The New Jersey Business & Industry Association today released its 58th annual Business Outlook Survey, which provides a look ahead at how NJBIA member companies predict their own businesses and the economy will fare in 2017. More than 1,000 members participated in the survey.

Our members tell us they expect hiring, sales and profits to rise in 2017. However, they still report concern about the state’s economic future. The cost of health benefits, property taxes and the cost of doing business in the state are the three biggest concerns of our members and more than two-thirds say a $15 minimum wage will impact their business.

Twenty-nine percent of our members said they would increase employment and 9 percent said they would decrease for a net positive of +20, a 5 percentage point increase over the forecast last year. Employment in 2016 has actually risen by a net positive of +10, which is below the +15 that was forecast in last year’s survey.

Fifty-four percent said sales would rise and 16 percent said sales would fall. The net positive of +38 is higher than last year’s forecast of +34. Actual sales in 2016 came in at below projection. The net positive of 12 percent is well below the forecast of +34.

Forty-eight percent said profits would rise while 17 percent said profits would fall. The net positive of +31 percent is higher than last year’s forecast of +25. Actual profits in 2016 showed a net positive of +3, which is well below the forecast of +25.

Forty-three percent said they would increase the dollar value of their purchases while 16 percent expect the dollar value of their purchases to go down for a net positive of +27. This is higher than last year’s forecast of +25. The actual dollar value of purchases in 2016 rose by a net positive of +13, which was below the forecast of +25 in last year’s survey.

Sixty-nine percent said they would give wage increases in 2017. Sixty-one percent will give raises ranging from 1 to 4.9 percent; 8 percent will give raises that are higher than that. This year 67 percent gave wage increases, higher than the 65 percent that said they would increase wages in last year’s survey.

Although our members feel positive about their own businesses they are concerned about the overall economic climate in the state and the many challenges they face.

Twenty-four percent cited health insurance costs as their top concern; 67% listed it as one of their top four concerns, 20 percent said property taxes were their top concern, and 20 percent also said the cost of doing business was their top concern.

Eight-one percent expect health benefits to rise next year; 64% believe they have been negatively impacted by the Affordable Care Act, and 69% expect their property taxes to rise.

New Jersey’s high cost of living and cost of doing business were also reflected in the survey results. Fifty-five percent take estate and inheritance taxes into account when making future business decisions vs. 67 percent last year—perhaps expecting that the estate tax would be eliminated. Sixty-eight percent would not keep New Jersey as their retirement domicile vs. 66 percent last year.

“We saw some positive signs in the latter part of this year with the first steps toward comprehensive tax reform,” said NJBIA President & CEO Michele Siekerka. “The elimination of the estate tax and the increase of the pension tax exclusion will go a long way toward keeping seniors and family-owned businesses in the state, slowing outmigration.

“As we look ahead to 2017 it is important to keep reform on track. Through our own research our goal is to keep the conversation going as we explore creative ways to reduce property taxes, reduce the cost of living and make New Jersey more affordable so families, millennials and seniors can afford to live here.

“Outmigration is still a major issue in the state. New Jersey has lost a total of $20.7 billion in net adjusted gross income in the last 11 years. This has led to a loss of 87,000 jobs, $4.6 billion in lost labor income and $13 billion in lost economic input.

“The elimination of the estate tax will directly address this outflow,” Siekerka said.

Seventy percent said increasing the minimum wage to $15 an hour would impact their business. Thirty-four percent would reduce staff; 28 percent would reduce hours; and 34 percent would raise prices.

New Jersey is also perceived by our members as being non-competitive with other states in most categories. Eighty-seven percent said we were worse in taxes and fees; 73 percent said New Jersey was worse in controlling government spending; 66 percent ranked New Jersey worse in attracting new business; and 63 percent said New Jersey was worse in controlling healthcare costs.

New Jersey was deemed better than other states in the quality of our workforce (30 percent vs. 17 percent); and the quality of our public schools (42 percent vs. 14 percent).

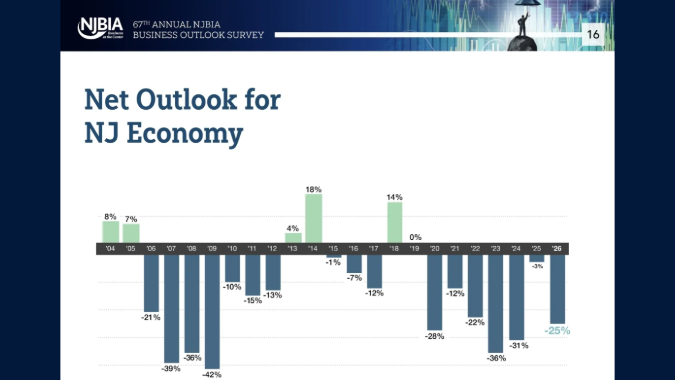

Although our members felt confident about their own businesses they also have great concern about the state’s economy as a whole in the first six months of 2017.

Only 20 percent felt it would perform better in the first six months of next year while 32 percent said it would perform worse, for a net -12 percent. Last year’s number was -7. Eighty-one percent expect health benefit costs to rise next year. Sixty-four percent believe they have been negatively impacted by the Affordable Care Act, and 69 percent expect their property taxes to rise.

Our members also told us they expect finance, insurance and real estate, communications and utilities, manufacturing, services and non-housing construction would perform better in 2017. They also told us that healthcare services, retail trade and transportation would fare worse.

A total of 1,046 members responded to the survey. Most were small businesses with 62 percent reporting fewer than 25 employees. The margin of error is plus or minus 2.9 percent at a 95 percent level of significance.