With the state budget deadline just a few weeks away, the Senate Republican budget officer is warning there is “chatter” that the draft legislation for Gov. Phil Murphy’s proposed $1 billion tax surcharge on businesses includes a new tax on utility ratepayers.

In February, the governor proposed a $55.9 billion budget that calls for replacing the former 2.5% corporation business tax surcharge (levied on top of the 9% corporate tax) with a new $1 billion tax on large corporations to fund NJ TRANSIT. The old 2.5% CBT surcharge sunset on Dec. 31, 2023, and the new “Corporate Transit Fee” would be retroactive to Jan. 1, 2024.

"With two weeks to go before the Legislature considers the governor’s CBT surcharge proposal, draft legislation is circulating that would newly extend the old tax surcharge to water, gas, and electric utilities,” Sen. Declan O’Scanlon (R-13) said in a statement issued on Tuesday.

“We know the tax will get passed along to everyone who drinks water, lights up the gas grill, heats their house, or turns on the air conditioning. It’s bad enough that the Governor is retroactively re-imposing an old surcharge that gets passed along to middle class shoppers at Home Depot, Walmart, and Aldi, but now it will newly slam water, gas and electric consumers who had previously been protected,” he said.

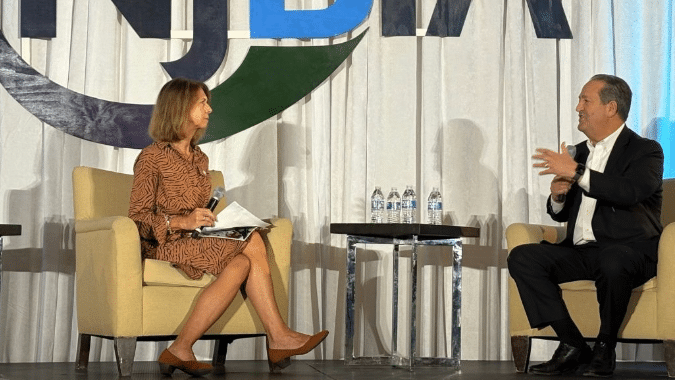

NJBIA has been leading a “Do Better for Business” campaign in opposition to the governor’s proposed $1 billion corporate tax, which if enacted would give New Jersey the largest corporate business tax rate in the nation (11.5%) and worsen the state’s struggling business reputation.

NJBIA Chief Government Affairs Officer Christopher Emigholz said Wednesday any effort by lawmakers to raise taxes on corporations as part of the budget would be misguided for many reasons including that it would raise costs for all New Jersey residents. Emigholz noted the FY25 budget bills have not yet been introduced and made publicly available yet, so all that is known right now are rumors about behind-the-scene legislative discussions on contents of the budget bills.

“Although there are months of legislative hearings, historically, the actual budget bill isn’t made public until days or even hours before the June 30 deadline for adopting the new state budget,” Emigholz said. “We urge legislative leaders to make the process more transparent and keep new taxes on businesses, utility ratepayers and all residents out of the budget bill.”

There have been ongoing closed-door negotiations between the legislative leaders and the Murphy administration about the details of the budget bill and these have reportedly included the possibility of raising the sales tax back to 7%. Assembly Speaker Craig Coughlin (D-19) told New Jersey Advance Media on Tuesday, however, that he was opposed to the sales tax increase and would “seriously consider” the 2.5% surcharge on corporations.

O’Scanlon, in his Tuesday press statement, warned about a “June surprise” and said he was suspicious because the administration is projecting that its new corporate tax would “generate hundreds of millions of dollars more” than the old CBT surcharge. He said the rumored tax on utilities may be the reason.

“In June, budget and tax legislation gets enacted in mere days after being available for the public,” O’Scanlon said. “Like the budget itself, this legislation will have a June surprise. If I’m wrong, the administration can finally release their actual proposal with a thorough explanation of why it will collect hundreds of millions more from taxpayers than the surcharge it supposedly just reimposes.”