On behalf of New Jersey’s business community, comprised of thousands of businesses across our great state of New Jersey, NJBIA thanks you for the opportunity to speak today to express our disappointment in Governor Murphy’s recently proposed FY2026 (FY26) State Budget.

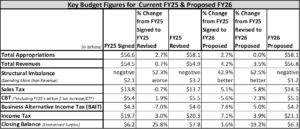

Despite some signs in recent years and before this budget proposal of moving to a healthier and more fiscally responsible state budget that prioritizes investments in innovation, workforce development and infrastructure, the proposed FY26 budget disappointingly continues New Jersey and all its taxpayers on an unsustainable path fueled by tax increases that harm our affordability and competitiveness. We appreciate that Governor Murphy and you, our Legislature, have made the full pension payment, the full school aid payment, a much larger surplus and some targeted pro-growth investments. But this is now the second proposed budget in a row that includes over $1 billion in new taxes, another budget that increases spending by over $1 billion and the fifth proposed budget in a row that is built on a structural imbalance with appropriations exceeding revenues by at least several hundred million dollars and in most cases billions.

Need a COMPREHENSIVE Plan & Not Schizophrenic-Budgeting Without Direction

Perhaps the most disappointing aspect of the proposed state budget is the lack of a cohesive plan or strategy to implement the policy goals on which the Legislature, Governor and business community all seem to largely agree. There almost seems to be a schizophrenic lack of consistency in the policy goals underpinning the budget proposal.

- Investing in Manufacturing & Innovation or Not??? – Governor Murphy proposed a new manufacturing tax credit to incentivize next-generation manufacturers from around the world to come to New Jersey. This is fantastic and something NJBIA will certainly support. But if our goal is tohelp manufacturers, which it should be, why would the proposed budget eliminate the $2 million budget line-item for the New Jersey Manufacturing Extension Program and the $10 million budget line-item for the Manufacturing Initiative, which is better known as NJEDA’s wildly successful Manufacturing Voucher Program (MVP)? Both programs have proven to be important resources to New Jersey manufacturers, and supporting manufacturers is one of the best ways to support the creation of good jobs. This also comes after the Governor included new AI and other innovation and higher education investments in last year’s FY25 budget. Yet the Commission on Science Innovation and Technology was cut by 33%, last year’s AI Innovation Challenge and Innovation Fellows Program was zeroed out in the proposed budget after only one year and our higher education institutions that support innovation and workforce development are seeing dramatic cuts in the proposed budget. If the Governor and Legislature are serious about supporting manufacturing and innovation, the funding for these two-manufacturing line-items should be restored to complement the proposed tax credit and not offset it. Additionally, for manufacturing workforce development, NJBIA asks you for an appropriation to support the robotics law that passed unanimously several years ago, A-2455 (Benson, Huttle, DeAngelo)/S-2204 (Greenstein, Oroho). This is an excellent way to get our next generation of workers into the next-generation manufacturing jobs that we hope to create from the new tax credit. Also, the Legislature should seek to restore other AI innovation and higher education line-items.

- Affordable Housing or Not??? – Housing in New Jersey is already too expensive and is a major contributor to our state affordability issues. NJBIA strongly supports the Governor’s push for regulatory reforms to ease the building of more housing as announced in the budget address. Yet, in the same proposed budget that calls for more affordable housing and more building, Governor Murphy proposes a massive increase in the tax on high-end housing transactions that could chill the housing market leading to fewer sales and less building. To truly prioritize greater housing affordability, NJBIA calls on the Legislature to reject Governor Murphy’s proposal to double and triple the realty transfer fee on homes over $1 and $2 million.

- Taxing Emerging Industries to Help Them Grow??? – Governor Murphy has spoken of the success of the new sports betting/online wagering in New Jersey, and he even talked glowingly about the success of cannabis in his budget speech, yet there are massive, proposed tax increases on these new industries. Taxing a fledgling industry is not the way to keep it growing, so NJBIA asks that the proposed increases on cannabis and sports betting/online wagering be rejected. Both new markets were intentionally created with lower tax rates to keep them competitive, so let us keep that focus on growing these new industries and supporting the legal market instead of losing market share to other states or to the black market due to higher tax rates.

- Do We Care About Affordability or Not??? – Affordability has been a common bipartisan refrain in the Legislature in recent years, and Governor Murphy even ran on a pledge of no new taxes due to affordability concerns. Yet there was a $1 billion tax increase on our largest job creators last year, and now there is over $1.2 billion in new taxes on a variety of products and services that will impact every New Jerseyan. If we genuinely care about affordability, then all the proposed tax increases should be rejected.

- Is Paying Down Debt Still a Priority??? – Despite it only becoming law in 2021, it seems like a long time ago when the state was so flush with cash that it smartly created the Debt Defeasance and Prevention Fund. NJBIA was happy to strongly support that new law to focus the extra cash on paying off our debt or avoiding future debt. Yet just four years later we have the second proposed budget in a row that uses hundreds of millions of dollars to help balance the budget instead of paying down and/or avoiding debt as it is statutorily required to do. If we care about debt, NJBIA requests that the Debt Defeasance and Prevention Fund fully return to what it was rightly intended.

