NJBIA testified on Thursday afternoon in support of legislation that would make New Jersey’s corporate tax policies more competitive with other states by changing the way global intangible low-taxed income (GILTI) and net operating losses (NOLs) are treated under the state code.

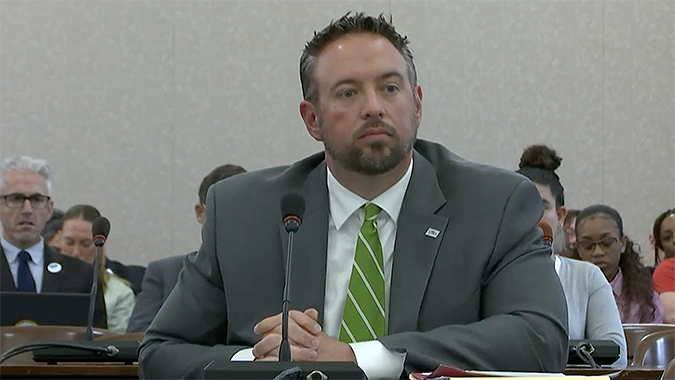

In his prepared testimony for the Senate Budget & Appropriations Committee’s public hearing to discuss S-3737, NJBIA Chief Government Affairs Officer Christopher Emigholz noted that very few states tax income earned abroad by U.S.-controlled corporations at all. New Jersey is an outlier and only allows corporations to deduct 50% of GILTI from their tax base.

“Of our neighbors, New York and Connecticut only tax 5% of it, while Pennsylvania does not tax GILTI at all,” Emigholz said. “Being a GILTI outlier harms our competitiveness with multi-national corporations and discourages their investments in New Jersey.”

Emigholz said S-3737 would reform New Jersey’s tax code to exclude 95% of GILTI income – just as neighboring states do – and this change is a priority for Garden State corporations.

“Aside from the questions on the appropriateness of states taxing foreign income at all, New Jersey should not be more aggressive on this possibly inappropriate tax than any other state in the nation, especially when we are fortunate to have as many multi-national corporations located and creating great jobs here,” Emigholz said.

The bill would also make the tax code more taxpayer friendly in the way it treats net operating losses (NOLs) by allowing the sharing of NOLs by combined businesses.

“New Jersey currently has two limitations on NOLs that hurt our competitiveness,” Emigholz said. “Current law does not allow the pooling of NOLs between combined businesses resulting in the inability to fully utilize them, and the current ordering of them also limits their full use.

“This bill allows the sharing of NOLs between combined businesses so that they are not locked away or captured, and changing the order would end them being partially absorbed by the dividends received deduction,” Emigholz said. “S-3737’s improved NOL treatment would make us more competitive for startup companies and all corporations with NOLs.”

Emigholz also praised the collaborative effort between the bill’s sponsor, Senator Paul Sarlo (D-36), state Treasury Department and Taxation Division officials, as well as expert tax attorneys and accountants from NJBIA member companies.

“This is a complicated piece of legislation that is better because it involved collaboration and compromise between state government and corporate stakeholders, and we know that has not always been the case for past corporate tax bills,” Emigholz said.

“We can all remember the 4th of July weekend several years ago where we were stuck in the State House while CBT reforms with mistakes were thrust upon the Legislature and stakeholders with no input or collaboration,” Emigholz said.

“The Murphy administration, the Treasury Department and its Division of Taxation deserve credit for reaching out to the business community to negotiate this bill,” Emigholz said. “It is a good government compromise that should be a model for future complicated reforms.”