Instead of raising corporate taxes in New Jersey to a top rate of 11.5%, the state should ratchet down its CBT rate over the next five years to the national average of between 5% and 6%, according to the nonpartisan research group The Garden State Initiative.

In an op-ed published Tuesday in the Asbury Park Press and other USA Today Network publications, GSI President Audrey Lane noted the consequences of New Jersey’s antibusiness climate. One-third of the Fortune 500 companies headquartered in New Jersey have left between 2006 and 2021, she said. The number of Fortune 500 companies based in New Jersey has fallen from 22 to 15 over that time span, she said.

The governor’s plan to raise the corporate income tax rate from 9% to 11.5% by enacting a new 2.5% corporate transit fee on large companies will only make matters worse, she said. Moreover, the governor’s rush to enact the tax by June 30 is concerning.

"It’s important to note the estimated $818 million the tax will generate annually, most of which will go to NJ TRANSIT, will be on top of the new 15% fare hike that the NJ TRANSIT board passed last week and automatic 3% annual fare hikes,” Lane wrote. “Regrettably, both the fare hikes and the tax hike are being pushed through before a comprehensive study of the agency’s finances and recommendations is complete.”

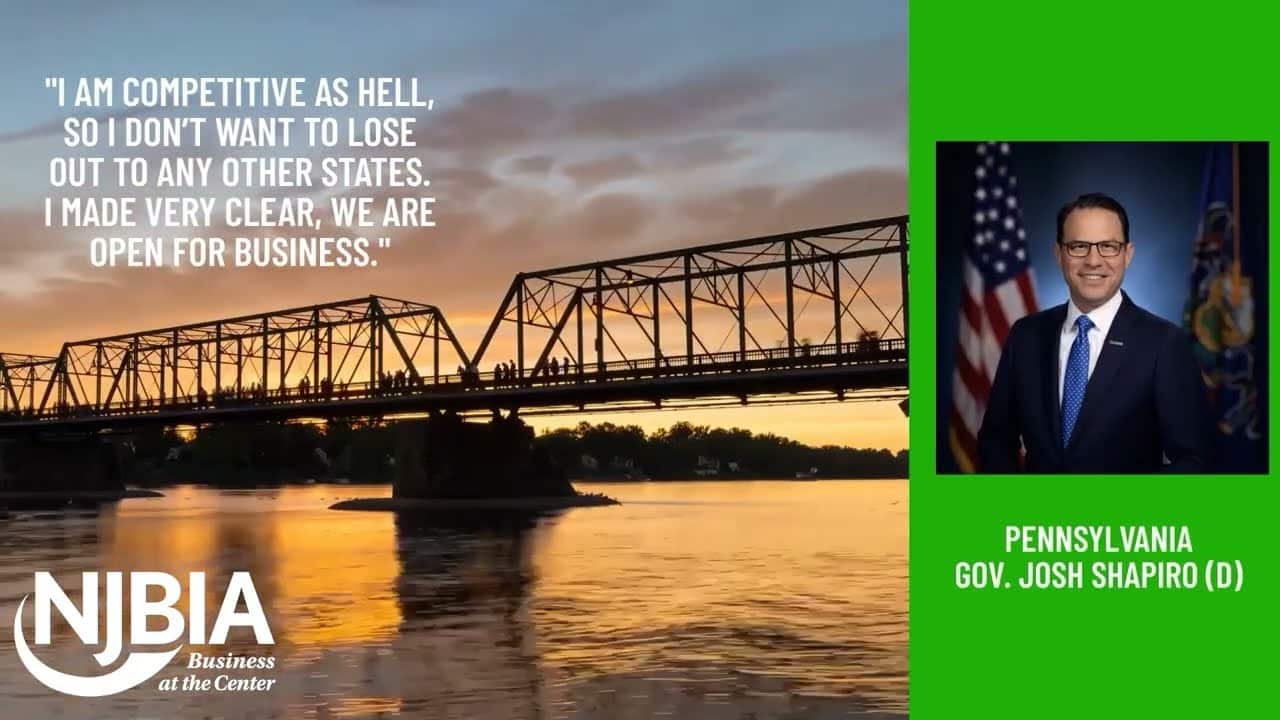

GSI said New Jersey needs to be more regionally competitive with neighboring states if it wants to stem the loss of large businesses and the jobs they provide residents. The group said the proposed reduction in the CBT rate could be paid for by repealing write-offs and exemptions that now reduce CBT collections by 20%.

Lane said that GSI is ready to work with NJBIA and other business groups to fight any legislative attempts to raise the top CBT rate and “be part of a real reform movement that changes how New Jersey does business.”

“If that doesn’t happen, more companies are going to grow and expand their business somewhere other than New Jersey,” Lane said.

Go here to read the entire GSI op-ed.