As we near the end of 2017, I would like to make sure you are aware of a number of important legislative changes that will impact tax filings for 2018. These changes will affect businesses, consumers, retirees, veterans, and heirs who receive an inheritance.

Many of these changes come as a result of legislation passed in 2016 which provided comprehensive tax reform, along with the reauthorization of the Transportation Trust Fund (TTF). For a summary of the tax changes for 2018, please see below:

Sales and Use Tax

On January 1, 2018, the New Jersey Sales and Use Tax rate will decrease to 6.625%, from the current rate of 6.875%. Business owners should prepare to change their point-of-sale systems to reflect the lower rate for the new year. Additional information on the Sales and Use Tax changes is available online.

Estate Tax

On January 1, 2018, the New Jersey Estate Tax will no longer be imposed on the estates of individuals who die on or after that date. Additional information on the Estate Tax changes is available online.

Income Tax

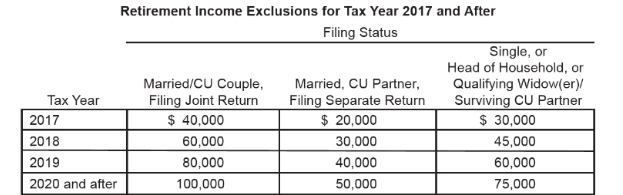

Retirement Income Exclusion – The retirement income exclusion will be available to taxpayers with $100,000 or less in gross income for the entire year and who are 62 or older or blind or disabled. The exclusion is being phased in over a four-year period, beginning with Tax Year 2017, as shown below:

Personal Exemption for Veterans — Veterans who were honorably discharged or released under honorable circumstances from active duty in the U.S. Armed Forces will be eligible for an additional $3,000 exemption. This includes persons serving in the Armed Forces Reserves or National Guard of New Jersey. Additional information on this new exemption is available online.

For more information on these and other changes, please visit the NJ Division of Taxation’s website.