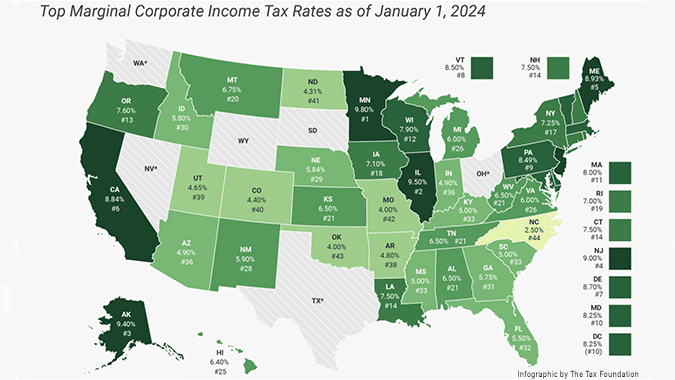

New Jersey is one of six states that lowered its corporate income tax rate in 2024 and now has the fourth highest levy in the nation instead of the highest, according to research released on Tuesday by the Tax Foundation, a nonpartisan think tank in Washington, D.C.

As of Jan. 1, Minnesota has the highest tax on corporate income in the United States at 9.8% followed by Illinois (9.5%), Alaska (9.4%), and New Jersey (9%). New Jersey’s Corporation Business Tax rate had been 11.5%, but the sunset on Jan. 1 of a temporary 2.5% surcharge levied since 2018 has returned the top marginal tax rate back to 9%.

New Jersey is one of six states where corporate income tax rates are lower in 2024 than they were in 2023. The other states that have enacted reductions include:

- Arkansas, which reduced its top marginal rate from 5.1% rate to 4.8%;

- Iowa, which reduced its 8.4% top marginal rate to 7.1% and will continue to decrease the rate over time until it reaches a flat 5.5%.

- Kansas, where the corporate tax (including a surtax) declined from 7% to 6.5%

- Nebraska, which reduced its top marginal rate from 7.25% to 5.84% and is on its way to a flat 3.9% rate by 2027;

- Pennsylvania, which reduced its top rate from 8.99% to 8.49% under a law that has put the state on a path to a 4.99% rate in 2031.

The Tax Foundation says 44 states levy a corporate income tax ranging from a flat 2.5% rate in North Carolina to the 9.8% flat rate in Minnesota. Only four states (Minnesota, Illinois, Alaska, and New Jersey) impose rates of 9% or more.

Conversely, 12 states have corporate income tax rates of 5% or less: Arizona (4.9%), Arkansas (4.8%), Colorado (4%), Indiana (4.9%), Kentucky (5%), Mississippi (5%), Missouri (4%), North Carolina (2.5%), North Dakota (4%), Oklahoma (4%), South Carolina (5%), and Utah (5%).

The states of Nevada, Ohio, Texas, and Washington forgo corporate income taxes but instead impose gross receipts taxes on businesses. The foundation said gross receipts taxes can be more economically harmful due to “tax pyramiding,” disparate impacts on low-margin businesses, and non-transparency. Tax pyramiding occurs when the same goods or service is taxed multiple times along the production process, which can yield vastly different effective tax rates depending on the length of the supply chain.

Delaware, Oregon, and Tennessee impose gross receipts taxes in addition to corporate income taxes, and several states — Pennsylvania, Virginia, and West Virginia — permit gross receipts taxes at the local (but not state) level.

South Dakota and Wyoming levy neither corporate income nor gross receipts taxes, and with the enactment of a budget in 2021 that includes the multiyear phaseout of its corporate income tax, North Carolina is due to join them by 2030.

A total of 29 states have a flat corporate tax structure without tax brackets, which the Tax Foundation says, “minimizes the incentive for firms to engage in economically wasteful tax planning to mitigate the damage of higher marginal tax rates that some states levy as taxable income rises.”

To read the entire Tax Foundation research document, go here.