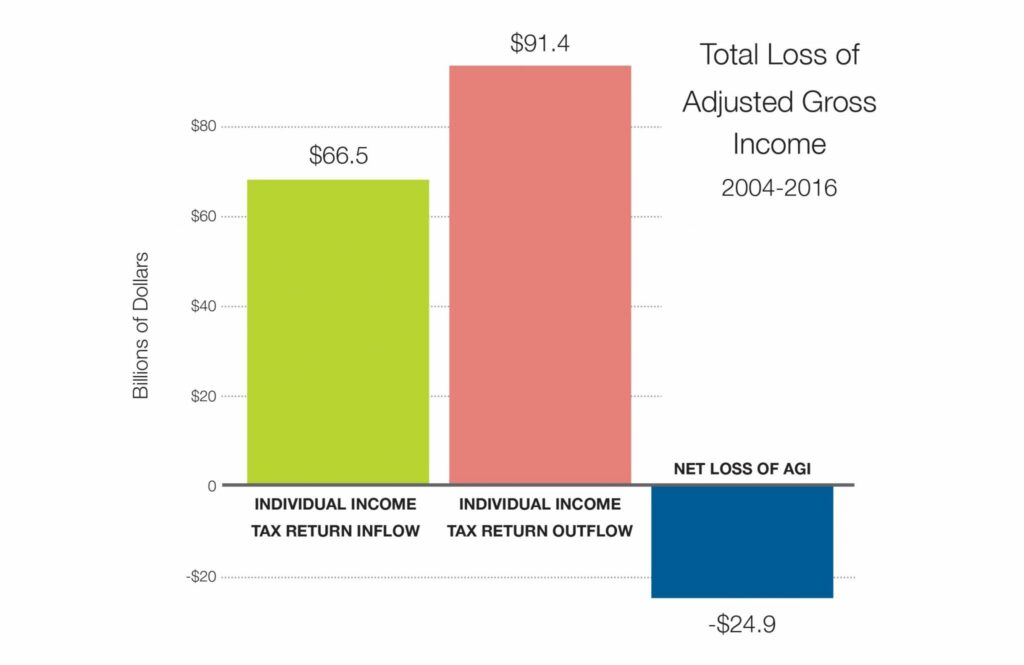

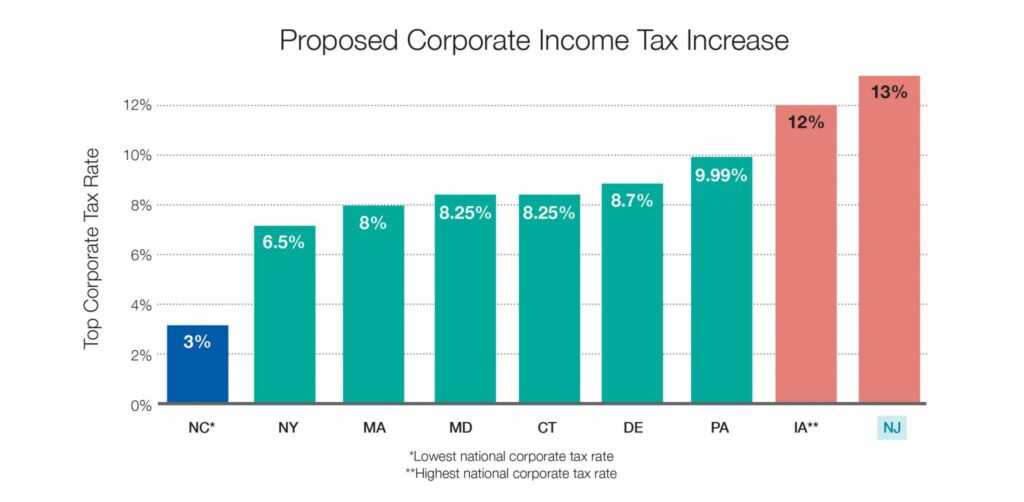

New Jersey currently has the sixth highest corporate income tax rate (9 percent) in the United States, while Pennsylvania ranks second (9.99 percent). If New Jersey’s rate on corporations earning a net income of $1 million increases to 13 percent, as proposed, New Jersey would surpass Iowa for the highest corporate income tax rate in the nation.

Meanwhile, regional competitors New York (6.5 percent) and Massachusetts (8 percent) have decreased their CBT and currently have the most competitive rates in the region.

