The Internal Revenue Service and the Treasury Department proposed regulations this week setting eligibility requirements for the new advanced manufacturing tax credit that is designed to spur development of the U.S. semiconductor industry.

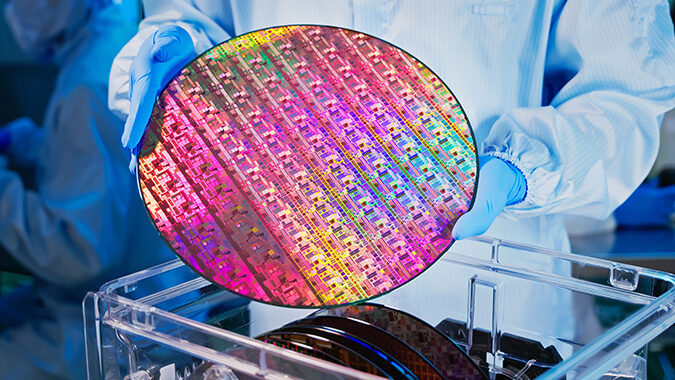

Congress enacted the tax credit last year in response to the semiconductor chip shortage during the pandemic that gave rise to concerns that the U.S. was relying too much on other nations for semiconductors – the brains of modern electronics. Semiconductors are used in thousands of products including smartphones, TVs, computers, household appliances and motor vehicles.

Under the 2022 CHIPS Act (“Creating Helpful Incentives to Produce Semiconductors and Science”) the tax credit is worth 25% of the value of qualified investments in domestic semiconductor chip production. The proposed rules governing the program were published in the Federal Register on Thursday and public comments must be submitted by May 22, 2023.

Under the proposed rules, the investment must be made in a facility whose “primary purpose” is manufacturing semiconductors or semiconductor manufacturing equipment, although no set revenue or production percentage is specified. The facility must have begun construction after Aug. 9, 2022, and been placed in service after Dec. 31, 2022.

The rules clarify that manufacturers cannot claim the tax credit for the portions of their facilities that are not “integral” to semiconductor chip manufacturing, such as sales, accounting and HR offices, parking lots, advertising displays or outdoor lighting.

The credit is available to taxpayers that meet certain eligibility requirements, and taxpayers can choose to receive the credit as an elective payment. An elective payment will be treated as a payment against the tax liability equal to the amount of the credit. A partnership or S corporation can make an elect to receive a payment instead of claiming the credit.

The statute also includes a requirement allowing the government to claw back the full value of the credit claimed, if within 10 years of claiming the credit, a taxpayer (or affiliates) engages in a significant transaction that materially expands the semiconductor manufacturing capacity of the taxpayer in a “foreign country of concern.” These countries are identified as the People’s Republic of China, Russia, Iran and North Korea.

The Congressional Joint Committee on Taxation has estimated the CHIPS Act will provide up to $24 billion in tax credits before it expires at the end of 2026.