Expectations are high for increased profits, sales and wages in 2019 following a successful 2018 for many New Jersey businesses, according to results found in the New Jersey Business & Industry Association’s 60th Annual Business Outlook Survey.

Expectations are high for increased profits, sales and wages in 2019 following a successful 2018 for many New Jersey businesses, according to results found in the New Jersey Business & Industry Association’s 60th Annual Business Outlook Survey.

But the survey, released today, also finds a much more guarded outlook for New Jersey’s economy on the whole.

In addition to a marginal increase of business owners who will look to offset a $15 minimum wage with raised prices, reduced staff or hours, or an increase in automation, there was a sizable decline from last year in respondents expecting New Jersey’s economy to perform better in the first six months of 2019.

Similarly, while 83 percent of members rated the performance of the U.S. economy as excellent or good, only 40 percent rated New Jersey’s economy in the same categories.

“It is very encouraging to see New Jersey businesses continuing to experience steady economic growth,” said NJBIA President and CEO Michele Siekerka. “We’re once again seeing a positive outlook on sales, profits and employment, and some of these numbers are truly impressive.

“However, increased taxes and mandates added onto the backs of New Jersey businesses are serving as a cautionary tale in this year’s survey. As our state continues to track among the worst in the nation for business tax climate, we hope our policymakers will understand the impact of these cumulative costs and work toward reforms that will result in both positive returns and outlook.”

Members were also lukewarm when asked if the potential legalization of recreational marijuana would be good for New Jersey’s economy – 42 percent said no, 33 percent said yes and 25 percent were not sure.

A total of 77 percent of respondents said they had business-related concerns about the legalization of recreational marijuana. Safety in the workplace was listed as a concern by 56 percent of those respondents, followed by productivity of workforce (48 percent), chronic absenteeism (26 percent) and proximity to dispensaries (10 percent).

“Knowing our members' concerns about workplace safety, first and foremost, NJBIA requested that legislation expanding the state’s medicinal cannabis program and legalizing recreational adult-use cannabis contain language protecting an employer's right to maintain a drug-free workplace," Siekerka said. "We're grateful the bills that were approved in the Budget Committees last week provided those protections as a step to ameliorate some of those concerns."

Among the positive trends reported in the survey:

• 62 percent said sales in 2019 would rise and only 9 percent said sales would fall. The net positive of +53 percent is higher than last year’s sunny forecast of +49 percent.

• 55 percent said actual sales were up in 2018, compared to 19 percent who said sales were down. The net positive of +36 percent is considerably higher than last year’s +27 percent net increase and +12 percent net positive in 2016.

• 59 percent forecasted that profits will increase in 2019, compared to 13 percent who expect profits to fall. The net positive of +46 percent is higher than last year’s forecast of +43 percent. Actual profits of NJBIA-member businesses in 2018 showed a net positive of +26 percent, compared to a +18 net positive in 2017.

• 39 percent said they would increase hiring in 2019, while only 7 percent said they would decrease employment for a net positive of +32 percent. Last year, a net positive of +25 percent forecasted increased employment. Employment in 2018 actually rose by a net positive of +19 percent for members.

• 76 percent of members granted a pay raise in 2018. 59 percent gave raises ranging from 1 to 4.9 percent.

• 77 percent said they would provide wage increases in 2019. 64 percent will give raises ranging from 1 to 4.9 percent.

• 57 percent of respondents described the current conditions in their particular industry as expanding. 22 percent said it was going from recession to recovery.

• 54 percent of members in the Housing Construction industry expect their conditions to improve in the first six months of 2019. 53 percent of members in the Transportation industry also expect improvement in the same time frame.

• 61 percent made investments to improve productivity in 2018.

• 44 percent said the quality of New Jersey’s public schools is better than other states, while 27 percent said the quality of our workforce is better than other states.

Among the concerning or negative trends in the survey:

• 66 percent said increasing the minimum wage to $15 an hour would impact their business. 39 percent projected that impact as “significant.” To offset those impacts, 32 percent said they would raise prices, 26 percent would reduce staff, 24 percent would reduce hours, and 13 percent would increase automation.

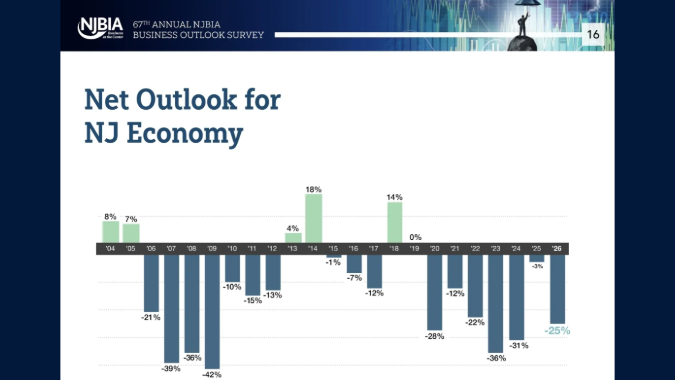

• 30 percent expect New Jersey’s economy to perform better in the first six months of 2019, while 30 percent expect it to perform worse. The net-zero percentage is down from the +14 net positive outlook for the first six months of 2018.

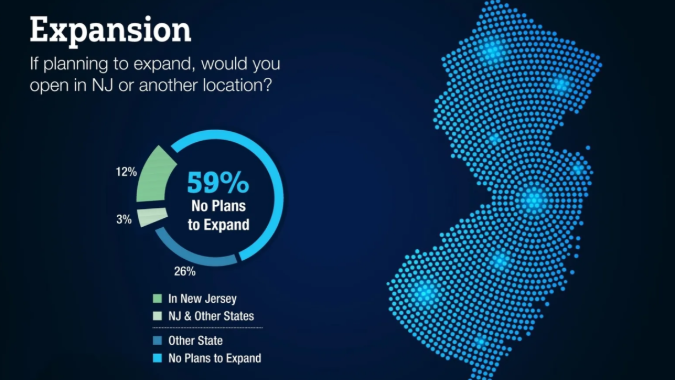

• 50 percent are not planning to expand their business in 2019. Of the 50 percent that are planning to expand, only 14 percent would open another location in New Jersey.

• 20 percent rated New Jersey as either “very good” or “good” as a location for new or expanded facilities. 47 percent deemed the state as “average,” while 33 percent listed it as “poor.”

• 83 percent said New Jersey has not made progress over the last year in easing regulatory burdens for business.

• New Jersey continues to be perceived as being non-competitive with other states in many categories, notably:

• 88 percent said New Jersey is worse in taxes and fees – a 5 percent increase from 2018.

• 77 percent said New Jersey is worse in controlling government spending.

• 65 percent said New Jersey is worse in controlling healthcare costs.

• 65 percent said New Jersey is worse in attracting new business.

• 59 percent said New Jersey is worse in controlling labor costs.

• 59 percent said New Jersey is worse in costs of regulatory compliance.

Additionally, only 36 percent of members surveyed said they would make New Jersey their domicile in retirement – down from 40 percent in the 2018 Business Outlook Survey.

“Last year, we saw an upward trend in this category which we attributed to the gradual elimination of the estate tax, which we long advocated for,” Siekerka said. “New Jersey will clearly need more in the way of tax reforms to move this trend back in the right direction.”

For a full copy of NJBIA’s Business Outlook Survey, visit here.