NJBIA released its 65th annual Business Outlook Survey on Nov. 27. While much of the attention of the 2024 outlook survey focused on inflation and affordability, there were many other facets of the survey.

Today, we look at deeper at New Jersey’s economic climate and economic outlook data found in the 2024 Business Outlook Survey.

NJ’s Economic Climate and Challenges

- When asked about the current business conditions in their industry:

-

- 29% said they were experiencing a slowdown (5 percentage points more than last year)

- 17% said they were experiencing an expansion

- 10% said their industry was moving from a slowdown to a recovery

- 7% said they were moving from an expansion to a slowdown

- 37% said conditions in their industry were staying the same

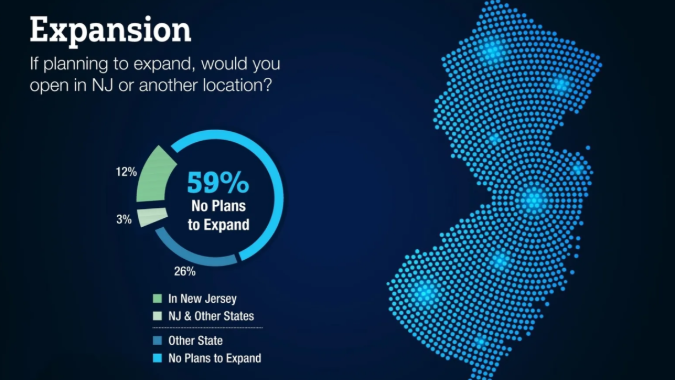

- For a second straight year, 58% of respondents said they had no plans to expand.

- 22% said they would expand in another state

- 14% that would expand in New Jersey

- 6% said they would expand in New Jersey and another state

- As a location for new or expanded facilities, 30% listed New Jersey as very good or good, which is a 9-percentage point increase from a year ago.

- 37% described it as fair

- 33% ranked it as poor

- Only 12% said they believe New Jersey has made progress over the last year in easing regulatory obstacles. That number has declined steadily from 24% in 2017.

- 21% said they had postponed installation of equipment or had expansion delays due to permitting or a regulatory process.

- 44% said they are planning to keep New Jersey as their domicile in retirement. That number is up from 39% last year and 32% two years ago.

- For the third straight year, the overall cost of doing business was listed as the most troublesome problem for New Jersey businesses – with 24% listing it as tops among their Top 4. That was followed by:

- 16% for availability of skilled labor

- 14% for health insurance costs

- 14% for property taxes

- 78% of respondents said they expect their health benefits costs to go up in 2024. Of those, 22% anticipated those health benefit costs to rise 11% or more in 2023.

- 67% expected an increase in local property taxes, 31% expected them to remain the same, and only 1% expected a decrease.

Economic Outlooks

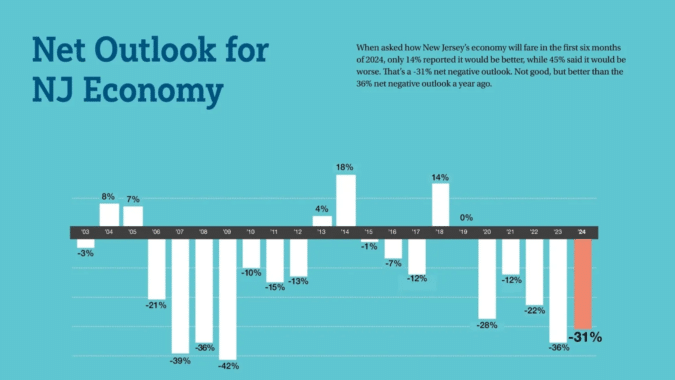

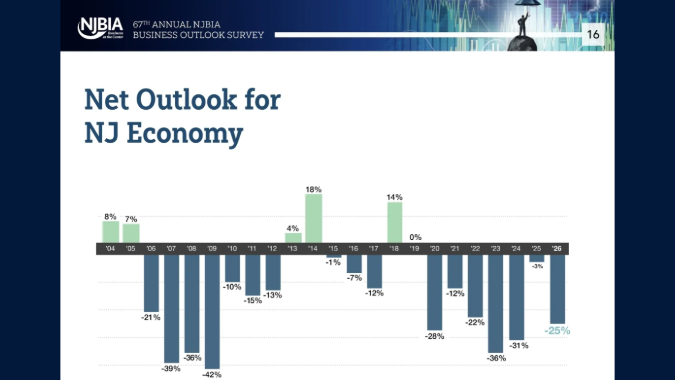

The economic outlooks for both New Jersey and the nation were very dismal a year ago. This year, the outlooks have improved, but are still negative overall.

- 45% rated New Jersey’s economy as fair and 24% listed it as poor, which is 3 percentage points less in those negative categories than a year ago.

- 28% ranked the state economy as good, compared to 25% in 2022 and 19% in 2021.

- When asked how New Jersey’s economy will fare in the first six months of 2024, only 14% reported it would be better, while 45% said it would be worse. That’s a -31% net negative outlook, which isn’t good, but better than the 36% net negative outlook a year ago.

- 70% rated the U.S. economy as fair (42%) or poor (28%) in 2023, compared to 81% which labeled it fair or poor in 2022.

- 47% said they believed the U.S. economy would perform moderately worse (36%) or substantially worse (11%) in the first six months of 2024.

- Comparatively, only 16% said the U.S. economy would perform substantially or moderately better in the first half of next year. That’s a -31% net outlook for the national economy, which is actually an improvement from the -40% net outlook for 2023.

- Only 22% called for a substantially or moderately better first six months of 2024 in their industry – compared to 26% who said it would be substantially or moderately worse.

- That’s the second straight year of a net negative industry outlook. Prior to that, there hadn’t been a net negative in industry outlook since 2012.