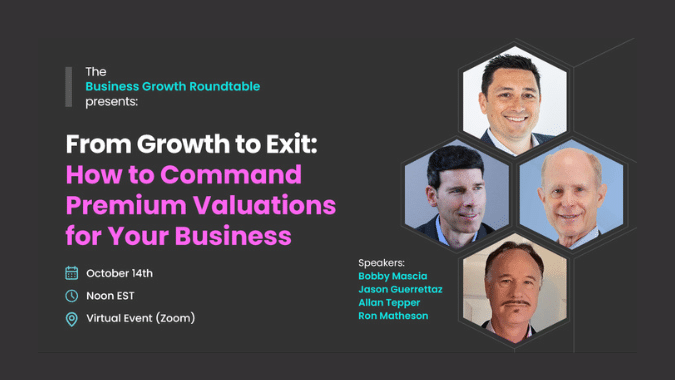

From Growth to Exit: How to Command Premium Valuations for Your Business

When you are planning to sell your business—soon or in the future—economic uncertainty, inflation, interest rates, and shifting markets can trigger apprehension and hesitation. With these factors, combined with an evolving M&A landscape and the expected Great Wealth Transfer of 2030, buyers are more selective, valuations are nuanced, and competition is intensifying.

However, these complications don’t have to derail your goals. Whether you’re planning to sell in the next 12 months—or simply want to protect and grow your company’s value—now is the time to prepare.

Join us for our next Business Growth Roundtable where our expert panel will walk you through the strategies, market insights, and financial realities every business owner needs to know to position themselves for a successful exit.

This discussion will include insight into how to:

- Get ahead of the Great Wealth Transfer

- Unlock premium valuations by learning what today’s buyers paying top dollar for

- Navigate today’s financing landscape

- Position your business for a successful sale

- Create a competitive bidding war during your exit

Preparing to sell may be the smartest growth decision you make. Don’t miss your chance to learn how top entrepreneurs are getting ready.

About our Experts:

Bobby Mascia– CEO Mascia Capital Group & CEO Green Ridge Wealth Planning

Robert “Bobby” Mascia is an entrepreneur and financial professional with a proven track record of building and growing businesses. After starting his career on Wall Street, he spent nearly a decade scaling his family’s Dunkin’ franchise operations, helping expand from 20 to 40 locations and $50M in revenue. In 2016, he leveraged that firsthand business experience to launch Green Ridge Wealth Planning, a boutique firm dedicated to guiding business owners, families, and individuals through complex financial decisions. Today, Bobby leads a team known for its personalized approach and deep understanding of the challenges entrepreneurs face.

Jason Guerrettaz – Founder & Marketing Strategist, Website Closers, LLC

Jason is a former corporate attorney who has advised mid-market companies and Fortune 500 firms. He later served as General Manager for a major digital marketing agency. Drawing on his legal, operational, and digital experience, he founded United Commerce Group, which owns web properties like GunSafes.com, Saunas.com, MassageChairs.com, and Melondipity.com. Jason launched Website Closers to address a gap in how online businesses are brokered—bringing deep operational insight and a hands-on understanding of internet business to every deal.

Ron Matheson – Co-Founder & Experienced Broker, Website Closers, LLC

Ron has over 20 years of experience buying and selling online companies. He began his entrepreneurial journey in 1985 after leaving UCLA Film School to open Off The Wall, an art and framing gallery in Colorado Springs, which grew into a chain of over 20 retail stores across several states. Ron owned and operated other businesses including Thomas Kinkade Signature Galleries, Dixies Hot Cinnabuns, and Bearly Camelot. In the early 2000s he tried re-entering business as a buyer, which led to the insight that many brokers were underprepared on diligence. This spurred him to become a broker himself, where he’s built a reputation as one of the top internet business brokers in the U.S., supported by awards and consistent Top 10 rankings.

Allan Tepper – Co-Founder &CFO Consulting Partners LLC

Allan Tepper leads the firm’s Business Services practice. With over 30 years of senior financial leadership, he has served as interim CFO, advised on sell-side M&A, restructuring, growth strategies, and regulatory compliance across industries including banking, technology, and apparel.

Previously, Allan was the top U.S. financial officer for CIBC for over a decade and held senior roles at Citibank, Chemical Bank, Jefferson Wells, and SCM Corporation. He has served on multiple corporate boards, founded CIBC’s commercial finance company, and continues to guide public and private companies on complex financial matters.

Allan is active in professional organizations, currently serving as President of XPX NYC, and has held leadership roles with the NYSSCPA and FEI. He is also a frequent speaker and M&A Advisor Awards judge.