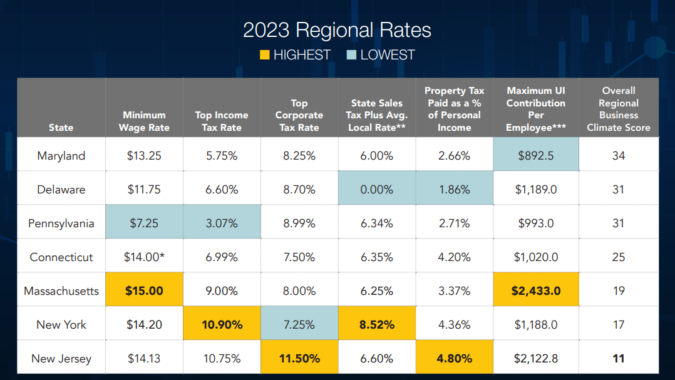

NJBIA’s 2023 Regional Business Climate Analysis shows New Jersey last in the region by a wide margin in terms of business taxes and cost competitiveness.

The analysis, found here, shows New Jersey maintaining the highest corporate business tax rate and property tax paid as a percentage of personal income, while also having the second highest top income tax rate, sales tax and maximum unemployment insurance tax contribution per employee among nearby states.

Each year, NJBIA analyzes six individual business cost drivers in seven states. Using a scoring system of those metrics, New Jersey ranks last overall behind New York, Massachusetts, Connecticut, Pennsylvania, Delaware and Maryland.

“It is unfortunately another year where New Jersey is both a regional and national outlier in terms of cost-drivers for business and we continue to fall short on bringing affordability to our employers,” said NJBIA President and CEO Michele Siekerka.

“We do believe that many of our policymakers are aware of this outlier status and want to improve our standing in these critical areas in some way. As we approach the FY24 budget season, we encourage them to seek – and act upon – comprehensive solutions and reforms to greatly improve our business climate.”

NJBIA’s annual Regional Business Climate Analysis, prepared by Director of Economic Policy Research Kyle Sullender, observes six metrics that affect business competitiveness.

Each state’s rates in each category are scored from 1 (least competitive) to 7 (most competitive).

New Jersey’s overall business climate score (11 points) was the weakest for the fifth straight year.

Maryland (34) replaced Delaware (31) to have the top score. Pennsylvania also had 31 points, followed by Connecticut (25), Massachusetts (19) and New York (17).

Compared to the six other states, New Jersey has the top corporate business tax rate in the region and in the nation at 11.5%. While a 2.5% CBT surcharge is expected to sunset at the end of 2023, a remaining 9.0% CBT rate would still be as larger than as second highest Pennsylvania.

The Keystone State reduced its CBT rate from 9.99% to 8.99% on Jan. 1 and is also on a trajectory to decrease its rate by 0.5 percentage points each year until it reaches 4.99% in 2031.

Compared to the six other states, New Jersey also has the top property taxes paid as a percentage of income at 4.80% – but it should be noted that this rate is lower than the 4.98% from a year ago.

New Jersey’s top income tax rate of 10.75% has been surpassed by New York’s top rate of 10.9% for the second consecutive year.

Massachusetts currently has the top minimum wage rate of $15 per hour. However, Connecticut’s current $14 rate will increase to $15 in June. New Jersey’s current minimum wage of $14.13 is the third highest in the region.

To continually seek ways to improve this research, NJBIA slightly adjusted the state sales tax metric to account for states where local sales taxes are applied in addition to state rates. As a result, New Jersey finished with the second-highest rate at 6.6% – an improvement from last year in this category and a good distance behind New York’s 8.52%.

NJBIA also adjusted its unemployment insurance tax category to represent the maximum UI contribution per employee, which is calculated by multiplying each state’s taxable wage base and maximum tax rate.

With this metric, New Jersey is the second highest at $2,122.8. Massachusetts has the highest maximum UI contribution per employee at $2,433.

“Unfortunately, developments like New Jersey’s $1 billion UI tax increase on employers have not offered any relief to businesses in our state,” Sullender said. “However, a reduction in the CBT tax, either by the sunsetting of the 2.5% surcharge or an additional CBT rate cut, could help New Jersey not be such an outlier in at least one metric.”