“While most states have either reduced or maintained their corporate tax rates, New Jersey is poised to go in the wrong direction,” Siekerka said. “Some studies link an increase in CBT to a reduction in employment and income and a decrease in CBT to quicker job creation. A CBT surcharge would only incentivize our larger corporations to expand their operations elsewhere. And if they’re stagnating here, that’s just as bad as outmigration for New Jersey.”

MILLIONAIRES TAX

A proposed “millionaires tax” provision in the FY 2019 budget proposal would increase the top income tax rate from 8.97 percent to 10.75 percent on income above $1 million.

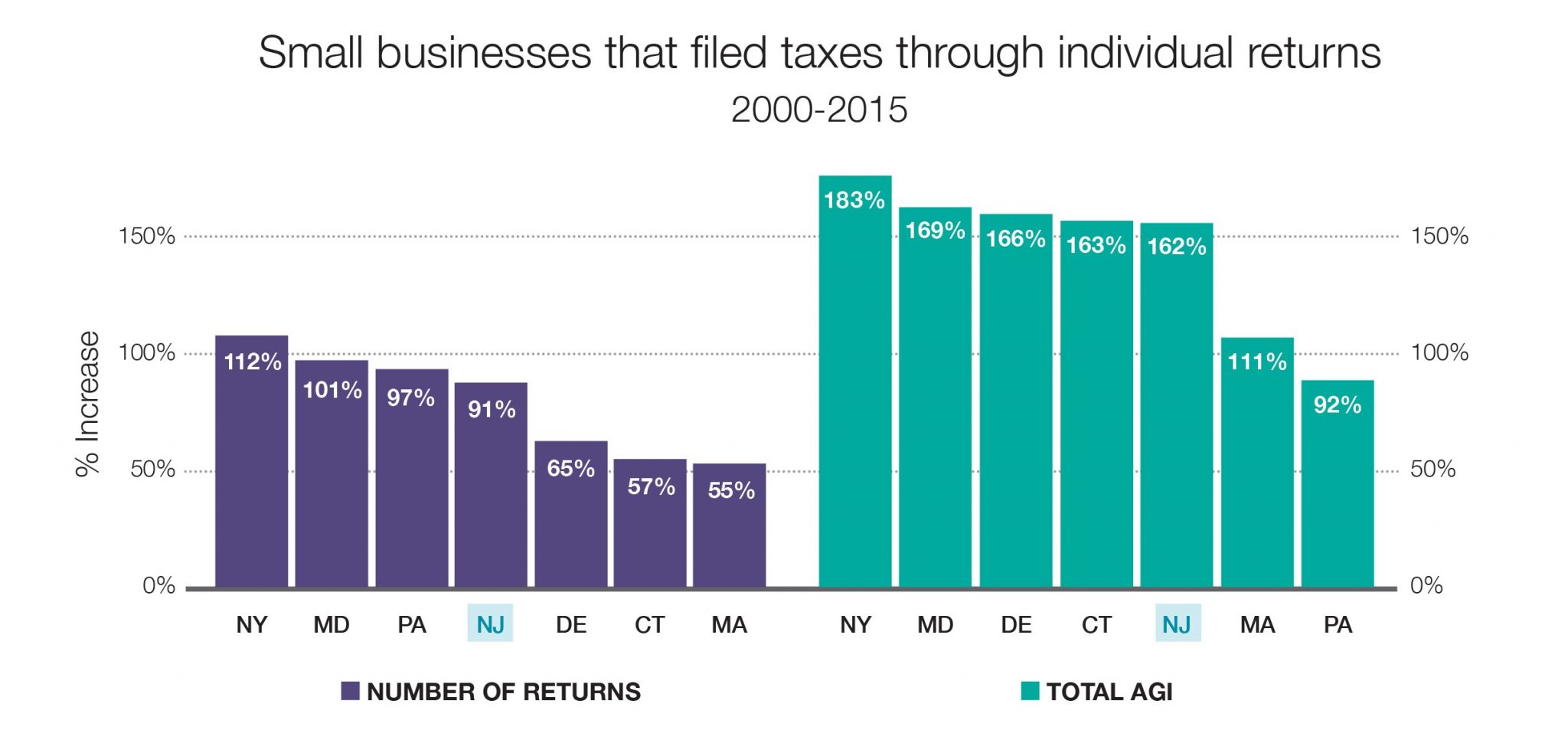

An NJBIA analysis found that while the number of returns for New Jersey businesses filing $1 million or more increased between 2000 and 2015, New Jersey grew at a slower rate in this category than three regional competitors - including Pennsylvania and New York. In addition, New Jersey’s total AGI for businesses filing $1 million or more ranked fifth out of seven regional states.

