While news broke over the weekend that Gov. Phil Murphy and legislative leaders agree that the FY25 State Budget will include a 2.5% Corporate Transit Tax, many critical questions remain for New Jersey’s business community.

This week, NJBIA looks at just a few of them that will need to be answered before the budget is finalized by June 30.

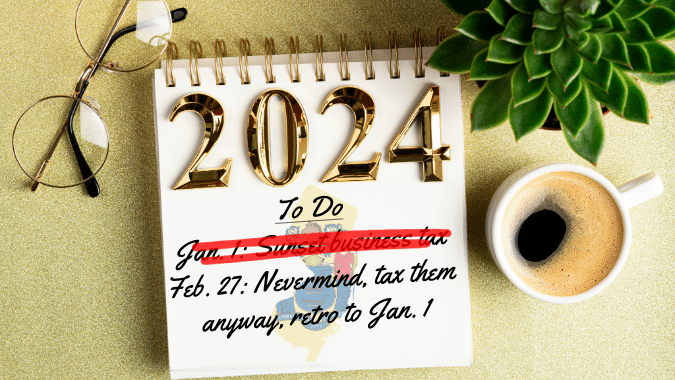

Why make the tax retroactive?

When Gov. Phil Murphy announced a new $1 billion tax as part of his budget speech in February, it shocked New Jersey’s business community as he had committed for the past year to the Dec. 31, 2023, sunset of a temporary 2.5% Corporate Business Tax surtax.

Instead, those companies who made $10 million in profit would now face a new 2.5% surtax in the form of a Corporate Transit Tax.

And the governor made it retroactive to Jan. 1, meaning those businesses would have no savings. But that’s not the worst of it.

“The worst of it is these companies based their 2024 financial projections and plans for expenditures on a statutory sunset and a commitment made by the administration and as such, put a budget in place based on those commitments,” NJBIA President and CEO Michele Siekerka said. “Companies may have already made new investments with that money. Now, they have to go back and restate their financials for the first two quarters of the year to reconcile this unintended and new liability.”

“Imagine as an individual if you knew that you would be saving money you needed to spend previously and made plans to spend that money elsewhere,” she said. “And maybe you already spent that money. Now the state tells you, you owe them six months' worth of that money after the fact? Where’s it coming from?”

NJBIA Chief Government Affairs Officer Christopher Emigholz added that Wall Street does not usually take kindly to restatements, and the downstream impacts could impact anyone who is invested in those companies.

NJBIA had sought to at least lessen the brunt of the unfair tax by calling for the end of the retroactivity. But so far, the Murphy administration and legislative leadership are sticking by it.

“This speaks to the heart of New Jersey not being business friendly,” Emigholz said. “Imagine being a company that provides thousands of jobs to the state. You give a disproportionate amount of tax revenue than other states. Then you’re assured that a statutory promise will be fulfilled. But then you have it taken away at the last minute and you’re essentially penalized extra for your troubles,” Emigholz said.

“That’s what Governor Murphy and our legislative leaders are telling these businesses by making this tax hit retroactive. There’s no soft pedaling around it. It’s punitive.”

There have been some rumors in Trenton that the retroactivity is needed because of cash urgency.

“That makes little sense given that NJ TRANSIT’s fiscal cliff doesn’t happen until next year and we have a surplus,” Emigholz said.

“What’s more concerning is if there really is a cash urgency, how did we not know about it last year when there was a commitment to sunset the surtax and an additional $1 billion in discretionary spending on top of an already bloated budget? What does it say about our fiscal planning when we add on to already unrelenting taxes, with no apparent spending reforms? If New Jersey is really in urgent need of cash, it’s a telltale sign we do not have our fiscal house in order.”

Added Siekerka: “NJBIA has cautioned about an inevitable fiscal cliff and has always been ready to work alongside our policymakers to avoid this and still does. If this is what faces us in the next few years, the calls for reforms should be shouted from the rooftops now.”