- Are Higher Education Investments the Best Way to Get to Stronger and Fairer, Stimulate the Economy and Prepare the Future Workforce or Not??? – The proposed budget that is supposed to be “Stronger, Fairer and More Prepared for the Future” cuts higher education aid significantly, appearing to be one of the hardest-hit areas of the state budget. Cuts like these negatively impact economic growth and lower-income residents, harming both our innovation eco-system and workforce development pipeline. Higher education should be prioritized and the needed funding to do so should be reinstated.

Unsustainable Overspending

Governor Murphy’s current $58.1 billion appropriation level is $1.4 billion or almost 3% more than last year, despite his reported push for his commissioners to find 5% cuts to their budgets. That is $23.4 billion or 67% more than the $34.7 billion budget Governor Murphy inherited just seven years ago. That kind of rapid spending growth is not sustainable and has put New Jersey into a vulnerable budget situation with repeated structural imbalances where appropriations significantly exceed revenues. The proposed FY26 state budget has $1.2 billion more in spending than revenues. While that structural deficit is down from $2.1 billion in the current FY25 budget, there has been a structural imbalance in six of the past seven Murphy budgets, with an astounding cumulative total of $7.6 billion more appropriations than revenues. In contrast, the prior eight budgets only had three structural deficits with cumulative total revenues exceeding appropriations by $23 million over eight years.

Governor Murphy and the Legislature deserve significant credit for the full pension and school aid payments continued in this budget, and getting there does account for a significant part of recent years’ budget growth. These full funding levels, after too many years of under-funding, is on top of building up a healthy surplus. That will lead to those defending the FY26 spending levels to push back on the perception of overspending with even Governor Murphy asking, “What would you cut?” in his budget message. NJBIA would ask the Governor and Legislature to do a better job of holding the line on new spending and better prioritizing the discretionary money available to meet the goals of affordability and place investments in areas that will grow NJ’s economy. In Governor Murphy’s last seven budgets, there was a cumulative $5.5 billion in spending added to the final budget after the Governor’s Budget Message with only one of seven years where the appropriation level actually wound up less than proposed. It is reasonable to ask what you would cut in the current budget, but to go from $3.2 billion less spending than originally proposed over the prior eight years to $5.5 billion more spending than proposed over Governor Murphy’s seven years tells a story of unsustainable growth.

Under these fiscal constraints, it becomes even more important that we properly prioritize any new spending, especially if doing so gives way to the need to defund a critical need such as post-secondary education and workforce development. Some examples of non-priority spending can be seen as follows: $3 million to support the school cell phone ban; $1 million to support voting by 16- and 17-year-olds; $10 million for state employee supplemental family leave payouts; and $1 million for more lawyers to sue the federal government.

Tax Increases That Make NJ Less Affordable & Less Competitive

After Governor Murphy stated that tax increases would not be needed in his second term, this is the second year in a row where over $1 billion in new taxes was proposed. Last year, the tax increase was squarely on the backs of our largest job creators and gave large New Jersey corporations the highest corporate tax rate in the nation. New Jersey still has the highest corporate tax rate, the highest property taxes, among the highest top income tax rates, a sales tax in the top third of states and the only state in the nation with each of the big four taxes in the top third of the country. And now, Governor Murphy proposes new tax increases of over $1.2 billion over a variety of products and services hitting every individual and business. NJBIA opposes these proposed tax increases because these taxes make New Jersey both less affordable and less competitive. Some proponents of the tax increases may say that they are needed for the revenues they bring in, but NJBIA would argue that the best way to increase state revenues is organic economic growth rather than tax increases that ultimately chase away some of that pursued revenue.

Governor Murphy proposes expanding the sales tax to several products and services that currently are not impacted by the 6.625% sales tax. Making participatory sports, interior design, car purchases if trade-ins are taxed, digital services, second-hand airplane sales, certain complimentary meals, rooms, and tickets, horse training and boats more expensive will result in negative economic impacts at a time when our residents and businesses are still reeling from years of high inflation with higher energy and insurance bills, grocery store prices and restaurant checks. This may raise $277.1 million but may also cost more in lost economic opportunities when sales and projects are happening elsewhere because it is cheaper. Taxing digital services may mean fewer cybersecurity projects completed in New Jersey or higher prices from the business that needed that cybersecurity upgrade will get passed down to the consumer. Making activities like mini-golf, bowling, go-carts or water parks more expensive may lead to fewer participants, less business and/or cuts elsewhere in household budgets. Making cars and boats more expensive will reduce their purchases, hurting the consumer and businesses selling these products.

Another new proposed tax burden is a $317 million increase in the realty transfer fee. Governor Murphy proposes doubling the fee on residential and commercial purchases between $1 million and $2 million from 1% to 2%, and the proposal is to triple the rate to 3% for property sales over $2 million. Housing costs are definitely part of New Jersey’s affordability issues, and a housing tax increase is certainly not going to help with that. New Jersey needs to build and sell more housing to improve the market, lower prices and help the state economy. This tax goes in the opposite direction on all those things. Further slowing the commercial real estate market would have an additional chilling effect on an already depressed commercial market. Proponents of this tax increase will point to it only being on higher-end purchases ignoring that this action can have a chilling effect on both the corporate and residential market.

