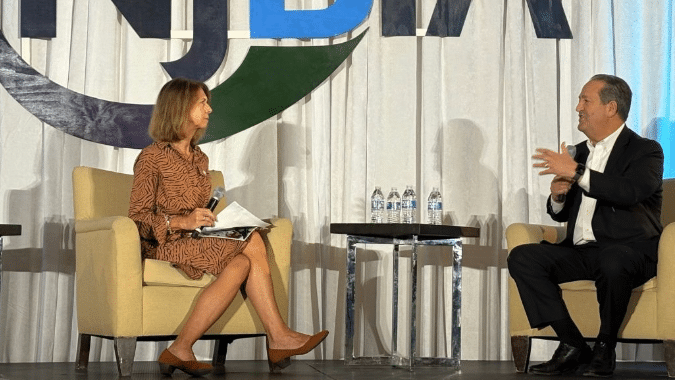

On this past weekend’s "State of Affairs with Steve Adubato," NJBIA President & CEO Michele Siekerka said that New Jersey runs the risk of losing companies who will either move or reinvest elsewhere if a proposed 2.5% Corporate Transit Fee comes to fruition.

“I spoke with one that said if it wasn’t for their long-term lease here in New Jersey, now’s the time to consider,” Siekerka told Adubato.

“We’re in a post-Covid, remote, hybrid work environment. Corporate footprints are shrinking. Let’s not invite a company who is going to be downsizing their corporate footprint and has the majority of their workforce remote already the invitation to take their corporate status out of the state of New Jersey and put in a lower-tax jurisdiction state.”

Siekerka also noted to Adubato that neighboring Pennsylvania is on a multi-year trajectory to lower its corporate business tax rate to 4.99%.

If the 2.5% Corporate Transit Fee is finalized in the FY25 budget, New Jersey’s top corporate rate will return to 11.5%, the highest in the nation by far.

To watch the clip with Siekerka and Adubato, click here.