Delivering Value to Members of Every Size

Power in Numbers: Through a Multiple Employer Plan (MEP), NJBIA members can join with other employers and leverage power in numbers. Access customizable, fiduciary-managed, top-shelf plans with very low expense ratios.

Significant savings: Companies could save $40,000 when comparing expenses, fees, audits, and the HR time associated with administering their plan vs. NJBIA’s Retirement Solutions. Now, that’s savings you can’t beat!

Recruit and retain valuable employees: Employees consider a retirement plan a vital part of their compensation package. In fact, 60% of employees are likely to switch jobs for a similar job with a retirement plan.

The most valuable cost savings can be found in eliminating audit fees. A 401(k) plan audit is REQUIRED every year for every employer with over 100 employees participating in their plan. The average cost of a 401(k) plan audit can run between $8,000 and $10,000 per year, which is ELIMINATED once you join an MEP. The overall NJBIA Multiple Employer Plan does get audited every year, however NJBIA picks up the cost! Each participating employer of the program will be subject to a limited-scope audit, drastically reducing the work and requirements you would have if you were to be audited independently.

Watch a recording of our recent webinar describing NJBIA's 401K Solution with James O’Donoghue of BCG Group, NJBIA's Retirement Solution Provider.

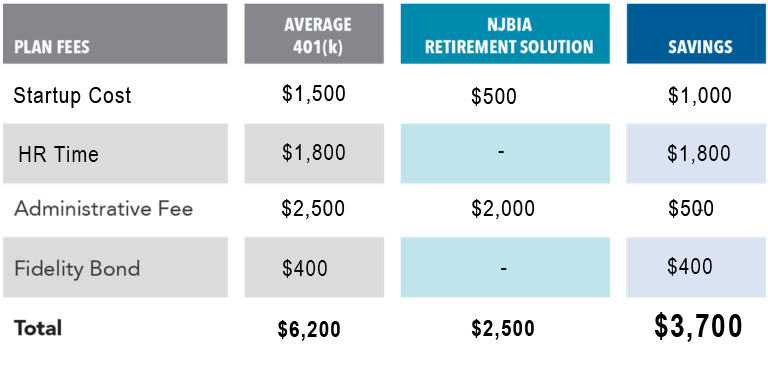

Under 24 Employees startup plan savings:

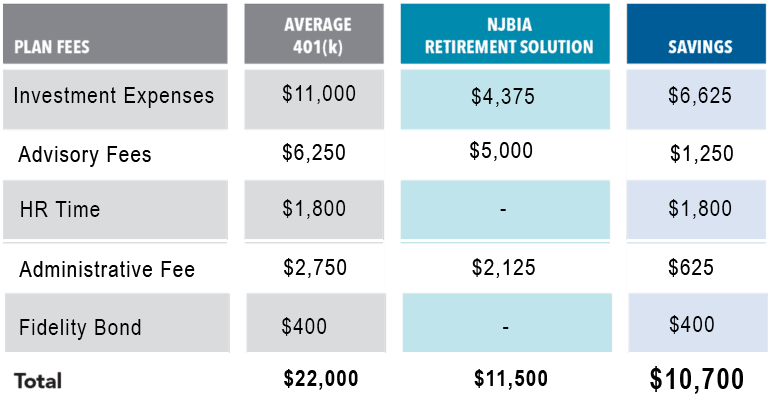

25-99 Employees with $1,250,000 in assets:

100+ Employees with $5,000,000 in assets:

The benefits of adopting a retirement plan through a MEP:

- Cost savings as compared to operating your own employer plan

- Less administration time – more time to grow your business!

- Fiduciary support

- Plan flexibility

- Access to more investment choices

- Tax deductions

- Employee retention and recruitment

- And many more

Plus, exceptional service: To ensure employers and employees receive the full benefit of their retirement plan, additional resources are provided including enrollment meetings with each employer/employee, one-on-one review of current retirement standings with a licensed Financial Advisor, annual or semi-annual reviews of portfolios and more.

Learn more: There is no obligation and no pressure. Explore the program and get a quote specifically designed for your business.

Administered by Employers Association of New Jersey