While some have not put much stock in recent U-Haul and United Van Lines studies showing a strong outmigration of New Jersey residents, a new Tax Foundation tax map utilizing the latest U.S. census data shows the Garden State is indeed one of the high tax states with more residents leaving than coming in.

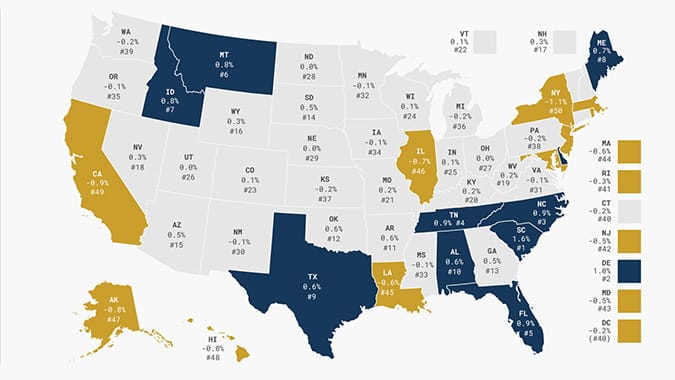

According to the study, New Jersey lost 0.5% of its population to other states between July 2022 and July 2023 – ranking 8th overall in states that lost residents.

Comparatively, the U.S. population grew 0.49% between July 2022 and July 2023, an increase from the previous year’s 0.37%.

The study shows a trend of residents moving from higher-tax states to lower-tax states. New York lost the greatest share of its population (1.1%) to other states, followed by California (0.9%), Hawaii (0.8%), Alaska (0.8%) and Illinois (0.7%).

Meanwhile, Florida (0.9% population increase), South Dakota (0.5%), Tennessee (0.9%) and Texas (0.6%) were amongst those states with the highest population net gains and do not levy income taxes at all.

Even states with more neutral tax systems saw benefit, according to the study, with only four of the 12 states that have single-rate, as opposed to graduated-rate, wage and income taxes seeing more migration losses than gains.

While people move for a variety of reasons, Katherine Loughead, Senior Policy Analyst and Research Manager at the Tax Foundation, noted that the data is hard to overlook.

“There is no denying a very strong correlation between low-tax, low-cost states and population growth, as well as a strong correlation between good tax structures and population growth,” she wrote.

“Given that many states, over the past few years, have responded to robust revenues and heightened state competition by cutting taxes and improving their tax structures—such as by moving from graduated-rate to single-rate income taxes—these trends may only get more pronounced.”

To learn more, read the full report at TaxFoundation.org.