One month from today, the Murphy administration leaves office.

Which means the clock is ticking for action on what would arguably be the most damaging business and worker policies in the governor’s two terms.

The administration has still not taken action on an April 2025 rule proposal by the Department of Labor and Workforce Development that would make it much more difficult to be an independent contractor in New Jersey.

The rule garnered more than 9,500 comments, with more than 99% opposing it. Nearly two dozen legislators from both sides of the aisle also wrote to NJDOL opposing it.

The same policy has proved to be an economic and workforce disaster in California.

Despite all this, Gov. Phil Murphy has been non-committal on the status of the proposal as it lies in wait.

“Because of the magnitude of this policy decision for both workers and businesses, the relative quietness around it is concerning,” said NJBIA Chief Government Affairs Officer Christopher Emigholz.

“But conceivably there are four options here. One is to scrap the rule, which we and many others have urged. Another is to just leave it as is for the incoming Sherrill administration to decide what to do with it.

“The Murphy administration could try to modify the proposal somewhat, but I don’t see how you modify it without just creating a new proposal. Or it could adopt the rule as is.

“Given those scenarios, there’s only one, clear best option – and that is to simply reject it on the merits that it’s legally flawed, economically unsound, procedurally deficient, and socially regressive.”

Unemployment Impacts

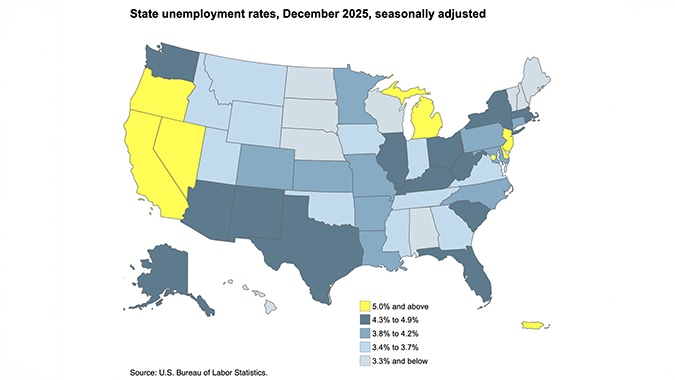

In a recent entry in her Freelance Busting Substack, Fight for Freelancers co-founder Kim Kavin noted how New Jersey’s unemployment rate has increased to 5.2%, the fourth highest rate in the nation – and how that’s even more reason not to go forward with the NJDOL proposal.

“The freelance-busting brigade likes to talk about ‘reclassifying independent contractors as employees,’ implying that all kinds of traditional W-2 jobs will suddenly be created after contractors are reclassified on paper as employees,” Kavin wrote.

“But what actually happens in most cases is that existing independent-contractor business relationships are destroyed. Companies fear government fines, and they cut ties with independent contractors. The incomes and careers that independent contractors have built get wiped out.”

Modifying the Messaging?

There is one school of thought that the administration could seek to tamp down or dismiss the concerns of the hundreds of different groups that have submitted comments and then seek exemptions.

Under New Jersey state law, businesses must use an “ABC test” to determine a gig worker versus an employee.

That means independent contractors are required to:

- Be free from control and direction by the business

- Do work outside of a firm’s “usual course of business” and “places of business."

- Be engaged in an independent and established “trade, occupation, profession or business.”

Emigholz said there should be no dismissing what a similar rule did in California.

“The failed process of exempting everyone who should legally be exempted proved to be laborious and costly in California, and we shouldn’t try it here,” Emigholz said.

“We’ve said it from the beginning and it’s true: NJDOL’s proposal is not merely a codification of current ABC rules – it’s a complete overhaul of the regulations that will drastically reduce the flexibility and economy of independent contractors and greatly add to the costs and efficiencies of New Jersey businesses,” Emigholz said.

Kavin also said there should also be no dismissing of a report by members of the California Advisory Committee to the U.S. Commission on Civil Rights, which cited significant evidence of the disproportionate and negative impacts this kind of overly restrictive independent-contractor policymaking has on women, immigrants, people of color and the politically powerless.

Kavin also noted research from Mercatus Center economists that shows the Garden State’s approach to independent-contractor policy has already led to:

- a 3.81% decrease in W-2 employment

- a 10.08% decrease in self-employment

- a 3.95% decrease in overall employment

“The New Jersey data reveals stark gender disparities: women’s traditional W-2 employment declined by 7.4%, while men’s showed no significant change—raising concerns about disproportionate impacts on women following the policy change.”

Kavin mused: “Why would that be true? Simple: because women are more likely to be independent contractors than we are to own businesses that have employees.”