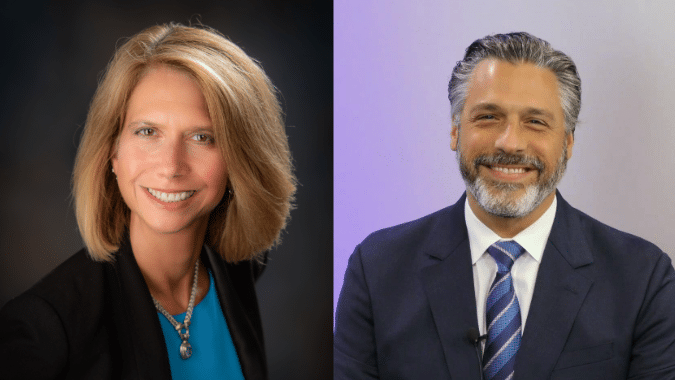

NJBIA President and CEO Michele Siekerka joined NJ101.5 morning host Bill Spadea this past week to discuss the damage done by Gov. Phil Murphy’s decision to replace a temporary 2.5% surtax on New Jersey’s largest employers with a permanent 2.5% Corporate Transit Fee.

Siekerka told Spadea that the governor’s “about face is a cultural issue,” after he vowed to sunset the original 2.5% surtax.

“It’s a competitiveness issue because (New Jersey) businesses can’t rely on the word of their policy makers, therefore they’re not going to make investments in the state of New Jersey,” Siekerka said.

“Businesses need predictability and certainty in order to make investments. Or if a company is considering coming to New Jersey, they need to know what the playbook is going to be. Nobody makes an investment in times of uncertainty.”

If the Corporate Transit Fee is included in Gov. Murphy’s FY25 budget, the total corporate tax would go from 9% – fourth-highest in the nation – to 11.5%, the highest in the nation, by far.

It would also be retroactive to Jan. 1, 2024 – meaning that New Jersey’s largest businesses would not see any tax relief at all.

At the same time, neighboring Pennsylvania is on a path to have a 4.9% top corporate tax rate.

“It’s a 20-percent tax increase on our largest and our most innovative job creators,” Siekerka told Spadea.

“We’re living in a time right now where we have folks working hybrid and remote. A lot of these companies have long-term leases coming up. They already have folks working remote. What’s to stop them from saying if I’m going to skinny down my lease here, I might as well move to a lower-taxed jurisdiction – one that’s right across the river in Pennsylvania.”

To hear the complete interview, click here and scroll to the 44-minute mark.