—Background—

In today’s competitive world of attracting jobs and investment, States across the nation are developing new and innovative ways to entice corporations, entrepreneurs, investors and developers to do business in their state. This can be done through changes in tax policy or other incentives that offset the cost of doing business. According to the NY Times, states across the nation spend over $80 billion per year in incentives. In that vein, while New Jersey’s incentive programs have done well, it was clear that the programs needed to be improved and expanded. The New Jersey Economic Opportunity Act of 2013 attempts to improve those programs, expand their scope, and provide more opportunities for businesses of all sizes to participate.

—Overview—

The “New Jersey Economic Opportunity Act of 2013,” (hereinafter referred to as EO13) merged five of New Jersey’s most prominent economic incentive programs into two programs, and provided added incentives for development and job creation in certain areas of the state.

Specifically, the new law phased out the Business Retention and Relocation Assistance Grant Program (BRRAG), the Business Employment Incentive Program (BEIP), and the Urban Transit Hub Tax Credit Program (UTHTC) on December 31, 2013, and expanded the Grow New Jersey Assistance Program (Grow) and the Economic Redevelopment and Growth Grant Program (ERG). The law sunsets the “new” Grow and ERG programs on July 1, 2019, and it prohibits the EDA from considering an application for eligibility for tax credits under Grow and ERG after June 30, 2019. The purpose of sunsetting the program is to ascertain its effectiveness.

Please note that the application deadline for the programs phased out by the law was the date of enactment (September 18, 2013). However, if a business submitted an application for eligibility under Grow before the enactment of EO13, may amend the application to receive more favorable terms under the revised programs. But, as stated above, that determination was to be made prior to December 31, 2013.

Businesses that received assistance through State incentive programs prior to the Act’s implementation will not qualify under the new Grow NJ or ERG programs until they satisfy all existing obligations.

Once a project meets the minimum eligibility thresholds, the Grow program established by EO13 provides both baseline and bonus corporate business tax credits based on a variety of criteria.

Those tax credits can be used to offset corporate business tax liability or may be sold on the open market. For the ERG program, grants or credits are provided to bridge the financing gap for certain development projects throughout the state. In instances other than residential projects, the grants are funded through revenues derived from various taxes generated by the projects (i.e. sales tax). For residential projects, corporate business tax credits are provided that, as stated above, can be sold on the open market.

The new law provides incentives statewide, however, the law goes further by creating special incentive areas that provide added incentives (bonuses) as well as different eligibility criteria for companies and developers that invest within those specific geographic boundaries. For example, the law provides lower investment and job creation/retention thresholds in the 8 southern counties of the state (Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Ocean, Salem). Reductions in thresholds are also provided in the newly created Garden State Growth Zones (GSGZ). The GSGZ’s are Paterson, Passaic City, Trenton, Camden and Atlantic City.

New Grow NJ Assistance Program – The new Grow program establishes baseline corporate business tax credits ranging from $500 to $5,000 annually per job. While we cannot outline every defined term in the law, certain key terms are listed below. The terms are listed in alphabetical order. As such, a term may encompass as part of its definition another term that is defined later in this paper.

Distressed municipality – a municipality that is qualified to receive assistance under the Municipal Urban Aid Program (N.J.S.A. 52:27D-178), a municipality under the supervision of the Local Finance Board pursuant to the “Local Government Supervision Act (1947),” a municipality identified by DCA to be facing serious fiscal distress, a SDA municipality (defined below), or a municipality in which a major rail station is located.

Garden State Growth Zone (GSGZ) – The four New Jersey cities with the lowest median family income, based on the 2009 American Community Survey from the US Census (Camden, Trenton, Paterson, Passaic City). The tourism district of Atlantic City was added as the fifth GSGZ in 2014, after “The Economic Opportunity Act of 2014, Part 3” was signed into law (P.L.2014, c.63).

Mega project

A qualified business facility located in a port district housing a business in the logistics, manufacturing, energy, defense, or maritime industries, that has either:

- a capital investment in excess of $20 million and creates or retains at least 250 full-time employees, or,

- the project creates or retains more than 1,000 full-time employees.

