If you’re one of the 135,203 New Jersey businesses that received a Paycheck Protection Program loan, there’s something you need to know about the online loan forgiveness application: It’s about to change.

If you’re one of the 135,203 New Jersey businesses that received a Paycheck Protection Program loan, there’s something you need to know about the online loan forgiveness application: It’s about to change.

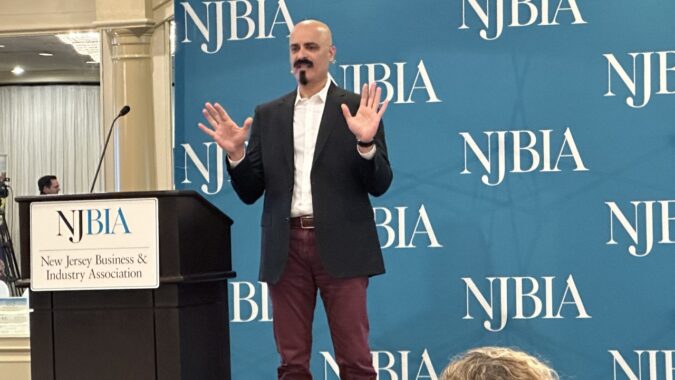

Attorney Scott Borsack, a partner at Szaferman Lakind, said Tuesday that the new federal Paycheck Protection Program Flexibility Act signed into law June 5 has made significant changes to the $670 billion program designed to help small businesses survive the COVID-19 pandemic.

The U.S. Treasury Department and U.S. Small Business Administration (SBA) this week promised that new PPP guidance and a modified online PPP loan forgiveness application are coming soon to reflect these latest changes which affect deadlines, spending rules, and the requirements for rehiring employees.

However, as of Tuesday, the SBA’s “first generation” loan forgiveness application remains the only one available online, Borsack said. This 11-page document has an OMB Control Number 3245-0407 in the upper right corner of the application with an expiration date of Oct. 31, 2020.

“As the SBA revises this application, both the control number and the expiration date are going to change,” Borsack told 1,267 people registered for an NJBIA webinar on navigating the PPP loan forgiveness process. “Subsequent applications are going to have expiration dates beyond (Oct. 31) and a different control number so we can keep track of what form we’re supposed to be using.”

PPP business loans, which are backed by the federal government, are intended to help businesses, the self-employed, sole proprietors, and certain nonprofits continue paying their workers during the economic downturn caused by COVID-19. These loans are potentially forgivable if borrowers generally maintain employee headcounts and payroll at pre-pandemic levels, and spend their loans on permitted expenses, such as employee compensation, mortgage interest, rent, utilities, leases on business equipment and transportation.

The SBA has said about $130 billion remains available from the second round of PPP funding for small business that apply by June 30.

Some of the most significant changes to the PPP program under the PPP Flexibility Act include:

- A borrower now has to use at least 60% of the loan for payroll costs in order to obtain forgiveness, allowing 40% of the loan to be used for eligible non-payroll costs. Previously, the program required 75% of the loan to be spent on payroll to obtain loan forgiveness with 25% spent on eligible non-payroll expenses.

- The time period borrowers were originally given to spend their loans and receive loan forgiveness has been expanded from eight weeks to 24 weeks. Borrowers have until Dec. 31 to spend the portion of loans ineligible for loan forgiveness. Borrowers can, however, use the eight-week timetable if they prefer.

- Borrowers have 10 months from the end of the covered period to apply for forgiveness, instead of six months. Loan payments begin 10 months after the loan is dispersed if borrowers choose not to apply for loan forgiveness.

- The repayment period for new, unforgiven loans has been extended from two years to five years. Borrowers with existing loans that originated prior to the signing of the PPP Flexibility Act can have the terms of their loans rewritten to five years if their lender agrees.

- A relaxing of the requirement to maintain the same level of full-time employee equivalent (FTEE) positions in order to be eligible for loan forgiveness. The PPP Flexibility Act allows borrowers to disregard FTEE requirements if they can’t rehire the same number of employees they had as of Feb. 15 due to government mandates restricting business operations, or if the employer is unable to find qualified replacement employees.

Borsack said he will lead a free Szaferman Lakind webinar at 2 p.m., Thursday, June 11 that takes a deeper dive into all the changes made by the PPP Flexibility Act. To register, go here.