The Senate unanimously approved a bill on Monday, supported by NJBIA, that would provide a tax credit to businesses that employ workers with developmental disabilities.

The legislation, S-3809, sponsored by Senate President Steve Sweeney (D-3), would allow a credit against corporation business tax liability or gross income tax liability of 10% of the salary and wages paid to an employee with a developmental disability. Under this bill, the credit would be claimed annually for the same employee. It would be capped at $3,000 per worker, and the total credit would be capped at $60,000 per taxpayer, per year.

NJBA also supports legislation, A-6230/S-4102, unanimously approved by the Assembly on Monday, that would address the recruitment challenges faced by organizations that employ direct support professionals caring for developmentally disabled people. The legislation, sponsored by Assemblyman Benson (D-14) and Senate President Sweeney, appropriates $1 million to establish a Direct Support Professional Career Development Center at the New Jersey Community College Consortium for Workforce and Economic Development in partnership with a trade association serving organizations that employ direct support professionals.

NJBIA is also supporting legislation before the General Assembly today that would provide $4.5 million to create county college-based adult centers for transition serving individuals with developmental disabilities up to the age of 24.

The bill, A-6228/S-4211, sponsored by Assemblyman Dan Benson (D-14) and Senate President Steve Sweeney, would help provide young adults with developmental disabilities the mentoring and skills training to transition to employment and independent living.

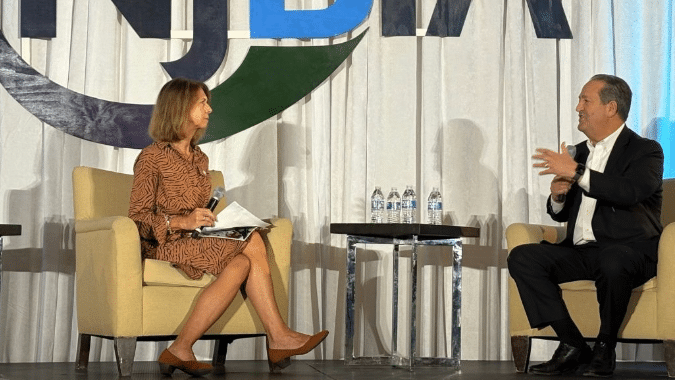

“Once individuals with developmental disabilities exit the secondary school system, there is often a sudden void that leaves them unable to reach greater productivity and independence,” NJBIA Chief Government Affairs Officer Chrissy Buteas said. “Developing career pathways for individuals with disabilities is important for them and for businesses as well.”