A qualified business facility located in an aviation district housing a business in the aviation industry, in a Garden State Growth Zone (GSGZ), or in a priority area housing the U.S. headquarters and related facilities of an auto manufacturer, either:

- a capital investment in excess of $20 million and creates or retains at least 250 full-time employees, or,

- the project creates or retains more than 1,000 full-time employees; or,

- a qualified business facility located in an urban transit hub housing a business of any kind, having a capital investment in excess of $50 million and creates or retains at least 250 full-time employees.

Other eligible area – The portions of the qualified incentive area that are not located within a distressed municipality or priority area. Other eligible areas would include aviation districts; Planning Area 3; certain portions of Meadowlands, Pinelands and Highlands; and certain portions of Planning Areas 4A, 4B & 5.

Port District – The portions of a qualified incentive area that are located within: a) the port district of the Port Authority of New York and New Jersey, as defined in Article II of the Compact Between the States of New York and New Jersey of 1921; or b) a 15-mile radius of the outermost boundary of each marine terminal facility established, acquired, constructed, rehabilitated or improved by the South Jersey Port District established pursuant to “The South Jersey Port Corporation Act,” P.L.1968, c.60 (C.12:11A-1 et seq.).

Priority area – The portions of the qualified incentive area that are not located within a distressed municipality and which:

- Are Planning Area 1 (Metropolitan), Planning Area 2 (Suburban), a designated center under the State Development and Redevelopment Plan or a designated growth center in an endorsed plan until June 30, 2013, or until the State Planning Commission revises and readopts the NJ State Strategic Plan and adopts regulations to revise this definition;

- Intersect with portions of: a deep poverty pocket, a port district, or federally owned land approved for closure under a federal Base Realignment Closing Commission action;

- Are the proposed site of a disaster recovery project, a qualified incubator facility, a highlands development credit receiving area or redevelopment area, a tourism destination project, or transit oriented development; or,

- Contain: a vacant commercial building having over 400,000 square footage of office, laboratory, or industrial space available for occupancy for a period of over one year; or a site that has been negatively impacted by the approval of a “qualified business facility,” as defined pursuant to the UTHTC Act.

School Development Authority (SDA) District is one identified as defined in section 3 of P.L.2000, c.72 (N.J.S.A. 18A:7G-3). These include the following municipalities: Asbury Park, Bridgeton, Burlington City, Camden, East Orange, Elizabeth, Garfield, Gloucester City, Harrison, Hoboken, Irvington, Jersey City, Keansburg, Long Branch, Millville, Neptune Township, Newark, New Brunswick, Orange, Passaic, Paterson, Pemberton Township, Perth Amboy, Phillipsburg, Plainfield, Pleasantville, Salem, Trenton, Union City, Vineland, and West New York.

“Targeted industry” means any industry identified from time to time by the authority including initially; a transportation, manufacturing, defense, energy, logistics, life sciences, technology, health, and finance business, but excluding a primarily warehouse or distribution business.

Urban Transit Hubs are located within 1⁄2 mile of New Jersey Transit, PATH, PATCO, or light rail stations in East Orange, Elizabeth, Hoboken, Jersey City, Newark, New Brunswick, Paterson, Trenton, and Camden (Note: radius is expanded to one mile for Camden).

Before we can delve into the specifics of the tax credits offered under the new Grow program of EO13, a project must meet the minimum capital investment and job creation/retention eligibility thresholds. To put these new thresholds in perspective, the former Grow NJ Assistance program required a $20 million investment and minimum of 100 created or retained jobs. Furthermore, the Urban Transit Hub Program required a $50 million investment and a minimum of 250 jobs created or retained. Under the new Grow program established under EO13, investment thresholds are dramatically lowered and are based on the type of building and a per square foot investment.

Specifically, the EO13 capital investment thresholds are:

- Rehabbed Industrial: $20 per square foot

- Rehabbed Non-Industrial (commercial): $40 per square foot

- New Industrial: $60 per square foot

- New Non-Industrial (commercial): $120 per square foot

Note: The minimum capital investment thresholds are lowered by 1/3 in the 8 southern NJ counties and in the GSGZ’s.

