Gov. Phil Murphy signed a $46.4 billion FY 22 budget on Tuesday that contains no direct increases in taxes, reduces state debt, shores up the state’s underfunded public employee pension system and invests in workforce development.

Gov. Phil Murphy signed a $46.4 billion FY 22 budget on Tuesday that contains no direct increases in taxes, reduces state debt, shores up the state’s underfunded public employee pension system and invests in workforce development.

The budget, which takes effect on July 1, also provides increased funding for K-12 schools, larger Homestead Benefit property tax relief and expands the state income tax exclusion for middle-income retirees to help seniors afford to continue living in New Jersey instead of moving to low-tax states.

“This year’s budget represents the culmination of a four-year journey to fix many longstanding problems in New Jersey,” said Governor Murphy, who signed the budget at a Woodbridge public school with legislative leaders and cabinet officials to highlight the $750 million increase in education formula aid in the budget.

However, the business community was disappointed the budget does not resolve an expected $1 billion increase in unemployment insurance taxes over three years that employers face because of the high number of jobless claims paid during the COVID-19 pandemic.

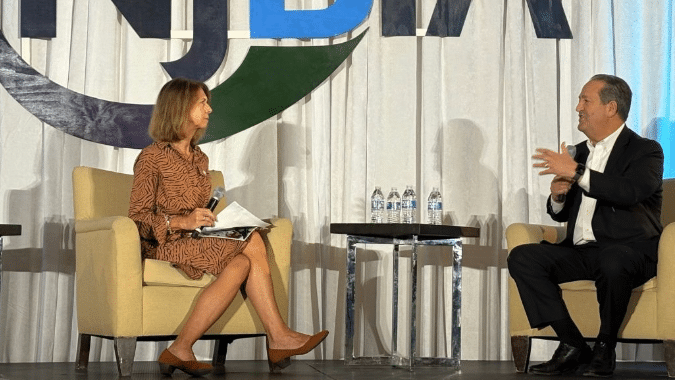

“Overall, this budget addresses some major needs for New Jersey, while leaving other needs unfulfilled,” NJBIA President & CEO Michele Siekerka said.

“The $6.9 billion payment into our underfunded pension system, to go along with $3.7 billion to address New Jersey’s perennial debt load, are indeed great positives that should not be understated,” Siekerka said.

Funding contained in the budget for workforce development investments is also good news and something that NJBIA and county colleges strongly advocated, Siekerka said. Businesses and employees will benefit from the upskilling and training it provides at a time when it is so critically needed.

Specifically, the budget contains $3 million for the NJBIA Basic Skills Training Program; $8.5 million for collaboration with the county colleges to develop, model and utilize workforce development best practices in key industries; and $5 million to support low‐income jobseekers in training programs.

However, Siekerka said it was “unsettling” that the FY22 budget failed to use the state's record FY21 budget surplus to pay down debt in the Unemployment Insurance Trust Fund. As a result, businesses face a July 1 increase in UI taxes that will slow job creation and hurt the state’s economic recovery, she said.

“It is imperative that this UI tax be addressed in the federal American Rescue Plan funding to help our businesses with their recovery,” Siekerka said.

NJBIA supported the budget’s use of federal aid and surplus revenues to reduce state debt, provide income tax relief for more middle-income retirees and invest in workforce development, infrastructure and innovation. However, the overall spending increases in other areas remains “a great concern,” Siekerka said.

“With $46.4 billion in appropriations, this budget is a dramatic 35% increase from four years ago and more than $1.5 billion higher than Gov. Murphy’s budget presentation only four months ago,” Siekerka said. “Further, New Jersey’s structural imbalance – the total amount of spending vs. incoming revenues – increased from $4 billion in February to $4.3 billion today.”

Go here to read more details about the FY22 state spending plan. Siekerka’s entire statement on the state budget can be read here.