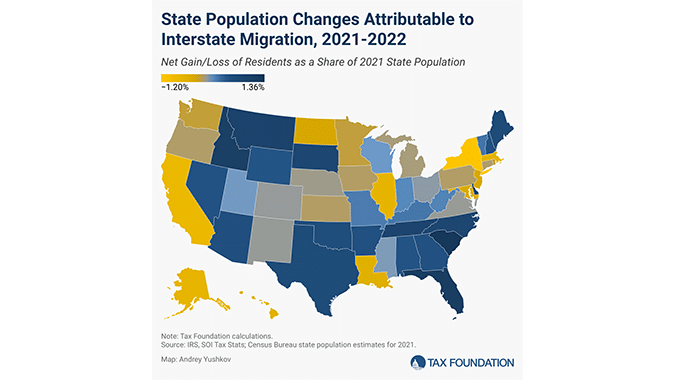

New Jersey was one of 24 states to experience a net loss of income tax filers between 2021 and 2022 due to interstate migration, according to an updated analysis of IRS data that was released on Tuesday by the nonpartisan Tax Foundation.

The Garden State lost 20,820 tax filers and $5.27 billion in adjusted gross income (AGI) during that 12-month period, the foundation said. New Jersey’s total non-inflation-adjusted net loss of AGI is approximately $45.5 billion since 2004-2005.

“For many years, policymakers, journalists, and taxpayers have debated the role state tax policy plays in individuals’ and businesses’ location decisions,” Andrey Yushov, Ph.D., a senior policy analyst at the Tax Foundation, wrote Tuesday in his analysis of the latest IRS data.

“Cost-of-living considerations, including tax differentials, may not be the primary reason for an interstate move, but they are often one of several factors people consider when deciding whether – and where – to move,” he said.

The IRS data show that between 2021 and 2022, 26 states experienced a net gain in income tax filers from interstate migration led by Florida (+125,551); Texas (+88216); North Carolina (+43,653); South Carolina (+32,927), and Tennessee (+30,935).

The 24 states that experienced the highest losses were California (-144,203); New York (-108,586), Illinois (-45,460); Massachusetts (-26,033), and New Jersey (-20,820).

States with the highest gains in net adjusted gross income included Florida (+$36.0 billion); Texas (+$10.1 billion) and North Carolina, Arizona, Tennessee, and South Carolina (all around $4 billion each).

States with the highest net AGI losses included California (-$23.8 billion); New York (-$14.1 billion); Illinois (-$9.8 billion); New Jersey (-$5.3 billion); and Massachusetts (-$3.9 billion).

The data show a “strong positive relationship” exists between states with well-structured tax codes and those that experience net inbound migration, the foundation said.

Among taxpayers with $200,000 or more in AGI, the most attractive destinations were Florida, Texas, North Carolina, South Carolina, and Arizona, while the least attractive states were California, New York, Illinois, Massachusetts, and New Jersey.

Among the 26 states that experienced net inbound migration of income tax filers, only 10 had a top marginal individual income tax rate above the national median, which was 5.7% in 2021 (and has since gone down to 5%), the foundation said.

Meanwhile, among the 24 states that experienced net outbound migration of income tax filers, 15 states had top marginal rates above the 5.7% national median. New Jersey’s top marginal income tax rate is nearly double that at 10.75%.

“One reason policymakers should care about their state’s interstate migration patterns is the effect of interstate migration on tax revenue, economic output, and economic growth over time,” Yushov wrote.

“Between 2021 and 2022, most states that experienced a net loss in income tax filers attributable to interstate migration also experienced a net loss in income associated with interstate migration, while most states that gained taxpayers also experienced corresponding gains in AGI.”

The IRS data covered the 12-month period when taxpayers filed their tax year 2020 returns in calendar year 2021 and when they filed their tax year 2021 returns in calendar year 2022.