Over the strong objections of NJBIA and other business groups, the Senate and Assembly budget committees advanced a $56.6 billion state budget supported by a $1 billion tax increase on the business community Wednesday night.

This action sets the stage for final votes by both houses of the Legislature on Friday. Gov. Phil Murphy is expected to sign the budget (A-4700/S-2025) and related corporate business tax increase (A-4704/S-3513) before the new fiscal year begins on Monday, July 1. The increase in the corporation business tax from 9% to 11.5%, however, would be retroactive to Jan. 1.

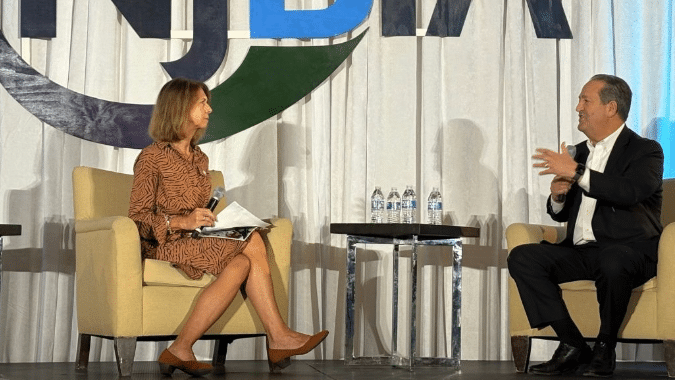

In her testimony before the Assembly Budget Committee, NJBIA President & CEO Michele Siekerka said raising corporate business taxes to 11.5% – the highest in the nation by far – would have a devastating impact on New Jersey’s economy. It will affect the cost of goods and services large companies provide, impact smaller businesses down the supply chain and cause corporate investments in facilities and workforces to be made in other states, she said.

“What makes this action even more egregious is its retroactivity,” Siekerka said. “This will cause companies to go back to a budget they already struck and to money they’ve already committed elsewhere, and perhaps spent, to find that 2.5% to pay back to the state, after the fact.

“This causes many of these companies to have to restate their financial statements,” she said. This is something that Wall Street frowns upon, and therefore affects the stocks of these companies, which many of our New Jersey families, businesses, and even our own state programs and pensions are invested.”

Additionally, the 2.5% increase in the Corporation Business Tax for companies with net income over $10 million, is called a Corporate Transit Fee in the enabling legislation, but the money collected for the 18-month period between Jan. 1, 2024, and July 1, 2025, would stay in the state’s general fund. NJ TRANSIT will not face an operating deficit until July 1, 2025.

NJBIA Chief Government Affairs Officer Christopher Emigholz said the $56.6 billion FY25 spending plan was a “bad budget.”

“It’s bad for our taxpayers. It’s bad for our job creators. It’s bad for our fiscal responsibility,” Emigholz said in his testimony to the Senate Budget & Appropriations Committee.

“The business community hears that we need cash as a state, yet we see a budget that’s spending $800,000,000 more in discretionary spending,” Emigholz said. “That’s outside of the pension and school aid investments that are the right thing to do. That’s outside of the formulaic things that we do as a state that are protecting our vulnerable and doing the right thing. Why?”

“We say that we have a structural deficit ...Yet we raid the debt defeasance fund that theoretically is supposed to help that. But we drain the surplus that we were proud that we built up,” Emigholz pointed out.

“We hurt economic growth by the transit tax that we just passed, and that’s how we get out of a structural deficit is to grow our revenues organically. We’re not doing that in this budget.”