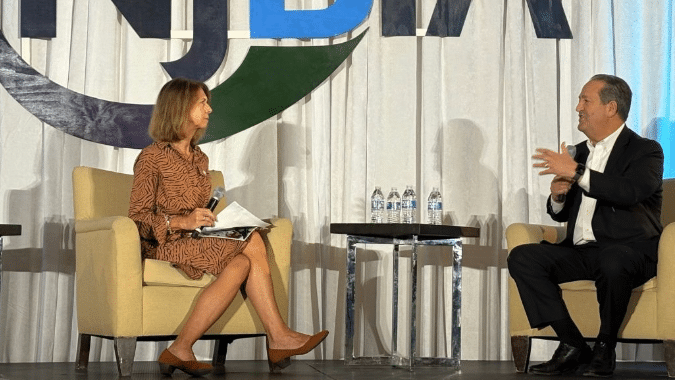

New Jersey’s “rollercoaster tax policy” that sunset a temporary corporate surtax only to propose replacing it with a permanent $1 billion corporate transit tax further exacerbates an already unrelenting tax burden on businesses, NJBIA President & CEO Michele Siekerka testified on Tuesday.

Speaking before the Senate Budget & Appropriations Committee during its public hearing on Gov. Phil Murphy’s proposed $55.9 billion FY25 state budget, Siekerka said the reason the temporary 2.5% surtax was allowed to sunset on Jan. 1 is because state policymakers recognized New Jersey is an expensive place to do business.

That surtax, imposed on top of the 9% corporate business tax, gave New Jersey the highest business income taxes in the nation and undercut its competitiveness.

“The proposed corporate transit fee is just another name for the corporate business tax that just sunset 11 weeks ago,” Siekerka said. “Those companies were banking on getting that money back to commit to their workforce, their facilities and their communities.

“They were making plans based upon the promise that the surtax would sunset and now what happens is we have uncertainty, a rollercoaster tax policy, and changes in the 11th hour that cause businesses not to make investments,” she said. “It causes businesses on the outside looking in not to consider coming to New Jersey.”

Moreover, the total $1 billion that would be collected under this new corporate transit tax, which is retroactive to Jan. 1, 2024, will end up in the state surplus until some point in the future when a when a voter referendum can be held on whether to dedicate the money to mass transit. Money in the budget surplus can be appropriated for any purpose.

“We say it’s going to be dedicated to NJ TRANSIT, however, absent a constitutional amendment for dedication, we can’t be guaranteed that will happen,” Siekerka said.

Siekerka told the committee that New Jersey has an “unrelenting tax environment” for businesses and the new taxes proposed in the budget make a bad situation worse.

“You can’t look at this in a vacuum,” Siekerka said. “New Jersey is the only state in the nation that ranks in the top of four criticial taxes: the corporate business tax, individual income tax, property tax and sales tax. That affects competitiveness.”

Siekerka noted New Jersey’s neighbor, Pennsylvania, is on a multi-year trajectory to lower its corporate taxes to below 5% and its budget supports mass transit without taxing the business community.

“We ask you to please reject Governor Murphy’s new 20% tax on the largest job creators in the State of New Jersey,” Siekerka said. “We are asking you to do better for business.”

Go here to view Siekerka’s written testimony that was submitted to the Senate Budget & Appropriations Committee for the public hearing at the New Jersey Insititute of Technology in Newark.