Senate President Stephen Sweeney said Tuesday the Murphy administration’s proposed millionaires tax would be absent from the state budget the Legislature approves next week, and that he was prepared to take his separate fight for public pension and benefit reforms directly to voters in a referendum.

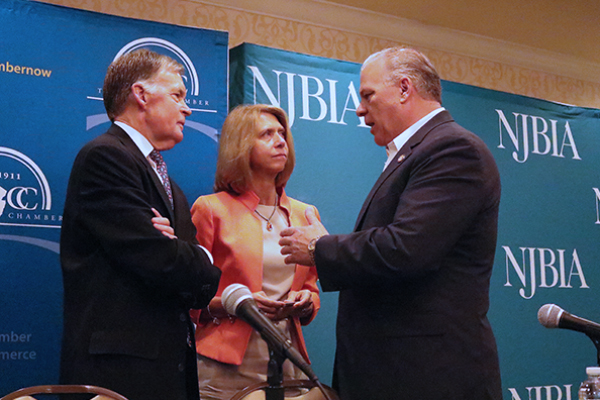

Speaking to more than 100 business leaders at NJBIA’s Meet the Decision Makers event, Sweeney made the case for his legislative package that implements the recommendations of the Path to Progress report. The reforms would save state taxpayers $3 billion in public employee pension and healthcare costs and $2 billion in county and municipal property taxes, he said.

The centerpieces would establish a hybrid government pension system and make a switch to more affordable gold-level health benefit plans for public employees in order to save both workers and taxpayers money. Changing from platinum health benefit plans to gold-level plans, for example, would save a teacher about $4,000 a year and save taxpayers $11,000 per teacher, Sweeney said.

“Our retiree health benefits are $100 billion in the hole … and our pension system is $115 billion in a hole,” Sweeney said. “This isn’t about attacking anybody. It’s about having a real dialog on how to fix this problem.” Tax increases, including the expansion of the millionaires tax proposed by Gov. Phil Murphy, cannot be part of the solution, Sweeney said, prompting the room to erupt in applause.

Sweeney pointed to a recent Bloomberg news article with data that mirrored NJBIA’s own findings showing that over $3.5 billion in adjusted gross income had left New Jersey in 2016 alone.

“That’s $250 million in income tax we lost,” Sweeney said. “Continuing to tax will not help this state. It’s only going to take us further and further into a death spiral.”

Sweeney blamed “bad decisions by both political parties throughout the years” for creating the current state of affairs, where rising public employee pensions and health benefits devour too much of the state budget at the cost of other priorities, such as higher education.

“We’re not investing enough in higher education and that’s not good for business,” Sweeney said, noting the cost of attending four-year public colleges in New Jersey is now the second-highest in the nation.

“We’re losing our kids to other states because it’s cheaper to go out of state than to go to college here,” Sweeney said. Noting that New Jersey pays more to educate students in grades K-12 than any other state, he asked, “Why do you think other states want them? We’re exporting our future.”

Asked about his timetable for enacting the Path to Progress reforms, Sweeney said he expected some pieces could be enacted legislatively in the near future, while others would likely require constitutional amendments that must ultimately be approved by voters.

“We’re going to start moving Path to Progress bills now… the Assembly and Governor’s Office have said there’s bills in there that they support,” Sweeney said. “In order to get the more important ones done —healthcare and pensions — that may be a constitutional amendment I think. I have to do the work to get people engaged so that when we put it up for a vote it will be successful.”