New Jersey drivers will be paying less at the pump on Oct. 1 when the state gas tax decreases 8.3 cents per gallon, state Treasury Department officials announced on Tuesday.

The new tax will be 42.4 cents per gallon for gasoline, down from 50.7 per gallon. The tax on diesel will fall from 44.2 cents to 35.9 cents for diesel fuel.

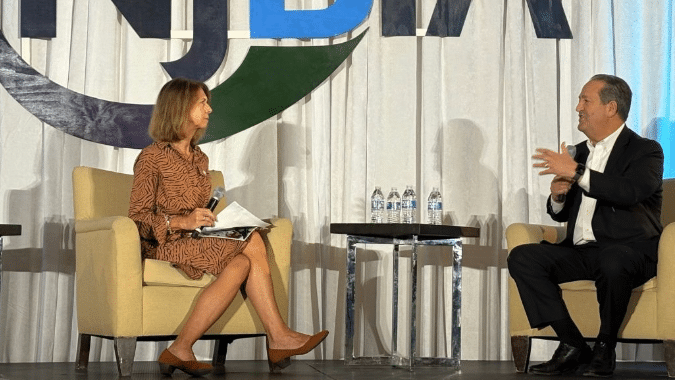

State Treasurer Elizabeth Maher Muoio said the decision to lower the gas tax was made because gasoline consumption between July 2020 and July 2021 turned out to be “closely in line” with state projections and because the department expects gas consumption to increase in the 2022 fiscal year.

The 8.3 cent gas tax decrease on Oct. 1 will bring the rate closer to what it had been before state officials increased the gas tax by 9.3 cents per gallon on Oct. 1, 2020.

Under a 2016 law, the state’s Transportation Trust Fund program is required to provide $16 billion a year to support improvements to the state’s roadways and bridges. To ensure the state has the funds to support these projects, the law requires the gas tax rate to be adjusted accordingly to ensure it generates roughly $2 billion a year.

Last summer, the Treasury Department had estimated consumption of gasoline and diesel fuel in FY 2021 (July 1, 2020 – July 1, 2021) would decline by 15.6% from pre-pandemic levels in FY 2019 and 20.2% from the FY 2016 baseline consumption level when the law was enacted. However, actual consumption of gasoline and diesel fuel in FY 2021 only declined by 13.6% from pre-pandemic levels in FY 2019 and 18.3 % from the FY 2016 baseline consumption level.