Other than progressive groups, few in New Jersey are truly eager to raise taxes.

But the idea of dedicating a corporate tax increase to fund NJ TRANSIT, as proposed by Gov. Phil Murphy, is the worst possible option within a bad overall predicament, according to NJBIA Chief Government Affairs Officer Christopher Emigholz.

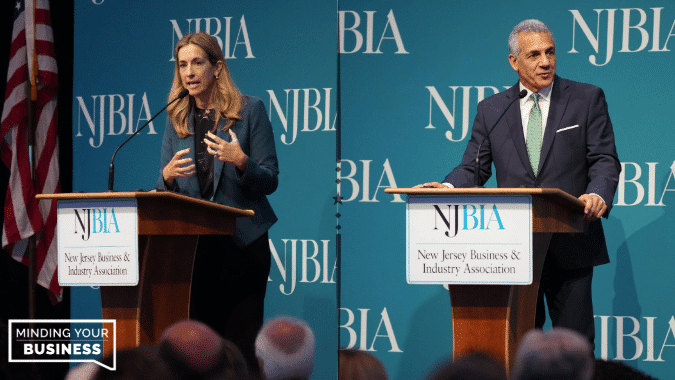

“Whether you believe in increasing taxes or not, relying on corporate taxes to fund anything is not wise based on the sheer volatility of that tax,” Emigholz said.

“You don’t want to subject businesses to roller coaster tax policy where tax rates are constantly changing and unpredictable. You may have corporations that post actual losses and have no net income to tax. Or a company that nets $9 million this year and is thus not subject to the proposed 2.5% surtax, but then makes $10 million the following year. In that case, they would pay an almost 30% higher corporate tax because of the surtax.

“So, it remains an unanswered question for those who support this $1 billion tax on employers: If you’re going to have a dedicated fund for transportation, why would you pick the most unpredictable tax to do it?” Emigholz said.

Nonpartisan analysts from the state’s Office of Legislative Services have raised the same concerns about the stability of corporate tax revenues as it applies to the proposed Corporate Transit Tax.

A Pew Trusts study released last week also listed corporate taxes as the most volatile in the nation.

Then this past week, Senate Budget and Appropriations Committee Chair Paul Sarlo asked state Treasurer Elizabeth Maher Muoio if increasing the current 6.625% state sales tax to 7% would be a more stable source of funding.

Assembly Budget Chair Eliana Pintor Marin did the same in her committee.

Neither lawmaker, however, said they were endorsing a sales tax increase with their questions. They said they were just asking hypothetical questions to get a fuller budget picture.

Emigholz said NJBIA would not support a sales tax increase either – as businesses account for approximately 49% of the state sales taxes paid in New Jersey.

“Sales tax, however, is a much more stable tax for dedicated funding, even during a downturn when people are still consuming goods and services,” he said.

“If you absolutely need to raise taxes, which the Murphy administration says it must, sales tax is a more reliable and predictable source of revenue than corporate taxes.”

Emigholz also reiterated NJBIA’s already established position that policymakers should model and observe the idea of dedicating a portion of organic sales tax growth without a tax increase to help fund NJ TRANSIT.

“Costs go up and, as a result, so does sales tax revenue every year,” Emigholz said. “By dedicating some of that sales tax growth to NJ TRANSIT, you can avoid the proposed $1 billion tax on business that will really hurt jobs and our competitiveness.

“If that method comes up short, then you can talk about filling the gap. But you should be able to do it without punishing our top job creators with the top corporate tax in the nation when they were promised for more than a year that their corporate taxes would be decreasing.”