It’s budget season in New Jersey, with more than $1 billion in proposed tax increases, program cuts, added spending, and a likely structural deficit and surplus draw.

And just about everyone in Trenton thinks the situation will be even worse next year under a new administration.

So, it begs the perennial question that never seems to get answered:

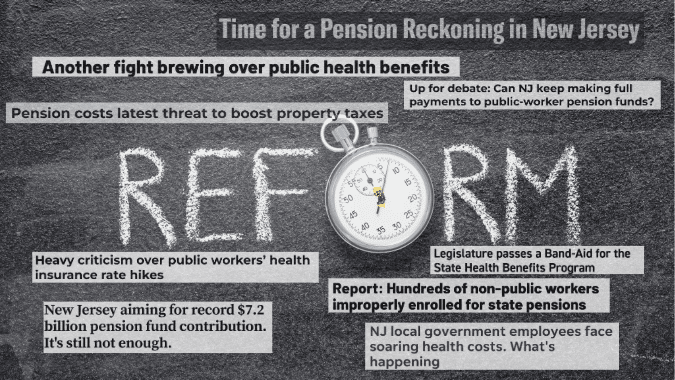

Will New Jersey policymakers, or a new governor, finally take meaningful steps to address public employee pension and health benefit reforms?

“One does have to wonder how much more foreboding our situation needs to become before there’s a concerted effort to try meaningful reforms so we’re not starting off every year committing so much of our revenues to these ballooning costs,” said NJBIA Chief Government Affairs Officer Christopher Emigholz.

“If not now, what will it actually take? What happens when you can’t possibly tax or cut any more or you don’t have that surplus or rainy-day fund?”

FIX IT OR NIX IT?

For years, NJBIA and other business groups, as well as some lawmakers from both sides of the aisle, have called for health benefit and pension reforms.

The topic was at least broached this week during an FY26 budget hearing with the non-partisan Office of Legislative Services and State Treasurer Elizabeth Muoio.

In her presentation, Muoio noted health insurance premiums for public employees are expected to increase by more than 20%.

Sen. Declan O’Scanlon, the Republican budget officer, added that the program seemed to be in a “death spiral,” and asked, “Why haven’t we done anything to fix it?”

While Muoio said the Legislature and the design plan committee for the State Health Benefits Program have the sole authority to make changes, O’Scanlon responded that all reforms often “came from the governor’s office” during the Christie administration.

“During the Christie years, all of the reforms came from the governor’s office,” said O’Scanlon, the ranking member on the budget committee representing Republicans, the minority party.

Speaking to NJ101.5 Morning Host Eric Scott on Thursday, O’Scanlon added: “Republicans have put numerous ideas on the table over the past seven years – ideas backed by labor, by the way – and they were completely ignored by (the Murphy) administration.”

PENSION ATTENTION

Gov. Phil Murphy did, however, sign legislation in 2020 that created a new state health benefits plan for teachers that was to provide approximately $700 million a year in property tax relief.

That bill was part of former Senate President (and current Democratic gubernatorial candidate) Steve Sweeney’s “Path to Progress” reforms to reduce government spending in New Jersey.

“That was a very good step, but more of those reforms are needed to bring more stability to our budgets every year,” Emigholz said.

“If we could transfer state and/or local government employees from platinum-level health coverage to gold-level plans that are comparable to what the best private-sector companies offer their employees, that would be really meaningful reform.”

As for pensions, Emigholz said Murphy deserves credit for proposing a fifth straight full pension payment of $7.2 billion as part of the FY26 budget.

“But while there has been a reduction of our pension liability, we’re still not confronting the root problem of state pensions – that they’re no longer sustainable,” Emigholz said.

In the past, NJBIA and the Path to Progress report have recommended hybrid pension plans – which contain elements of both defined benefit and defined contribution plans – or yielding state pension plans for future state workers in exchange for robust 401K plans.

“If you think about it, we’re committing more than 12% of the FY26 budget to our pension payment, yet there is no talk of reforming our pension system,” Emigholz said. “It’s a conversation that needs to be had, now more than ever.”