The minimum job requirements are as follows:

Life sciences/technology startups/manufacturing: 10 new jobs 35 new jobs, 25 retained jobs

Targeted industries: 25 new jobs, 35 retained jobs

All other businesses/industries: 35 new jobs, , 50 retained jobs

Tax Credits: The program establishes base corporate business tax credits for certain types of industries in certain locations throughout the state. Then, the law allows the New Jersey Economic Development Authority (EDA) to award bonus tax credits based on a variety of different criteria which will be used to drive development into certain areas of the state. Bonuses include but are not limited to: areas located in deep poverty pockets; qualified incubator facilities; transit oriented development; food deserts; Urban Transit Hub municipalities; properties located adjacent to a rail spur, transit hub, aviation district, or marine terminal; projects that create jobs with higher than average salaries or substantial job creation (250-1000+ employees).

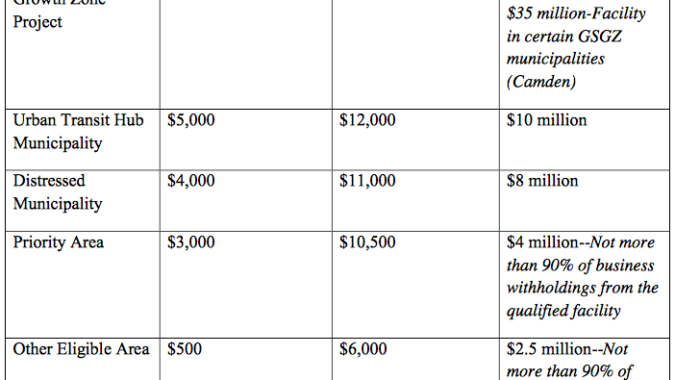

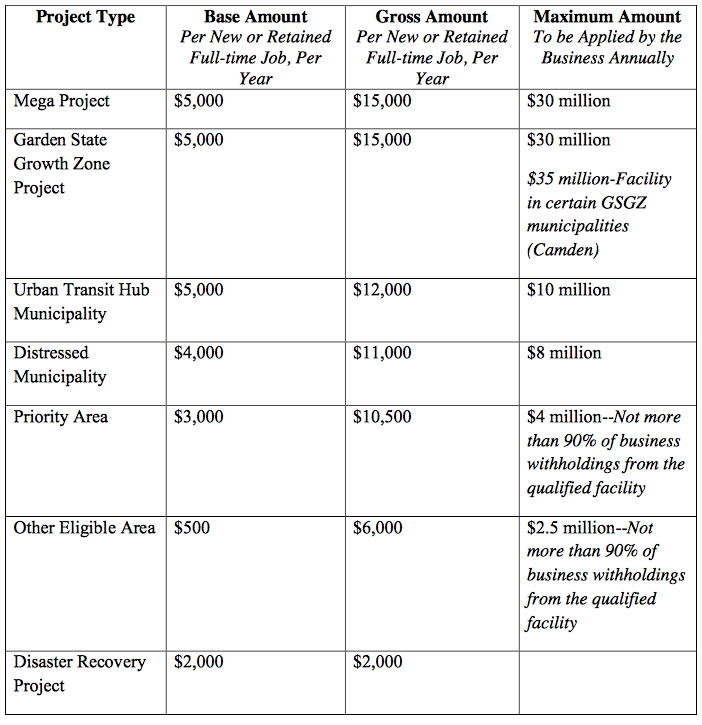

There is no cap on the value of the tax credits attributable to the Grow program. However, there are specific caps on individual projects. A qualified business can use the credits to offset their Corporate Business Tax liability or sell those credits to another buyer, with certain restrictions. The table below outlines the project types, base credits, maximum gross amount of credits allowed per full-time employee, and total project maximums.

