The latest FY25 budget news does not appear to be good for New Jersey businesses.

Multiple reports on Friday, based on unnamed sources, said legislative leaders have agreed with Gov. Murphy to include a 2.5% Corporate Transit Tax of New Jersey’s largest employers as part of the final budget to help fund NJ TRANSIT.

The $1 billion tax will return New Jersey to the highest corporate business tax in the nation, by far, at 11.5%.

The reports said the new tax would be temporary for five years, rather than permanent as initially proposed.

But other key mitigants were left out of the agreement.

One mitigant NJBIA was seeking would have eliminated the retroactive nature of the tax.

Without it, impacted businesses will need to pay the higher tax dating back to Jan. 1, 2024 – even though Gov. Murphy had promised to sunset a previous temporary 2.5% on Dec. 31, 2023.

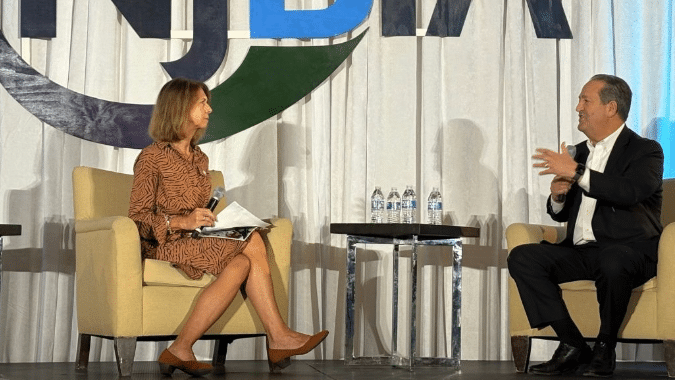

"We're in a wait-and-see mode,” said NJBIA President and CEO Michele Siekerka. “Obviously, a temporary tax is better than a permanent one.

“But including that retroactivity of the tax going back to Jan. 1, after the Governor's year-long promise to sunset the temporary CBT, is a major and impactful hit that borders on punitive. Especially when you consider these impacted businesses will have to restate their financials for the first half of the year for taxes they've already paid.

"If this is what it's going to be, with no other meaningful concessions or structural spending reforms to make our budget more affordable, then it will be taken as a blatant disregard for the consequences and impacts that we have been sharing for months,” Siekerka continued. “These are coming directly from our impacted job creators. It will also confirm that regional competitiveness means nothing to our policymakers.”

WHAT COULD HAVE HELPED

NJBIA Chief Government Affairs Officer Christopher Emigholz had suggested there were ways the governor, Assembly Speaker Craig Coughlin and Senate President Nick Sctuari could lessen the brunt of another billion-dollar increase on business.

In short, they were:

- To make the tax temporary (and with a short-duration time bar), not permanent as Murphy initially proposed

- To not make the Corporate Transit Tax retroactive to Jan. 1, 2024, as Murphy initially proposed

- To count the current 9% Corporate Business Tax and the 2.5% Corporate Transit Tax count as one 11.5% tax to allow for tax credits, offsets and carry-forward losses, rather than separate taxes.

“A 20% business tax increase without meaningful mitigants crosses a big line with the business community,” Emigholz said. “Without those mitigants, it gives them much more reason to move, grow or invest elsewhere.”

“If this is the result it will be a sad and defining moment for our business community, with broken promises and no regard for their input. It is a line in the sand that will have been crossed,” Siekerka added.

A DEDICATED RESOURCE?

During his FY25 Budget Address in February, Murphy stated he wanted his proposed Corporate Transit Tax to be solely dedicated to funding NJ TRANSIT.

In recent weeks, however, Coughlin has suggested that some of that money should go to property tax relief programs like the Stay NJ program he championed, or the ANCHOR program.

Ironically, it was a year ago Friday, when Gov. Phil Murphy was asked at a press conference if he would rule out raising taxes at a time of softening revenues to fund the Stay NJ property tax relief program for seniors.

His affirmative and confident response with legislative leaders at his side was: “I think I can say definitively, yes, we rule it out – because it’s kind of crazy to raise taxes to deliver tax relief.”

But if any of the 2.5% corporate surtax is to go to anything but NJ TRANSIT, then Murphy would in fact be raising taxes to deliver tax relief.

“Even if there was a constitutional dedication for this funding to be for NJ TRANSIT only, you’re still raising taxes on business to include a budget that includes Stay NJ,” Emigholz said.

Added Siekerka: “If this tax prevails, we can only pray that the revenue makes its way one year from now to its intended purpose, NJ TRANSIT.

“We feel that may be unlikely given the public discussions recently by our policymakers about how they would like to use this money elsewhere. We can only hope we are not standing here next year discussing more broken promises."