The House Ways and Means Committee held a legislative hearing Thursday on the Social Security 2100 Act, a bill that would increase the Social Security Tax to 14.8%, a 2.4 percentage point increase or about a 20% tax increase.

If enacted, both businesses and employees would see their payroll taxes increase to 7.4% each. The bill also would lift the cap on income on which the Social Security tax is applied, raising the effective tax increase to about 40% when fully phased in.

The rationale for the increase is the fact that the program’s long-term financial prospects are shaky (though the bill does increase benefits as well). Next year, existing Social Security benefit payments are expected to exceed the amount of contributions coming into the fund, meaning it will have to dip into its reserves to continue payouts. If nothing is done, those reserves would be depleted by 2035, forcing a 20% cut in benefits.

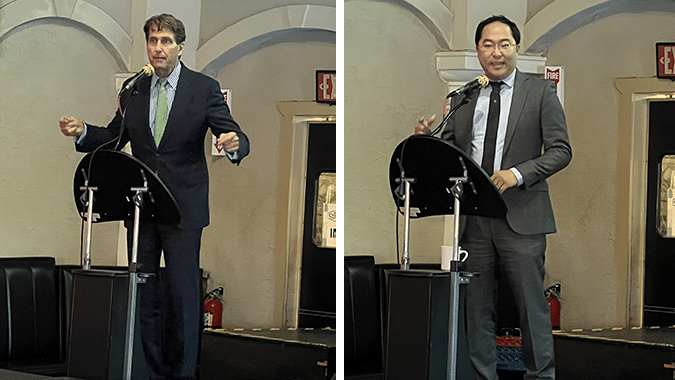

“Congress has never allowed these kinds of cuts to occur, and it certainly isn’t going to happen on my watch,” said Ways and Means Committee Chairman Richard Neal (D-MA).

The bill would address the problem, said Stephen Goss, chief actuary of the Social Security Administration. He testified that the bill would achieve “sustainable solvency, meaning that the Social Security program would be projected to be fully solvent for the foreseeable future.”

But ranking member Kevin Brady (R-TX) noted that the bill amounts to a $19 trillion tax increase that would impact workers and employers alike, regardless of their wealth or income. He advocated reforms to the Social Security program to protect its solvency.

“Main Street businesses get hammered,” he said. “…their taxes all go up, which means they have less money to hire workers, raise wages, grow their business, or contribute to their local economy.”

The increase would be especially hard on sole proprietors, who pay both sides of the payroll tax, said Kelly Brozyna, president of the Colorado Business Development Foundation.

“It takes about three to five years for new businesses just to break even,” she said. “The vast majority of those businesses are solo entrepreneurs, who would be paying full 14.8% tax themselves.”

View the hearing here.