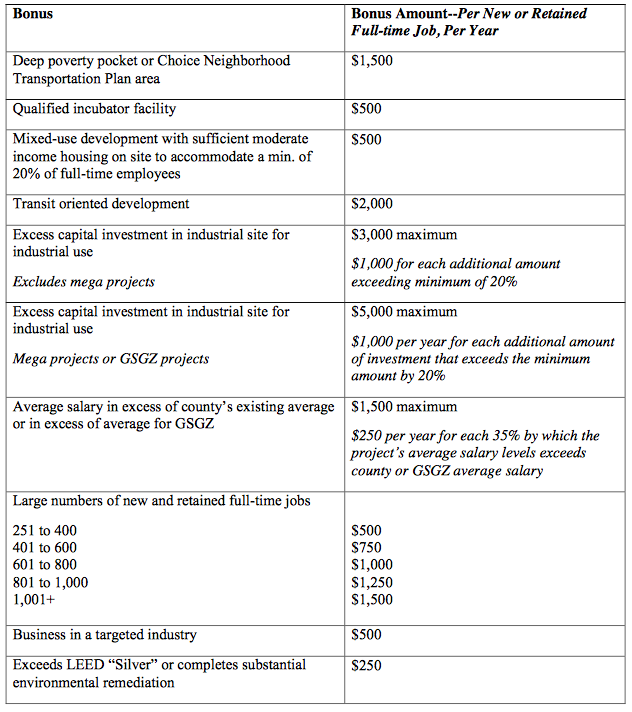

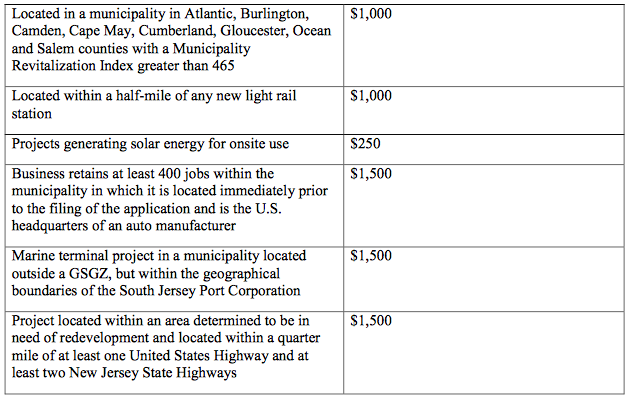

Bonus Credits: In addition to the base credits, the law also provides for bonus credits based on specific types of projects, their location, excess capital investment, number of jobs created or retained, and salaries compared to those in the surrounding areas.

Source: NJEDA

Net Benefits Test: All projects will now be subject to a comprehensive net benefit analysis to verify that the revenues the State receives will be greater than the incentive being provided. Specifically, the project must return to the State a minimum of 110 percent of the approved benefit. Generally, this was determined based on a 30-year outlook, 10-year incentive plus an additional 20 years to meet net benefits test. Under EO13, that remains the same except in two cases:

Under a Mega Project or a project in a Garden State Growth Zone, a project receives a 10-year incentive plus 30 years to meet the net benefits test. Further, in the city of Camden a project is given 35 years beyond the 10-year incentive term to meet the test.

Final Determination of Credits: The final determination of gross credits is based 100 percent of the gross credits for new full-time employees and 50 percent of the gross credits based on the number of retained full-time employees.

Economic Redevelopment and Growth Grant Program (ERG)

EO-13 designates Economic Redevelopment and Growth grant program (ERG) as the State’s sole redeveloper incentive program. The law provides attractive incentives to help close the funding gaps in these difficult economic times. The law also provides for bonus award capacity for redevelopment in certain areas of the state, including GSGZ’s, tourism areas that were impacted by Sandy, and in urban areas desperately in need of grocery stores, commonly referred to as “food deserts.”

While there is a cap on the amount of ERG grants for residential development (See below), there is no cap on the amount of non-residential ERG grants. The ERG grants are generally limited to 20 percent of any project cost but may be increased to as much as 40 percent for certain types of projects. One further caveat is that municipal redevelopers are eligible for credits between 75 percent and 100 percent of project costs.

The Act sets the maximum value of ERG redevelopment incentive grant agreements at $600 million for residential projects. The breakdown of those monies is as follows:

a) $250,000,000 for qualified residential projects within the 8 southern New Jersey counties, of which $175,000,000 of credits will be used for residential projects in the city of Camden, and $75,000,000 of credits will be used for residential projects in municipalities with a 2007 Municipal Revitalization Index of 400 or higher as of the date of enactment (http://www.state.nj.us/state/planning/publications.html)