“Millionaires have grown around the nation during a time of economic upswing, but New Jersey’s percent change of growth is slower than most of our regional competitors,” Siekerka said. “We should be wary of our tax policies making New Jersey more dependent on the highest income earners who are being given more reasons to consider leaving the state.”

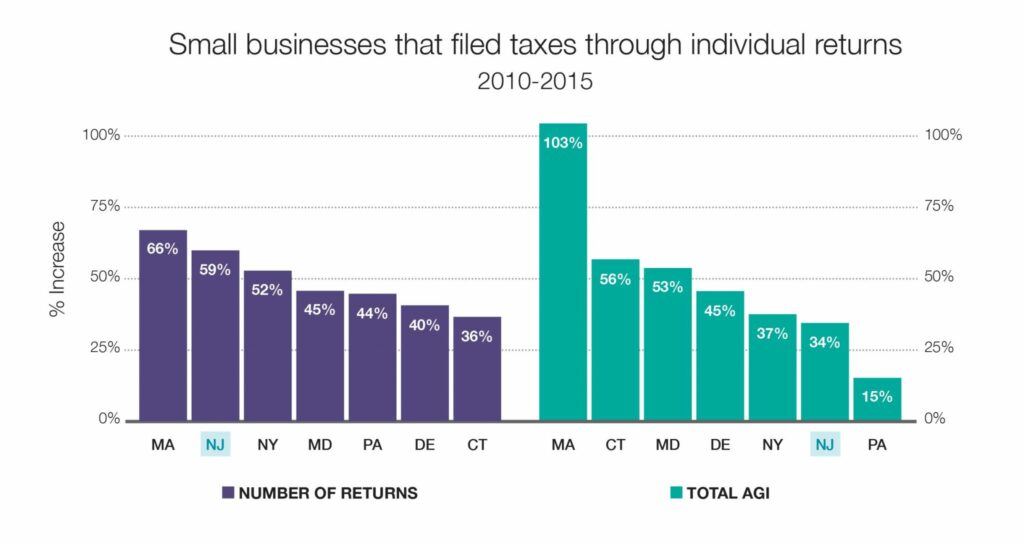

Between 2010 and 2015, New Jersey’s number of businesses filing $1 million or more ranked second in the region. But tellingly, New Jersey ranked sixth out of seven regional states in total AGI growth.

The story is similar for New Jersey individuals filing a tax return of $1 million or more. When analyzing data from 2010 to 2015, New Jersey ranked third in the region in this category, but only fifth out of seven in the percentage change of total AGI. In fact, Massachusetts surpassed the Garden State in total AGI from individual millionaires in 2014 and 2015, despite having nearly 3,500 fewer filings of $1 million and more.

“NJBIA continues to call for comprehensive tax and regulatory reform to fix our structural budget deficits,” Siekerka said. “We need our policymakers to pause until the State Tax Policy Working Group, created by Senate President Steve Sweeney, and the Economic Growth Council, created by Gov. Murphy, complete their work and advance comprehensive recommendations. We need them to plan and adopt long-term, sustainable solutions rather than attempt to tax our way out of fiscal challenges.”

Sources:

An NJBIA Analysis of SOI IRS, 2004-2015

AN NJBIA Analysis of SOI IRS Migration Data, 2004 to 2005- 2015 to 2016

J. Walczak, S. Drenkard, J. Bishop-Henchman. (2018). 2018 State Business Tax Climate Index. Tax Foundation.

Office of Revenue and Economic Analysis. (Jan. 2017). New Jersey Corporation Business Tax Statistical Report. Office of the Chief Economist.

R. McGrath. (Mar. 2018). SWEENEY PROPOSES LANDMARK $758M SCHOOL FUNDING REFORM UNDERWRITTEEN BY RECAPTURING FEDERAL CORPORATE WINDFALL. New Jersey Senate Democrats. Press Release.

State Government Websites