GILTI

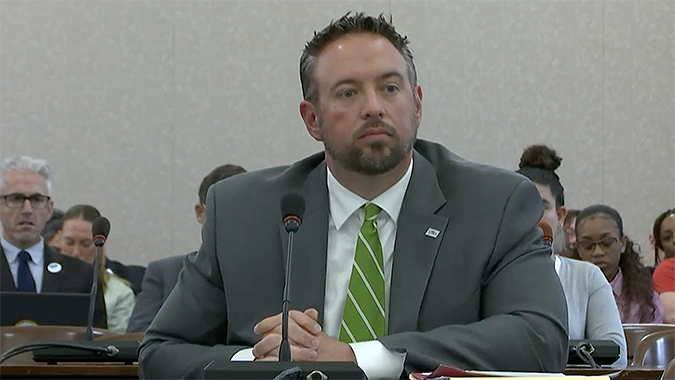

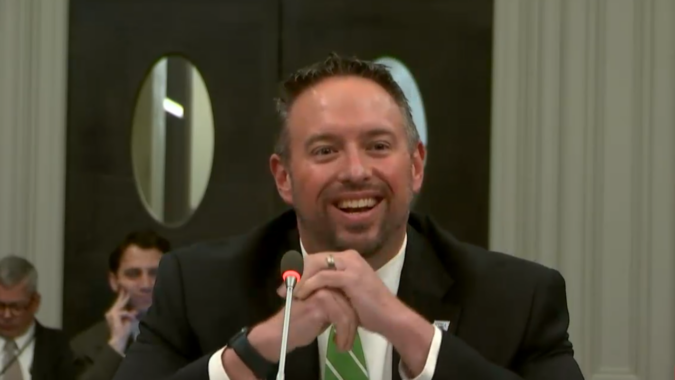

NJBIA Testifies in Support of Bill to Make NJ Corporate Taxes More Competitive

NJBIA testified in support of a bill advanced by a Senate committee on Monday that would make New Jersey’s corporate tax policies more competitive ...

Published April 22, 2022

Seeing NJ’s Corporate Taxes Through a New Lens

Published March 29, 2022

NJBIA Testifies FY23 State Budget Needs to Do More to Make NJ Affordable

Read More

Personalize Your Experience.

Get started customizing today!

Become a Member Already a NJBIA member? Sign In

Employment & Labor Law

Economic Development

Energy & Environmental Quality

Taxation & Economic Development

Government Affairs

Health Affairs

Law

Education & Workforce Development