(b) $250,000,000 will be restricted to qualified residential projects located in; (i) urban transit hubs that are commuter rail in nature that otherwise do not qualify under the subparagraph (a) above (ii) a Garden State Growth Zone not located in a county mentioned in subparagraph (a) above; (iii) disaster recovery projects that otherwise do not qualify under subparagraph (a) above; or (iv) SDA municipalities located in Hudson County that were awarded State Aid in State Fiscal Year 2013 through the Transitional Aid to Localities program and otherwise do not qualify under subparagraph (a) of this paragraph;

(c) $75,000,000 for qualified residential projects in distressed municipalities, deep poverty pockets, highlands development credit receiving areas or redevelopment areas, otherwise not qualifying pursuant to subparagraphs (a) or (b) above; and

(d) $25,000,000 for qualified residential projects that are located within a qualifying economic redevelopment and growth grant incentive area otherwise not qualifying under subparagraphs (a), (b), or (c) above.

Not more than $40,000,000 of credits shall be awarded to any qualified residential project in a deep poverty pocket or distressed municipality and not more than $20,000,000 of credits shall be awarded to any other qualified residential project.

Property Tax Exemption Allowed in GSGZ’s Under Certain Circumstances: In an effort to compete with other states that offer tax free areas and tax abatements, EO13 provides for the opportunity for a 20 year tax abatement in GSGZ municipalities if certain requirements are met.

EO13 provides that a Garden State Growth Zone Development Entity is authorized to undertake the clearing, re-planning, development, or redevelopment of property within a GSGZ. Every development entity that owns real property within a GSGZ, and that undertakes such activity on the property, is granted a property tax exemption on the improvements to the property for any new construction, improvements, or substantial rehabilitation of structures on the property for a period of 20 years from receiving a final certificate of occupancy; provided, however, that a municipality located within the GSGZ is to, by ordinance, opt into the program within 90 calendar days after enactment.

The property tax exemption is to be dependent upon: (1) the owner of the property making improvements to the property after the date of enactment; and (2) the Division of Codes and Standards within the Department of Community Affairs, in consultation with the eligible municipality, issuing a final certificate of occupancy within 10 years of the date of enactment of EO13.

As it pertains to the 20 year tax exemption, for the first 10 years immediately subsequent to the issuance of a certificate of occupancy, the entity will be exempt from the payment of taxes on the improvements to the eligible property. The Act provides that, thereafter, the entity is to pay to the municipality, in lieu of full property tax payments, an increasing percentage of the amount otherwise due to the municipality.

Tax Credits for Wind Energy – EO13 provides that the tax credits allowed for the development of qualified wind energy facilities in wind energy zones, do not apply to the overall cap under the UTH and extends the application deadline for that tax credit program to July 1, 2019.

Public Private Partnerships (P3) – EO13 extended for two years, from August 1, 2013 to August 1, 2015, the application deadline for a public institution of higher education public-private partnership (P3) agreement approval by the EDA and also extended, for two years, from August 1, 2014 to August 1, 2016, the deadline for P3 agreement approval involving state or county college leases to a private entity for the operation of a dormitory or other revenue-producing facility to which the college holds title, in exchange for up-front or structured financing by the private entity for the construction of classrooms, laboratories, or other academic buildings.

Written Report to Legislature and Governor – EO13 requires the EDA to submit a written report to the Governor and the Legislature on or before July, 2018, providing a comprehensive review and analysis of Grow, ERG, and other economic incentive laws under the EDA’s jurisdiction, with particular emphasis on the recalibration of those programs, the creation of GSGZs under that program, and the effectiveness of these programs on economic development and private-sector job retention and growth.

—For More Information—

Both Ted Zangari Esq. from Sills Cummis and Gross P.C. and Anthony Pizzutillo from Pizzutillo Public Affairs LLC provided extensive technical information for this fast facts.

If you need additional information, please contact Andrew Musick at 609-858-9512, or via e-mail at amusick@njbia.org, Ted Zangari Esq. from Sills Cummis and Gross P.C. at 973-643-5781or via e-mail at tzangari@sillscummis.com, or Anthony Pizzutillo at 609-452-1500, or anthony@pizzutillopublicaffairs.com.

Updated: December 18, 2017

This information should not be construed as constituting specific legal advice. It is intended to provide general information about this subject and general compliance strategies. For specific legal advice, NJBIA strongly recommends members consult with their attorney.