Good afternoon! My name is Christopher Emigholz, and I am the Chief Government Affairs Officer for the New Jersey Business & Industry Association (NJBIA). On behalf of our member companies that make NJBIA the largest business association in our state, thank you for the opportunity to speak in support of A-5323 and explain why this legislation makes our corporate tax system more competitive.

NJBIA thanks Chairman Pintor Marin for sponsoring this bill, the Murphy Administration (especially staff from Treasury and Treasury’s Division of Taxation) for working with NJBIA to create and advance it and for including it in the FY24 Budget-in Brief. We also thank all of NJBIA’s corporate members, tax attorney members and accountant members that helped get this legislation to the better negotiated product that it is now.

A-5323 is complex with many different corporate tax changes but represents an overall improvement in New Jersey corporate tax policy, primarily for 3 reasons:

- Correcting New Jersey’s Outlier Treatment of GILTI to Better Match Neighboring

States - Making Treatment of Net Operating Losses More Taxpayer Friendly

- Creating a more Collaborative Stakeholder Process with Negotiated Changes

GILTI:

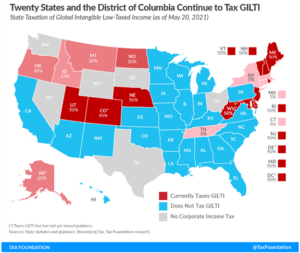

As the map below indicates, New Jersey currently is a negative outlier with how it treats GILTI (Global Intangible Low-Taxed Income). Most states in our nation do not tax GILTI, and of those that do, New Jersey taxes the highest percentage of it at 50% like only a handful of states do. Of our neighbors, New York and Connecticut only tax 5% of it, while Pennsylvania does not tax GILTI. New York changed from 50% to 5% several years ago. Being a GILTI outlier harms our competitiveness with multi-national corporations and discourages their investments in New Jersey.

A-5323 seeks to change this harmful outlier status in section 1k where it adjusts the “Entire Net Income” definition by bringing us in line with what New York did several years ago – moving from taxing 50% of GILTI to 5% of it. This change is a priority for many New Jersey corporations that identify this tax policy as a hindrance to their competitiveness. Aside from the questions on the appropriateness of states taxing foreign income at all, New Jersey should not be more aggressive on this possibly inappropriate tax than any other state in the nation, especially when we are fortunate to have as many multi-national corporations located and creating great jobs here.

Net Operating Losses:

The positive tax treatment of net operating losses (NOLs) helps taxpayers in a variety of ways, but it specifically helps smooth business income and mitigate risk, especially for startups and businesses in the innovation economy. New Jersey currently has two limitations on NOLs that hurt our competitiveness. Current law does not allow the pooling of NOLs between combined businesses resulting in the inability to fully utilize them, and the current ordering of them also limits their full use.

Section 2g of A-5323 corrects those less taxpayer friendly NOL policies. This bill allows the sharing of NOLs between combined businesses so that they are not locked away or captured, and changing the order would end them being partially absorbed by the dividends received deduction. A-5323’s improved NOL treatment would make us more competitive for startup companies and all corporations with NOLs. In terms of tax policy, this fits with the shift to the Finnigan apportionment method in the bill, and in terms of economic policy, this fits with recent attempts by Governor Murphy and this Legislature to restore New Jersey to its rightful place as the Innovation State.

Process:

This is a complicated piece of legislation that is better because it involved collaboration and compromise between state government and corporate stakeholders, and we know that has not always been the case for past corporate tax bills. We can all remember the 4th of July weekend several years ago where we were stuck in the State House while CBT reforms with mistakes were thrust upon the Legislature and stakeholders with no input or collaboration. The Murphy Administration, the Treasury Department and its Division of Taxation deserve credit for reaching out to the business community to negotiate this bill. It is a good government compromise that should be a model for future complicated reforms. Bad policies and misunderstandings in earlier drafts of this bill were corrected and/or avoided. Technical language and substantive changes were agreed to that clarify tax policy to help both with tax administration by the Division of Taxation and with tax compliance by corporate taxpayers. There are certainly imperfect elements to this legislation, as there almost always is with anything this complicated, but all the stakeholders gave a little and got a little. This bill and the future relationships and processes are better for it, and getting this bill done now importantly helps avoid potentially more problematic CBT legislation in the future.

Conclusion:

The bill includes many changes that I can answer your questions on or get answers for you from other corporate tax experts, but I wanted to focus on these three CBT improvements above. There are other positive but more technical changes being made to New Jersey CBT law as well.

NJBIA understands that there may be some critics of this legislation, as there often are with reforms like this. It is probably a good sign of the collaboration that took place that there are critics on both sides – businesses that wanted more and progressive groups that think businesses got too much. But we cannot forget that there are elements of this bill that progressive tax experts have been requesting for years, while at the same time, there are reforms here that the business community has also sought for years. NJBIA believes Treasury staff that this bill is revenue neutral, indicating that a well-balanced give and take took place and that it should not negatively impact this or future state budgets.

Thank you for considering NJBIA’s support of A-5323, and we hope to see it pass this committee today and the full Assembly and Senate later this week. We look forward to working with all of you to make A-5323 law, as well as to maintain the sunset of the CBT surtax as proposed in the FY24 state budget. Our corporate tax climate will be dramatically improved if those two corporate tax changes currently in front of the Legislature do indeed occur. Please email Christopher Emigholz at cemigholz@njbia.org to further discuss any questions or concerns about this bill and/or New Jersey’s corporate tax.