NJBIA released its 63rd annual Business Outlook Survey on Nov. 30. While much of the attention of the 2022 outlook survey focused on hiring challenges and employer morale, there were many other facets of the survey.

Today, we look deeper at the state of sales, profits and purchases of small businesses found in this year’s Business Outlook Survey.

Sales

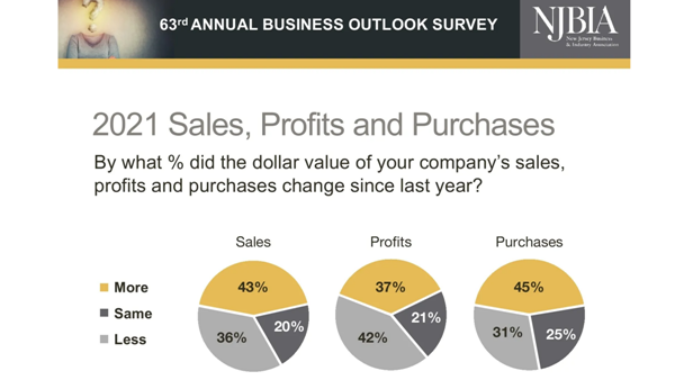

Actual sales rebounded for New Jersey businesses in 2021, with 43% claiming an increase in sales this year – compared to the meager 19% that saw more sales in 2020 due to the pandemic.

Remarkably, the exact percentage of businesses projected the same sales next year as they forecasted in 2020. A total of 46% anticipate increased sales in 2022, compared to 23% who foresee less sales. Prior to last year, the +23% net positive outlook was the lowest since 2015.

Profits

In the throes of a pandemic, only 20% reported net profits a year ago, compared to 62% who recorded a loss. It marked the first net negative of earnings (-42%) in this survey since the outlook for 2012.

In 2021, however, businesses rebounded at least somewhat – with 37% reporting profits and 42% taking a loss.

What hasn’t improved is businesses’ outlook for profits. Last year, there was a net positive of only 14% believing they would report a profit in 2021. In 2022, however, 38% believe they will make a profit, compared to 26% who think they will lose money. That net positive of 12% is the lowest outlook for profits in this survey since 2012.

Of that 38% hoping to be on the plus-side for 2022, 15% are forecasting profits of 1%-3% next year.

Purchases and Prices

With the increased costs of doing business and historic losses of revenue in 2020 due to the pandemic, 55% of respondents said the prices for their products and/or services increased in 2021 (17% increased substantially, 38% increased modestly).

That 55% is compared to 31% who said they raised prices in 2020. Another 40% said their prices were kept the same this year, while only 5% said they decreased prices.

Regarding future purchasing plans, 44% are expecting to increase the dollar value of their purchases in 2022 and 18% anticipating a decline. That’s a net positive of +26%, nine percentage points higher than the outlook for 2021.

In 2021, 54% of businesses said they made investments to productivity. That’s a slight increase from 50% in 2020, but still off the mark from the pre-pandemic years of 2019 (62%), 2018 (61%) and 2017 (60%).