Both houses of the Legislature passed a bill that would impose a 2.5% excise tax on certain health plans. The money would be used to make health insurance more affordable, according to the bill’s advocates.

NJBIA opposes the tax and urges its members to contact Gov. Phil Murphy and ask him to veto it. Go here to use the online system to send a message.

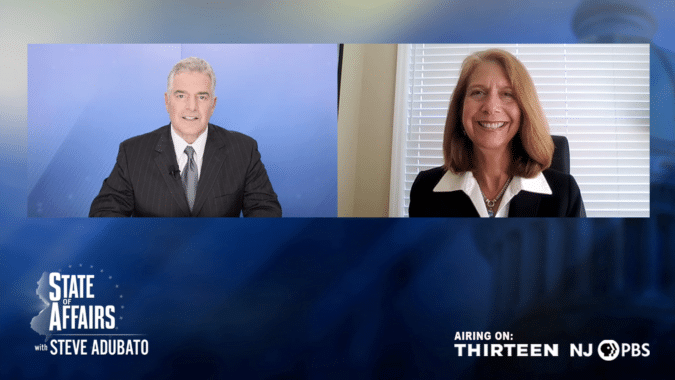

“New Jersey has seen its GDP contract more than the national average,” NJBIA Chief Government Affairs Officer Chrissy Buteas said in a written statement. “Our unemployment is now the second highest in the nation. And many businesses that will be impacted by this new tax have already been greatly compromised by months of closure or having had limited capacity in their reopening.”

“Raising taxes does not make healthcare more affordable. It’s unfortunate that our policymakers continue to seek ways to inflict financial pain on New Jersey employers as they struggle during these unprecedented challenges.”

The state tax attempts to mirror a federal tax that was imposed nationally as part of the Affordable Care Act (ACA). In 2019, Congress permanently repealed it after twice suspending the tax because it would have led to a 2.2% increase in health insurance costs for individuals, employers, workers and Medicare Advantage members. New Jersey’s policymakers should reject any new health insurance tax on the state level as well, Buteas said.

The tax is also opposed by dozens of other business groups and medical organizations, which wrote a joint letter to Gov. Phil Murphy and members of the Legislature on July 20 saying the legislation would compound the financial hardships facing New Jersey businesses.