A whopping $46.4 billion budget for FY22 is on Gov. Phil Murphy’s desk and ready to be signed.

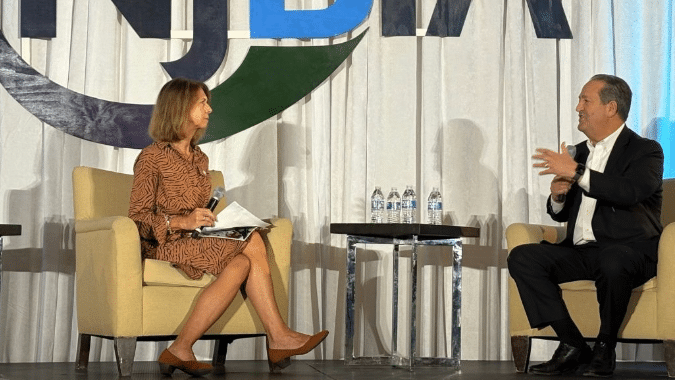

NJBIA’s Vice President of Government Affairs Christopher Emigholz said there is much to like and dislike about the budget. But the bad stuff is particularly dangerous for the state’s economy.

“When you’re talking about such a massive budget and so many different interests throughout the state, no one is going to get everything they want,” said Emigholz, who was the only member of the business community to testify in person on the budget legislation while in committee.

“However, the levels of spending we are reaching in New Jersey should be concerning to everyone in the state – because it’s not sustainable and may very well lead to more tax increases.”

On the positive side, the budget commits a $6.9 billion pension payment – the largest of its kind and the first full pension payment since 1996. It also reserves $3.7 billion for debt defeasance and capital projects that will avoid future bonding – investments recommended by NJBIA. .

“If New Jersey can address our long-term liabilities and avoid further borrowing, it’s a great thing,” Emigholz said.

NJBIA also worked closely with New Jersey’s county colleges to successfully lobby the Legislature to dedicate federal funds for workforce development – more than doubling the existing basic skills training program NJBIA members have enjoyed for years.

All while adding a new $8.5 million program to create centers to collaboratively develop training best practices in our key industries.

“This is great news for business owners and employees and something we lobbied hard for,” Emigholz said. “It will allow for more re-skilling, up-skilling and basic training at a time we really need it.”

The overall spending numbers, however, are concerning, Emigholz said.

The $46.4 billion in appropriations is a 35% increase from four years ago and more than $1.5 billion higher than Gov. Murphy’s budget presentation only four months ago.

Additionally, New Jersey’s structural imbalance – the total amount of spending vs. incoming revenues – went from $4 billion in February to $4.3 billion now. And that’s after some very positive revenue numbers came in this month.

“These are the numbers that are indicative of not having a fiscal house in order,” Emigholz said. “And when you think of the $10.1 billion surplus we have at the end of this current budget – with much of that bolstered from unnecessary borrowing last year – it does lend itself to the notion that we could have really lost an opportunity to hold the line on near-future tax increases.

“While we can look favorably upon this budget in that it doesn’t directly include any tax increases, we may very well indeed be looking back next year and more fully recognize how the state lost a great opportunity to keep increased taxes at bay.”

Not included in the budget was funding for replenishing the state’s depleted Unemployment Insurance fund to further lower the pending payroll tax increase. NJBIA will be strongly advocating for some of the remaining federal money to be deposited into the UI fund.

“We’re hopeful we’ll see federal American Rescue Plan funds used for the UI fund,” Emigholz said. “It’s something that needs to be addressed much sooner than later.”