Two COVID-19 tax relief bills to help New Jersey businesses were unanimously approved by the Senate on Thursday.

S- 3234, sponsored by Senator Troy Singleton (D-7), would ensure New Jersey businesses that received federal assistance under the Paycheck Protection Program (PPP) do not have to pay state income taxes on their loans, even if those loans are eventually forgiven. The second bill, S-3305, sponsored by Senator Bob Smith (D-17), allows businesses to take a tax credit for COVID-19-related health safety improvements made in nonresidential buildings in order to reduce the spread of the virus.

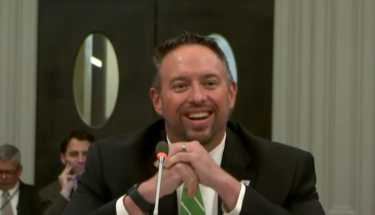

“New Jersey businesses certainly need tax relief and assistance wherever they can get it right now, and both of these bills will be a big benefit,” said NJBIA Vice President of Government Affairs Christopher Emigholz.

Emigholz noted the federal government has already announced that forgiven PPP loans are not taxable on federal tax returns. It is important for New Jersey to follow suit for state tax purposes.

“To be sure, the notion of New Jersey increasing state taxes off federal aid runs counter to the very purpose and benefit of that aid in the first place,” Emigholz said. “We have heard this concern about this potential tax and expense issue from our members who received PPP and we are very pleased that bill S-3234 has taken another step to ensure there are no added state tax liabilities due to PPP.”

S-3305 is also an inportant tax relief benefit for the thousands of New Jersey businesses that have invested in safety enhancements during the pandemic, such as improvements to building ventilation systems, ultraviolet lighting, infrared thermometers, transparent sneeze guards or shields, touchless entryway and security, and other equipment designed to protect employees from contracting COVID-19. NJBIA successfully fought for a recent committee amendment that makes the tax credit available to corporation business taxpayers, as well as pass-through businesses.

Both bills now go to the Assembly.

“NJBIA thanks the sponsors and the supporters of both pieces of legislation and we look forward to working with the Assembly on them moving forward,” Emigholz said.