The proposed budget also includes the troubling return of the truck warehouse tax. Despite this tax being dead on arrival last year at one buck per truck, here it is again in a multiplier form now at two bucks a truck for a total of a $20 million truck-warehouse tax. This budget proposal is very bare bones as to who will pay this tax (truckers, retailers, manufacturers, warehouse facilities, etc.?) and how it will be collected, but New Jersey is a logistics state with many jobs from this important industry that would be impeded by this new tax. The logistics industry also supports other important sectors that would be negatively impacted by this tax like our critical manufacturing industry. Ultimately, everything is on a truck at some point, and we can expect that this cost will be borne by the ultimate recipient of the goods being delivered.

Governor Murphy is also proposing a series of sin tax increases totaling over a half million dollars that could make New Jersey less competitive. Not only would this affect some new and growing industries, but again we can expect that the price will be borne by those who consume these products:

- $41 million from 30 cents per pack increase in the Cigarette Tax rate from $2.70 per pack to $3 per pack.

- $18.5 million from a 10% increase in Alcoholic Beverage Tax rates

- $402.4 million from a significant increase in internet gaming and online sports wagering tax rates from 15% and 13% to 25%, respectively.

- $70 million from increasing cannabis taxes by 500%

- $7.8 million from higher firearm and ammunition fees

Overall, this budget represents about a 2% increase in the state tax burden on New Jersey residents and businesses, and that means about $130 per person of new taxes. That is not something our residents and business can afford when they are seeing all their costs increase at the same time, and it is not something that will make our state more competitive with others to grow the economy.

Maintain Pro-Growth & Fiscally Responsible Initiatives

Despite this budget’s tax and spending overreach in the many areas we described, it is imperative for the Legislature to maintain the responsible fiscal policies and pro-growth investments found in the budget when sending it back to the Governor in June.

Governor Murphy and the Legislature deserve credit for this fifth consecutive full pension payment. However, pension and benefit reform should still be pursued for future public employees to lower future budget liabilities. We know that savings cannot be found by reducing what we rightfully owe into the current underfunded system.

Maintaining the full school aid payment is also important to support our property taxpayers and our workforce development pipeline. Additionally, the school aid formula adjustments this year were thoughtful, but further adjustments should be pursued in statute to make our school aid formula more equitable.

Similarly, despite strongly opposing the corporate tax rate increase last year, if that tax is now law to help fund NJ Transit, it is paramount that it goes to NJ Transit. It is critical that this commitment to fund transportation infrastructure in this manner be kept.

A more robust budget surplus is also a positive development of recent budget years. And while the current $6.3 billion is an important cushion for future budget uncertainty, it should also not be preserved to the detriment of pro-growth investments or as a reason to keep anti-growth tax increases.

NJBIA also requests the Legislature to include in the budget they return to Governor Murphy the pro-growth tax changes he proposed. The Governor called for passing legislation this year that would align New Jersey with the federal tax treatment for Qualified Small Business Stock (QSBS). That bill, which would help our small entrepreneurs and job creators, has passed an Assembly Committee in the Legislature without opposition as A-4455 (Freiman, Schaer). It is estimated to save taxpayers $10.4 million. The budget proposal also sought to expand the Angel Investor Tax Credit to encourage investment in innovative new businesses. That bill has already passed the Senate and an Assembly committee without opposition as S-3189 (Zwicker, Sarlo)/A-2365 (Tully, Murphy, DePhillips). Additionally, Governor Murphy plans to introduce a new manufacturing tax credit to incentivize manufacturers globally to come to New Jersey. NJBIA looks forward to learning more about this program and the positive impact we hope it will have on our manufacturing industry.

NJBIA supports the budget proposal to exempt certain baby products and sunscreen from the sales tax to reduce sales tax revenue by $7.5 million.

NJBIA also supports and thanks Governor Murphy and the Legislature for the continued investment of $6 million in funding from the New Jersey Department of Labor & Workforce Development to the NJ Community College Consortium for Workforce and Economic Development. This allows for the continued investment for the new Career Pathways program and other workforce training programs that have well aligned our education providers with the needs of the economy.

CONCLUSION

The current budget as proposed represents an anti-business and anti-growth budget. NJBIA requests our legislators to take the following actions to make this budget better address affordability and competitiveness and prioritize pro-growth investments to strengthen our economy:

- Reject Governor Murphy’s proposed new taxes of over $1.2 billion that will make New Jersey less affordable and less economically competitive.

- Reverse the manufacturing, innovation and higher education cuts that undermine New Jersey’s pro-growth innovation and workforce development efforts.

- Avoid adding any new spending that does not improve innovation, workforce development and infrastructure.

Thank you for considering NJBIA’s perspective on the proposed FY26 state budget. We look forward to working with all of you over the next few months to make this budget best meet the needs of our great state of New Jersey. Please email Christopher Emigholz at cemigholz@njbia.org to further discuss any of NJBIA’s budget points.