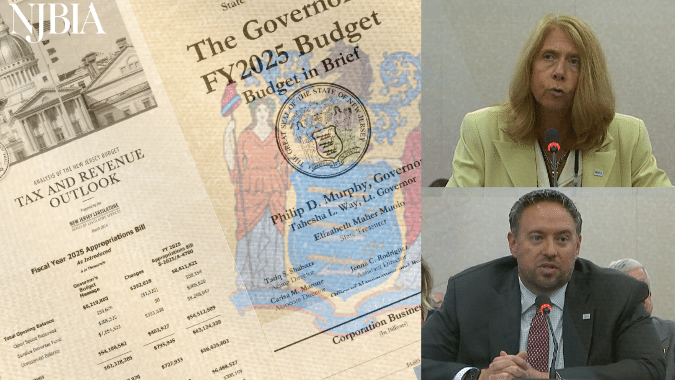

NJBIA President and CEO Michele Siekerka issued the following statement regarding the $56.6 billion budget for FY 2025 approved by the Legislature today, which includes a 2.5% Corporate Transit Tax to reinstate New Jersey with the top corporation business tax in the nation, by far, at 11.5%.

“While we always try to find the positives in a state budget, the unfortunate fact is this spending package is overwhelmingly bad for our job creators, for our taxpayers and our overall fiscal responsibility.

“We are raiding a debt defeasance fund while we have a surplus. We have a structural deficit, but we have $700,000,000 in discretionary spending and a damaging, yet unnecessary $1 billion business tax that will stymy economic growth and jobs and make our state less affordable.

“Obviously, we have been on record for more than four months the many reasons why this Corporate Transit Tax is just terrible policy, not just for businesses, but for New Jersey residents, consumers and workers.

“But what’s more concerning as we look ahead is the apparent lack of appreciation and consideration of our employers and our business community.

“At the end of the day, this massive, 20% tax on our largest employers was born of a broken promise from our governor.

“It is on top of other major businesses taxes levied by this administration. It will have little to no benefit for impacted employers. It is punitive and damaging in its retroactivity. It wholly worsens our business reputation. It is not needed this year. And it quite likely won’t be used solely for its stated intent, NJ TRANSIT.

“We truly do understand that Governor Murphy and the Legislature have many constituents to answer to and there are a lot of issues in this state. Theirs is not an easy job. And we also greatly appreciate those who stood firm and voted ‘no’ on this tax.

“But what are New Jersey employers to think when they are not only continually overburdened and overregulated, but also misled by policy statements that don’t stick – without any apparent remorse?

“It’s a hard truth, but we’ll say it: We believe that some policymakers have some work to do to make our job creators feel they’re more than a bottomless trough of revenue. And they should know that we will always tirelessly fight for those employers and their right to a business climate that breeds success.

“But it shouldn’t have to be a fight. We respectfully ask our leaders, once and for all, to seek more pro-business policies, rather than continually seeking to be an extreme national outlier in our taxes, costs and regulations.

“As always, we stand ready to work with them to bring that much-needed balance to business, rather than just tipping the scales in a direction that dissuades prosperity. We need to do better for business.”